Pound Takes a Hit As U.K. Employment Data Missed Estimates

2026-02-18 03:00:00

The U.K. employment change figure for January reflected a 28.6K increase in joblessness versus the estimated 22.8K gain, while the unemployment rate ticked higher from 5.1% to 5.2%.

Average hourly earnings also fell short of expectations in the three-month period ending in December 2025, as wage growth slowed from 4.6% to 4.2% instead of holding steady.

Key Takeaways

- Unemployment rate rose to 5.2% (October–December 2025), up 0.2 percentage points on the quarter and above pre-pandemic levels — the highest reading since early 2021.

- Employment rate edged down 0.1 percentage points to 75.0% in October–December 2025, as labour force growth outpaced jobs creation.

- Total earnings growth (including bonuses) slowed to 4.2% in October–December 2025, the weakest reading since June–August 2024.

- Public sector earnings growth remained elevated at 7.0% (affected by base effects), while private sector regular pay growth eased to 3.5%, down from 3.8% in the prior period.

- Real total pay growth (CPI-adjusted) softened to 0.7%, down from 1.0% in the previous three-month period — the weakest real wage growth since May–July 2023.

- Youth unemployment (18–24 year olds) rose to 14.0%, up from 12.8% a year earlier, with the rate for young men approaching one-in-five.

- Total weekly hours worked increased by 6.9 million on the quarter to 1,093.1 million, a modest bright spot in an otherwise downbeat release.

The increase in employer National Insurance contributions, which took effect in April 2025, is widely considered a contributing factor to the slowdown in private-sector hiring. Firms appear increasingly reluctant to replace departing workers, let alone expand headcount.

Link to officials ONS U.K. Labour Market Overview (February 2026 release)

The divergence between public and private sector pay is also worth noting. While headline wage growth has continued to moderate, which is typically welcomed by BOE policymakers, the public sector’s 7.0% gain contrasts sharply with private sector workers, whose real wages were essentially stagnant once adjusted for inflation.

Market Reactions

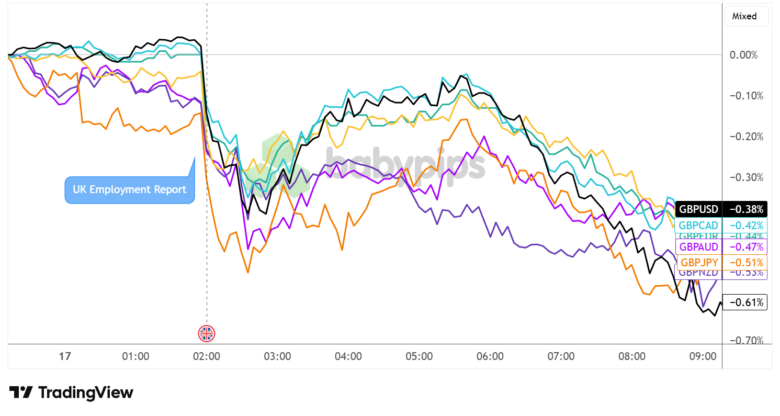

British pound vs. Major Currencies: 5-min

Overlay of GBP vs. Major Currencies Chart Faster with TradingView

Sterling sold off sharply upon seeing the numbers, with the pound falling broadly across major pairs in the minutes after the release. GBP/NZD and GBP/JPY led losses, declining approximately 0.53% and 0.51% respectively on the session by mid-morning, while GBP/USD and GBP/CAD were softer by around 0.38%–0.42%.

The U.K. currency pulled up roughly an hour after the report was printed, possibly on profit-taking, but resumed its bearish trajectory during the latter part of the London session onto the start of U.S. market hours.

This broad-based weakness likely reflects markets pricing in stronger odds of further easing by the BOE, as the central bank is managing a deteriorating labor market and slowing wage growth.

Promotion: Master your trading psychology with AI-powered trade journal and backtesting! TradeZella helps you track, backtest, and eliminate bad habits automatically! Click on the link and use code “PIPS20” to save 20%!

Disclosure: To help support our free daily content, we may earn a commission from our partners if you sign up through our links, at no extra cost to you.