Sterling Wobbles as U.K. Inflation Dropped to Lowest in 10 Months

2026-02-19 03:57:00

U.K. CPI eased to 3.0% year-on-year in January 2026, down from 3.4% in December last year. This marked its lowest reading in ten months, as lower fuel prices and cheaper airfares weighed heavily on the headline figure.

On a monthly basis, CPI fell 0.5% in January 2026, compared with a decline of just 0.1% a year earlier. The broader CPIH measure — which includes owner-occupiers’ housing costs and is considered the ONS’s most comprehensive inflation gauge — fell to 3.2% annually, down from 3.6% in December.

Key points from the U.K. CPI Report

- Headline CPI: 3.0% year-on-year (January 2026), down from 3.4% in December 2025

- Monthly CPI: -0.5% in January 2026, compared with -0.1% in January 2025

- Core CPI (ex-energy, food, alcohol, tobacco): 3.1%, down from 3.2% — the lowest since September 2021

- CPI goods inflation: 1.6%, down from 2.2% in December

- CPI services inflation: 4.4%, down from 4.5% in December

- RPI: 3.8% annually, down from 4.2% — the all-items index fell from 408.5 to 406.4

The single largest contributor to the monthly decline was the transport division, where prices fell 1.8% on the month compared with only a 0.5% decline a year earlier. Petrol prices dropped 3.1 pence per litre between December 2025 and January 2026, reversing a 0.8p rise seen in the same period a year earlier.

Airfares added a notable secondary downward effect. Fares typically spike in December and unwind in January, which saw a decline of roughly 26.5% on the month.

Link to official ONS U.K. Consumer Price Index (January 2026)

In addition, private school fees provided a meaningful downward contribution in January 2026. Fees rose sharply by 12.7% a year earlier when VAT was applied to private school tuition for the first time. No equivalent price change occurred in January 2026, producing a sizeable base effect that dragged on the annual rate.

Food and non-alcoholic beverages fell 0.1% on the month, also a notable change from a rise of 0.9% a year earlier.

Promotion: Master your trading psychology with AI-powered insights! TradeZella helps you track, backtest, and eliminate bad habits automatically! Click on the link and use code “PIPS20” to save 20%!

Disclosure: To help support our free daily content, we may earn a commission from our partners if you sign up through our links, at no extra cost to you.

Market Reactions

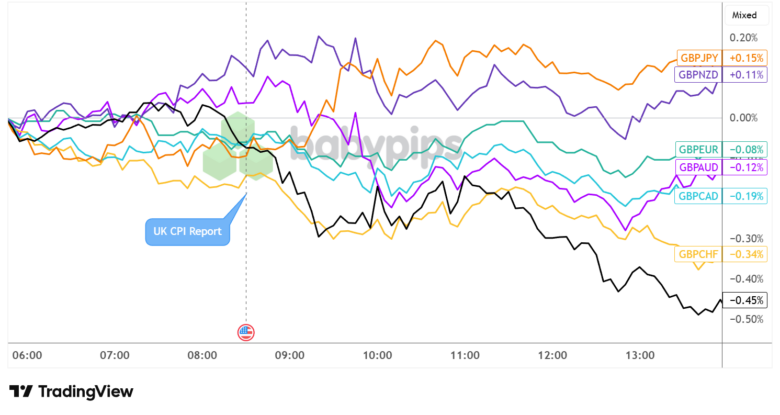

British Pound vs. Major Currencies: 15-min

GBP Overlay 15-min – Chart Faster with TradingView

Sterling’s reaction to the data was mixed across the major currency pairs, reflecting a degree of divergence in how markets interpreted the CPI print relative to recent recalibration of the Bank of England’s policy path.

GBP immediately weakened against CHF (-0.34%) and USD (-0.45%), sustaining its steady selloff in the hours that followed the release. Sterling also chalked up gradual declines against EUR (-0.08%) and AUD (-0.12%) but managed to trim losses as the session went on.

On the flip side, the U.K. currency barely dipped against JPY (+0.15%) while also fighting to stay afloat against NZD (+0.11%).

Promotion: Lux Trading Firm funds with real capital (up to $10M in buying power) and refunds evaluation fee 100% after Stage 1. Get a certified track record, no time limits and a focus on institutional-grade execution. It’s designed for those looking for a career, not a contest.

Learn More at Lux Trading Firm

Disclosure: To help support our free daily content, we may earn a commission from our partners if you sign up through our links, at no extra cost to you.