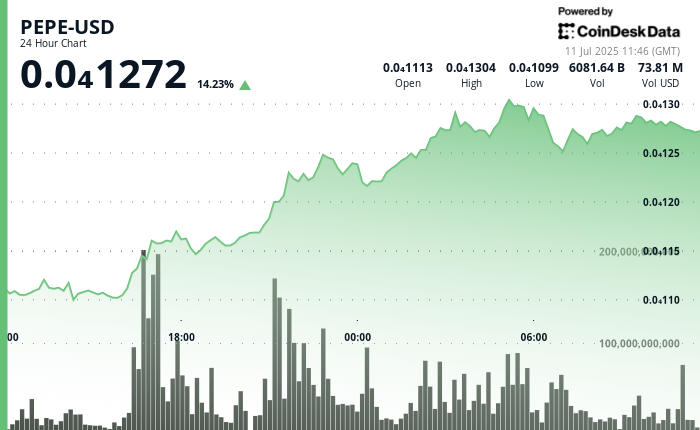

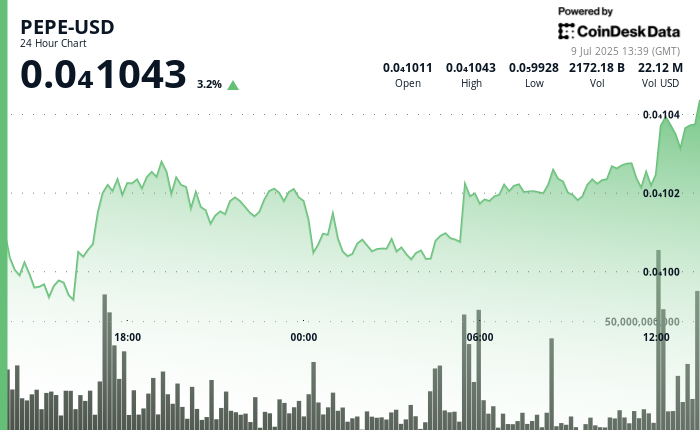

Widespread meme-inspired cryptocurrency PEPE rose greater than 4% during the last 24 hours to commerce up practically 10% over the previous week.

The surge comes amid renewed curiosity in meme tokens, with the CoinDesk Memecoin Index (CDMEME) rising greater than 11% over the previous week, outperforming bitcoin’s 1.4% transfer. Over 24 hours, the memecoin sector is up 2.5%, in contrast with BTC’s 0.2%.

PEPE rallied from $0.00001013 to $0.00001074, setting a brand new short-term resistance close to $0.00001082, in line with CoinDesk Analysis’s technical evaluation information mannequin. Buying and selling exercise spiked considerably, with over 5.89 trillion PEPE tokens altering palms through the peak of the rally, greater than double the 24-hour common.

The worth motion exhibits a gradual sample of upper lows, a sign that consumers are stepping in persistently at more and more elevated ranges. That kind of construction is commonly interpreted as an indication of accumulation by extra engaged traders.

Throughout essentially the most lively section of the transfer, the token additionally touched $0.00001081 earlier than settling barely decrease. That fast spike drew a brand new resistance line whereas a agency help degree emerged round $0.00001017.

These value boundaries, examined a number of instances, assist form merchants’ expectations about the place the coin may go subsequent.

The rally was marked by robust liquidity and sustained demand. Exercise surged round a number of retests of the $0.00001069 mark, a degree that held every time, reinforcing its power.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.