Bitcoin ETFs Extend Losses as Solana Funds Keep Ground

US-listed spot Bitcoin exchange-traded funds (ETFs) continued to bleed on Wednesday as market sentiment remained negative and BTC briefly dipped below $66,000.

Spot Bitcoin ETFs recorded $133.3 million in net outflows on Wednesday, bringing weekly losses to $238 million, according to SoSoValue data. BlackRock’s iShares Bitcoin Trust (IBIT) led outflows, with over $84 million exiting the fund.

Trading volumes remained subdued, falling below $3 billion, highlighting the persistent lack of activity even as analysts previously noted potential inflection points amid the slowdown in outflows.

If the ETFs fail to recover in Thursday and Friday sessions, this week could mark the first five-week outflow streak for Bitcoin (BTC) ETFs since March of last year.

Year-to-date, Bitcoin ETFs have seen about $2.5 billion in outflows, leaving assets under management at $83.6 billion.

Solana ETFs keep bucking the trend after launch in late 2025

While Ether (ETH) and XRP (XRP) ETFs posted modest daily outflows of $41.8 million and $2.2 million, respectively, Solana (SOL) funds continued to buck the trend.

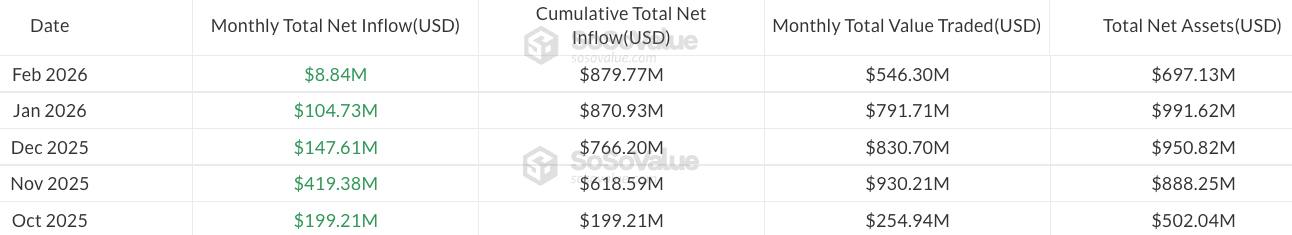

Solana ETFs have recorded a six-day streak of inflows, with year-to-date gains totaling around $113 million. Trading activity, however, remains subdued compared with past months, as February inflows of $9 million so far are well below $105 million in January and December 2025’s $148 million.

Since their October 2025 launch, US spot Solana ETFs have accumulated nearly $700 million in assets under management, trailing XRP funds, which have amassed $1 billion since their November debut.

Crypto market remains in extreme fear, BTC down 24% year-to-date

The ongoing sell-off in Bitcoin ETFs comes as the Crypto Fear & Greed Index continues to signal persistent negative sentiment.

Even though Bitcoin has slightly recovered from multi-month lows near $60,000 logged in early February, the index has largely remained in “Extreme Fear” territory.

At the time of writing, Bitcoin traded at $67,058 on Coinbase, down about 24% year-to-date. Analysts at major financial institutions, including Standard Chartered, have predicted that BTC could fall as low as $50,000 before potentially recovering to $100,000 later in 2026.

Related: Bitwise, GraniteShares join race for prediction market-style ETFs

According to the crypto analytics platform CryptoQuant, Bitcoin’s short-term Sharpe ratio has reached levels historically associated with “generational buying zones.”

“The arrows in the chart illustrate this clearly: each prior extreme negative reading was followed by violent recoveries to new highs,” CryptoQuant analyst Ignacio Moreno De Vicente said.

Magazine: Did a Hong Kong fund kill Bitcoin? Bithumb’s ‘phantom’ BTC: Asia Express