Key takeaways:

-

Bitcoin may flip parabolic if costs transfer above $115,000 to liquidate greater than $7 billion in brief positions.

-

Onchain indicators enter overheated territory, suggesting extended profit-taking from BTC traders.

Bitcoin (BTC) confirmed energy on Could 27, briefly tagging $110,700 after a powerful US equities market open and the Trump Media and Know-how Group’s announcement that it might elevate $2.5 billion for a Bitcoin treasury.

Bitcoin’s bullish momentum aligns with the favorable US monetary situations, as famous by Ecoinometrics. The macroeconomic-focused Bitcoin publication highlighted that the Nationwide Monetary Situations Index (NFCI) reveals a fast shift to ultra-loose territory after a tightening part in February 2025.

The NFCI, printed by the Federal Reserve Financial institution of Chicago, tracks stress within the monetary system by aggregating measures like credit score spreads, leverage, and funding situations. When the index strikes into looser territory, it displays simpler entry to capital and diminished market stress—situations that sometimes encourage risk-taking habits amongst traders.

For prime-beta belongings like Bitcoin, such intervals usually coincide with worth rallies as capital flows into speculative markets.

Ecoinometrics talked about that inside 4 weeks, liquidity has returned, making a supportive macroeconomic surroundings for danger belongings like Bitcoin. The publication famous,

“That’s the form of macro backdrop the place Bitcoin thrives. Bitcoin’s rally to new highs didn’t come out of nowhere. It’s monitoring the identical sample we noticed since 2023: easing situations → capital rotation → risk-on.”

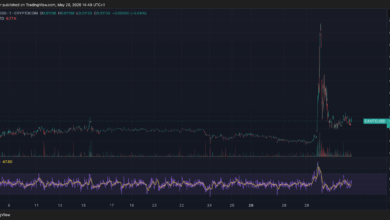

With Bitcoin simply 2% away from its all-time excessive worth, information from CoinGlass signifies that the likelihood of a short-squeeze stays excessive attributable to important sell-side liquidity. As illustrated beneath, if Bitcoin breaches $115,000, over $7 billion in brief positions may get liquidated, triggering a cascading impact that pushes costs increased.

Associated: Bitcoin reveals indicators of ‘easing momentum’ however merchants nonetheless count on $150K

Onchain information reveals Bitcoin in ‘overheated zone’

Whereas the general momentum stays bullish, Bitcoin’s rally has pushed the market right into a zone the place historic patterns urge warning. Two key onchain indicators—Provide in Revenue Market Bands and the Superior Internet UTXO Provide Ratio—are flashing indicators in step with prior market tops.

The Provide in Revenue Market Bands metric tracks how a lot of the circulating BTC provide is at present in revenue. As of late Could 2025, this determine has surged to 19.4 million BTC, nearing historic extremes and coming into the “Overheated Zone.” Beforehand, BTC costs examined this zone on Dec. 17, 2025, which was adopted by a worth correction to $93,000 from $107,000.

Concurrently, the Superior Internet UTXO Provide Ratio (NUSR), which compares worthwhile versus unprofitable UTXOs (unspent transaction outputs), is brushing towards its historic ceiling round 0.95—a stage incessantly previous promote indicators. Purple markers on the chart point out prior cases when such situations led to native worth tops or extended consolidations.

The above information doesn’t assure a direct drop, however these metrics recommend a excessive likelihood of elevated volatility and profit-taking within the short-term.

Associated: Bitcoin 2024 convention sparked 30% worth crash — Can bulls escape this yr?

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.