U.S. Consumer Spending Stalls in December; Dollar Shrugs Off Weak Data

2026-02-11 02:24:00

U.S. retail sales unexpectedly stalled in December, coming in flat month-over-month and missing market expectations for a 0.4% gain, according to data released Tuesday by the Commerce Department’s Census Bureau.

The flat reading followed November’s unrevised 0.6% increase and marked a sharp deceleration from the robust spending seen earlier in the holiday shopping season. October sales were also revised lower to a 0.2% drop, reinforcing signs that consumers are starting to feel stretched.

The disappointing figures suggest consumer spending momentum weakened as the year drew to a close, potentially setting the economy on a slower growth path heading into 2026.

Key Points

- Retail sales: 0.0% month-over-month (vs. +0.4% expected), following +0.6% in November

- Retail sales ex-autos: 0.0% (vs. +0.3% expected)

- Core retail sales (control group): -0.1% (vs. +0.4% expected) after a downwardly revised +0.2% in November (previously +0.4%)

- Year-over-year growth: +2.4% in December

- Broad-based weakness: Eight out of 13 retail categories posted declines

The report arrived more than a month late after the 43-day government shutdown, and the delay did nothing to soften the message.

December weakness was broad. Furniture, clothing, electronics, autos, and even restaurants all posted declines, pointing to softer discretionary spending. There were a few bright spots, with building materials and garden equipment rising again and modest gains in sporting goods, but online sales barely moved after stalling the month before.

More concerning was the control group, which feeds directly into GDP. It slipped 0.1% after a downward revision in November, prompting economists to trim Q4 growth estimates. The Atlanta Fed cut its GDP forecast to 3.7% from 4.2%.

Link to official U.S. Retail Sales Report (December 2025)

Economists largely blame thinner savings and slower income growth. The saving rate has fallen sharply from pandemic highs, and wage growth continues to cool.

While larger tax refunds could offer some support early this year, many households are expected to rebuild savings rather than spend aggressively. Consumer demand is holding up, but it is increasingly uneven, with higher-income households carrying most of the load.

Market Reaction

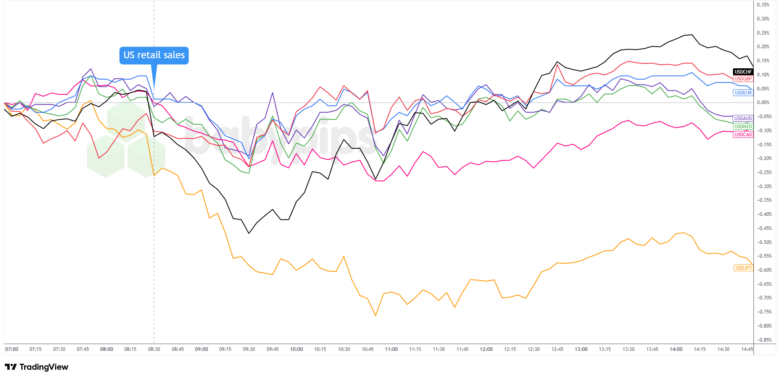

United States Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart Faster with TradingView

The U.S. dollar, which was trading in ranges ahead of the event, dropped sharply and broadly as traders reacted to the broad miss and the downward revision to November’s core figure, signaling that consumer spending may be cooling faster than markets had priced in. Treasury yields slipped alongside the data, adding to the dollar’s early pressure.

That initial move, however, did not hold. About an hour after the release, the Greenback found its footing and gradually recovered through the rest of the session, finishing the New York day mixed.

Support came from still solid Q4 growth expectations, with the Atlanta Fed tracking GDP near 3.7%, as well as relatively calm equity markets. Softer Employment Cost Index data also pointed to easing wage pressures, reinforcing the Fed’s wait-and-see stance.

With jobs data and CPI still ahead, traders appeared reluctant to commit to strong directional positions based on retail sales alone.

The U.S. dollar recouped some of its post-retail sales losses by the London session close, and finished the day in the green except against the Canadian dollar.

Interested in fundamental analysis made for newbies and how to pair it up with technical analysis to find high-quality opportunities that may match your trading and risk management style? Check out our Premium membership for event trading guides, short-term strategies, weekly recaps and more!

BabyPips.com Annual Premium Members also get an exclusive 30% discount on the annual subscription for the first year on Tradezella–the top-rated journaling app! ($120 in savings)! Click here for more info!