Bitcoin Top Traders Hold Tight Despite 14% Price Recovery

Key takeaways:

The Bitcoin long-to-short indicator at Binance hit a 30-day low, signaling a sharp decline in bullish leverage demand.

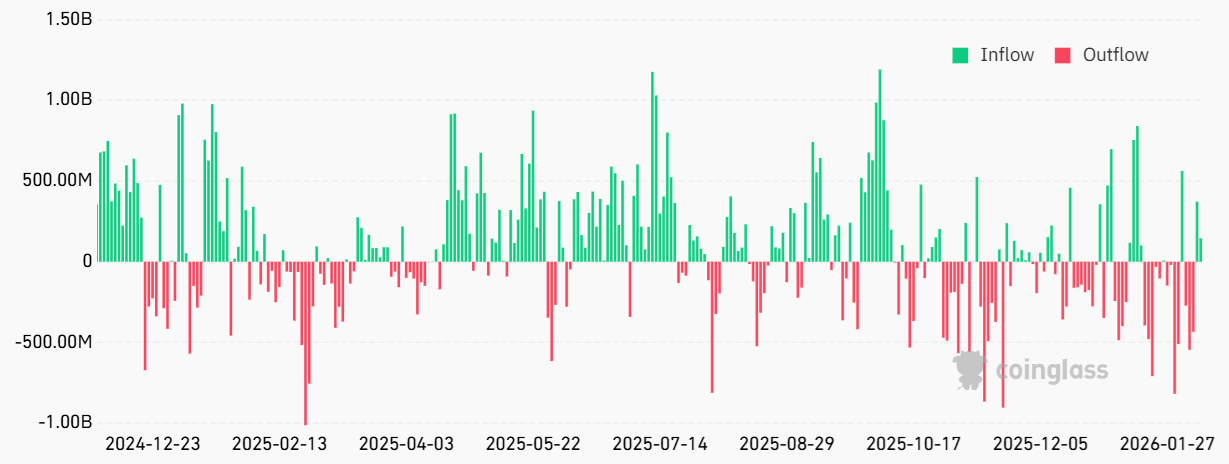

US-listed Bitcoin exchange-traded funds reversed a negative trend with $516 million in net inflows following a period of heavy liquidations.

Bitcoin (BTC) has fluctuated within a tight 8% range over the last four days, consolidating near $69,000 after an abrupt slide to $60,130 on Friday. Traders are currently grappling with the primary catalysts for this correction, particularly as the S&P 500 holds near record highs and gold prices have climbed 20% over a two-month period.

The uncertainty following the 52% retreat from Bitcoin’s $126,220 all-time high in October 2025 has likely prompted an ultra-skeptical stance among top traders, stoking concerns of further price declines.

Whales and market makers on Binance have steadily pared back bullish exposure since Wednesday. This shift is reflected in the long-to-short ratio, which dropped to 1.20 from 1.93. This reading represents a 30-day low for the exchange, suggesting that demand for leveraged long positions in margin and futures markets has cooled, even with BTC hitting 15-month lows.

Meanwhile, the long-to-short ratio for top traders at OKX hit 1.7 on Tuesday, a sharp reversal from its 4.3 peak on Thursday. This transition aligns with a $1 billion liquidation event in leveraged bullish BTC futures, where market participants were forced to close positions due to inadequate margin. Importantly, this specific data point reflects forced exits rather than a deliberate directional bet on further downside.

Strong ETF demand suggests Bitcoin whales are still bullish

Demand for spot Bitcoin exchange-traded funds (ETFs) serves as strong evidence that whales haven’t flipped bearish, despite recent price weakness.

Since Friday, US-listed Bitcoin ETFs have attracted $516 million in net inflows, reversing a trend from the previous three trading days. Consequently, the conditions that triggered the $2.2 billion in net outflows between Jan. 27 and Feb. 5 appear to have faded. A leading theory for that pressure pointed to an Asian fund that collapsed after leveraging ETF options positions via cheap Japanese yen funding.

Franklin Bi, a general partner at Pantera Capital, argued that a non-crypto-native trading firm is the most likely culprit. He noted that a broader cross-asset margin unwind coincided with sharp corrections in metals. For instance, silver faced a staggering 45% decline in the seven days ending Feb. 5, erasing two months of gains. However, official data has yet to be released to validate this thesis.

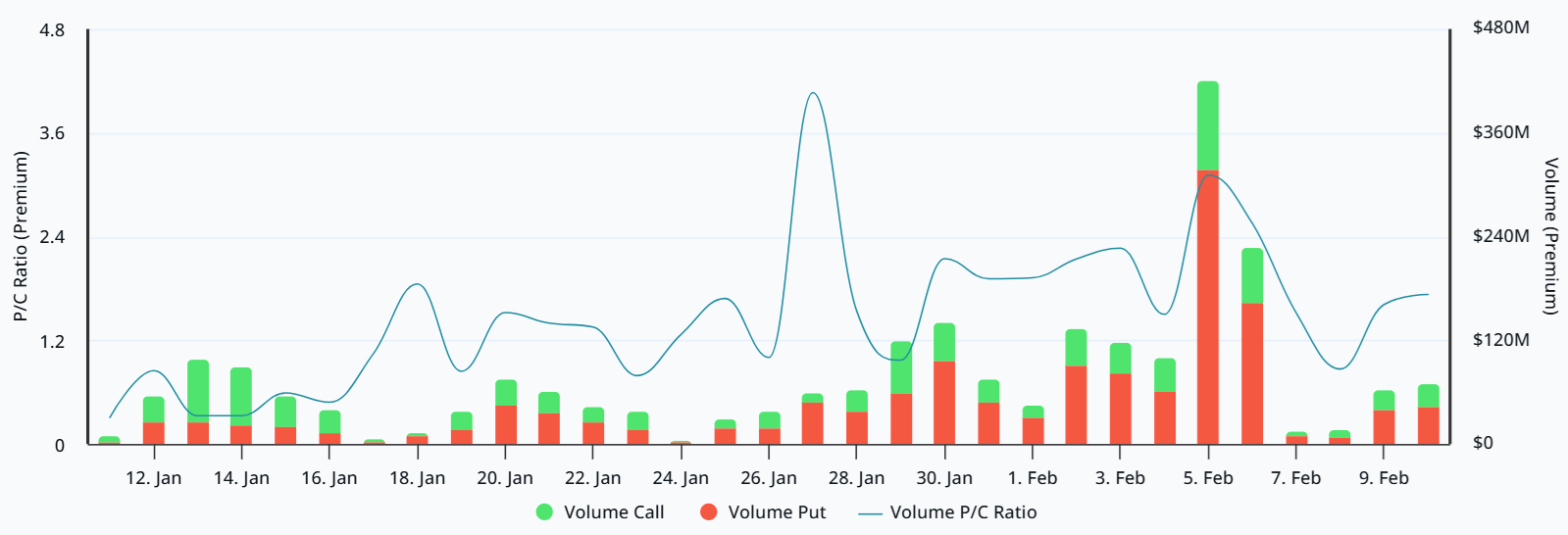

The Bitcoin options market followed a similar trajectory, with a spike in neutral-to-bearish strategies on Thursday. Traders pivoted after Bitcoin’s price slipped below $72,000 rather than anticipating worsening conditions.

Related: Bitcoin sentiment hits record low as contrarian investors say $60K was BTC’s bottom

The BTC options premium put-to-call ratio at Deribit surged to 3.1 on Thursday, heavily favoring put (sell) instruments, though the indicator has since retreated to 1.7. Overall, the past two weeks have been marked by low demand for bullish positioning through BTC derivatives. While sentiment has worsened, lower leverage provides a healthier setup for sustainable price gains once the tide turns.

It remains unclear what could shift investor perception back toward Bitcoin, as core values like censorship resistance and strict monetary policy stay unchanged. The weak demand for Bitcoin derivatives should not be interpreted as a lack of confidence. Instead, it represents a surge in uncertainty until it becomes clear that exchanges and market makers were unaffected by the price crash.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.