Banks Can’t Seem To Service Crypto, Even as It Goes Mainstream

Across the globe, it remains common for crypto users to have their bank accounts frozen and transfers blocked, even as institutional adoption rises.

Panos Mekras, co-founder and CEO of blockchain fintech Anodos Labs, began dealing with crypto in Greece in the late 2010s. Most Greek banks didn’t allow transfers to crypto exchanges back then. Mekras experienced blocked card payments until one bank finally permitted his transfers, but first, he was questioned to ensure he understood he was interacting with a “risky” counterparty.

Mekras told Cointelegraph that those early rejections are symptomatic of how banks treat digital assets as inherently high risk. That label often led to account closures or sudden freezes without explanation, ultimately pushing his business to rely solely on onchain tools and payment rails.

Public perception of crypto has since evolved. Now, crypto is undergoing an image refresh, from a speculative asset class to an infrastructure layer for future financial products. However, Mekras said he still experiences the same banking barriers, as recently as a “few months ago”:

“I tried to send money from an exchange to Revolut, and they froze my account for three weeks. I had no access to my [funds] during that time.”

The long shadow of crypto debanking

Mekras isn’t the lone crypto holder with such complaints despite banks announcing expansions into custody and blockchain initiatives.

A January report from the UK Cryptoasset Business Council found that bank transfers to exchanges were being blocked or delayed, with roughly 40% of payments encountering restrictions and 80% of exchanges reporting increased friction over the past year.

The council warned that blanket bans and transaction limits are often applied without regard to the legal status of the exchange.

Revolut is one of two banks that permit both bank transfers and debit cards in the UK council’s study, and it is also the platform where Mekras claims to have experienced his recent account freeze. It operates as an authorized UK bank “with restrictions,” meaning it is currently building up its banking processes before full launch. It also holds a European Union banking license through Lithuania and offers crypto trading services in its app.

A Revolut spokesperson told Cointelegraph it treats account freezes as a “last-resort” customer protection measure in compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

“A temporary freeze may occur if our systems detect irregular activity. This could be a combination of a few factors, such as if a customer interacts with a platform frequently exploited by fraudsters, or we believe that the funds in question may be the proceeds of crime or sanctions circumvention,” the spokesperson said.

The representative added that since Oct. 1, just 0.7% of Revolut accounts where customers deposited crypto funds were restricted or frozen after investigation.

Related: How Europe’s blockchain sandbox finds innovation in regulation

When banks close doors, users move onchain

In some regions, crypto is blocked and leaves users to more extreme restrictions. Crypto on- and off-ramps are not legally possible in regions like China, so users resort to peer-to-peer (P2P) platforms or black markets to trade crypto.

While China sits on the extreme end of the spectrum, other jurisdictions have eased official and unofficial restrictions. Nigeria once banned crypto and even blocked P2P platforms. However, it formally recognized digital assets as securities in 2025.

Related: Crypto takeaways from Davos: Politics and money collide

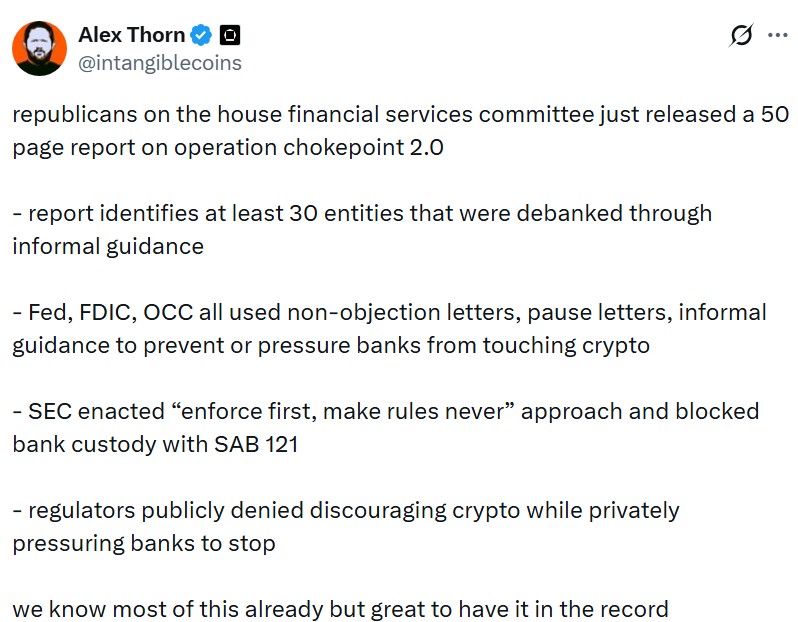

Similar banking friction patterns also emerged in the US. Lawmakers and the industry have invoked the term “Operation Chokepoint 2.0” to describe the federal regulators’ informal guidance that discouraged banks from maintaining relationships with crypto companies.

The original “Operation Choke Point” was an initiative in which enforcement agencies were accused of pressuring banks to cut ties with politically contentious industries such as payday lenders and firearms sellers.

In January 2025, Donald Trump took office as the president of the US and has been pushing for crypto-friendly policies to position the world’s largest economy as the “crypto capital” of the world.

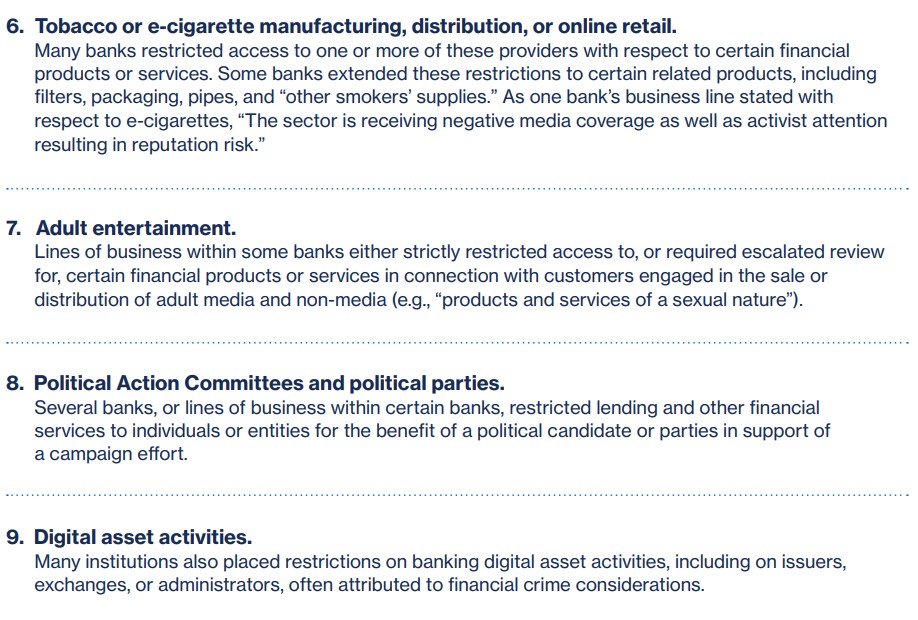

Crypto debanking issues have since been officially recognized. In December, the US Office of the Comptroller of the Currency (OCC) released its findings on debanking practices by nine of the country’s largest banks. The OCC also published an interpretive letter to confirm that banks may facilitate crypto transactions in a broker-like capacity.

Regardless of the positive momentum, users still complain that the banking sector won’t service accounts exposed to cryptocurrencies.

“This is still the case [and] there are still anti-crypto positions. Some have even said publicly that they are not willing to support crypto activity or engage with the industry,” said Mekras.

Mekras argued that users can consider fully detaching from the traditional banking system and moving finances onchain. It sounds viable in theory, but in reality, most businesses and users still cannot operate purely within crypto without reliable access to fiat rails.

Banking’s turn toward blockchain infrastructure

In recent years, there has been a global shift in how traditional financial institutions engage with crypto.

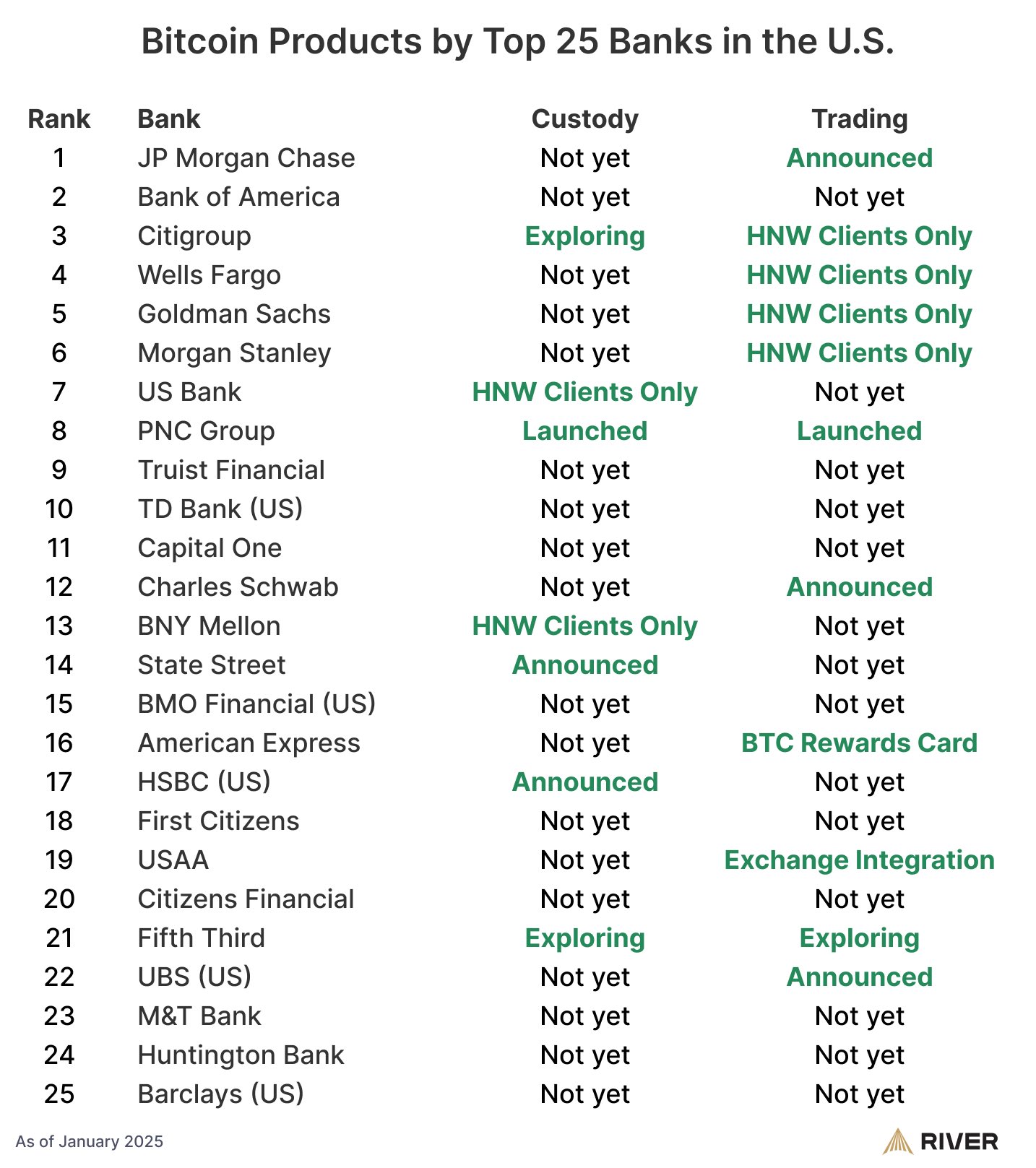

Major banks and financial infrastructures are increasingly building products and services tied to Web3. In the US, 60% of the top 25 banks are reportedly offering or planning Bitcoin-related services, including custody, trading and advisory solutions.

Across Europe, regulated services such as crypto custody and settlement are being introduced by legacy exchanges and financial groups under the Markets in Crypto-Assets Regulations (MiCA). In the UK, HSBC’s blockchain platform was selected to support pilot issuances of tokenized government bonds.

In that backdrop of institutional adoption, some companies working to bridge banks and blockchain claim that the challenges that lead to account freezes are linked to tooling gaps and risk frameworks inside banks.

“The problem is that there’s a huge amount of friction because traditional banks don’t really have the internal infrastructure to interpret blockchain data in a way that fits inside their existing risk and compliance frameworks,” Eyal Daskal, CEO of Crymbo — a blockchain infrastructure platform for institutions — told Cointelegraph.

He described the situation as one where banks often default to precautionary measures because they lack the ability to link onchain activity with the identity and compliance signals they rely on:

“If crypto is involved, they block the account and treat it as out of scope. It’s the simplest option for them because they don’t have the tools to assess it properly.”

Crypto is entering the financial mainstream, but for many users, access to basic banking still depends on whether a bank’s risk engine can understand what happens onchain. Until that gap closes, the industry’s institutional embrace and retail friction may continue to coexist.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum: BIP-360 co-author

Cointelegraph Features and Cointelegraph Magazine publish long-form journalism, analysis and narrative reporting produced by Cointelegraph’s in-house editorial team and selected external contributors with subject-matter expertise. All articles are edited and reviewed by Cointelegraph editors in line with our editorial standards. Contributions from external writers are commissioned for their experience, research or perspective and do not reflect the views of Cointelegraph as a company unless explicitly stated. Content published in Features and Magazine does not constitute financial, legal or investment advice. Readers should conduct their own research and consult qualified professionals where appropriate. Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.