Cash falls to 88 cents on the dollar but Bitcoin is up to $3.26 if you bought before the ‘crash’

If you hold either US dollars or Bitcoin, then you’re a little poorer this morning than when you went to bed last night. It doesn’t matter whether there’s cash in your pocket or sats in your wallet; both have less purchasing power today than they did yesterday.

That’s because Bitcoin is down, the dollar is down too, but the feeling isn’t quite the same. That quiet little subtraction before you have even had coffee usually doesn’t take the value of the dollar itself into account, unless you live outside the US.

Today’s charts make it obvious. BTC slid roughly 3% overnight, the kind of move that feels personal when you are holding it, the kind of move that makes people say “see,” like it proves a point.

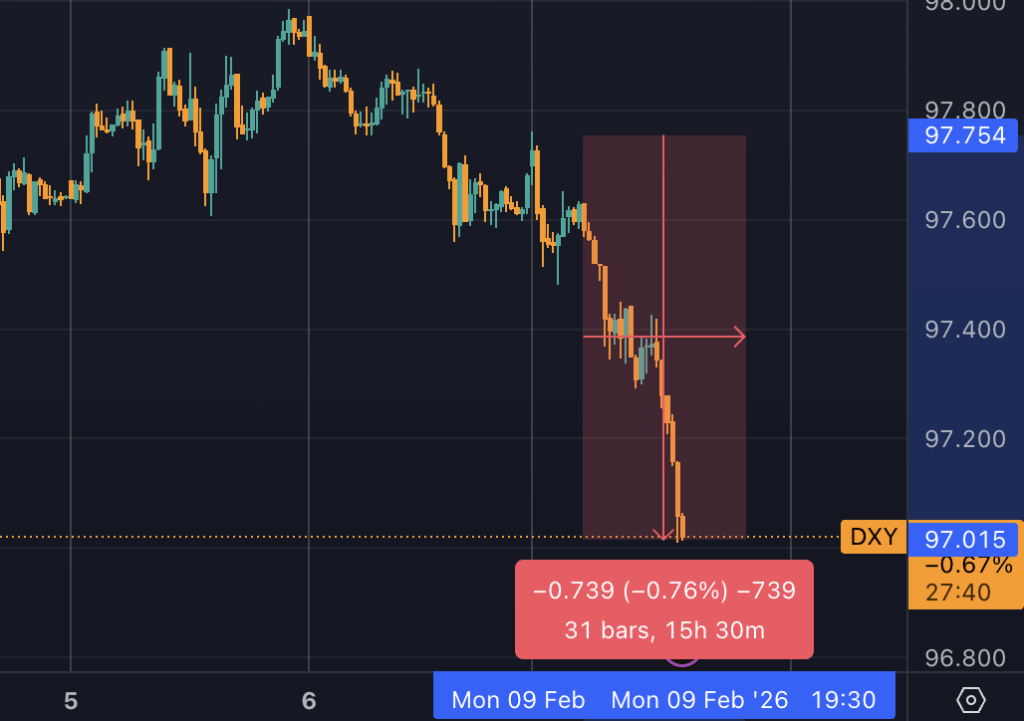

At the same time, the dollar weakened on the foreign exchange side, roughly 0.7% on the day by the DXY gauge, which is small enough to shrug at, and large enough to matter if you are keeping score.

The difference is that one of these moves gets called a dump, and the other gets called background noise, because the paper in your wallet still says one dollar.

That is the trick with cash, it looks the same while it changes.

The dollar isn’t worth a dollar anymore

The scrumpled-up dollar you recently found in an old jacket you haven’t worn in three years feels the same, but trust me, it’s not. If you’re struggling to understand this, Frank Reynolds has a great explanation.

Jokes aside, if you want the cleanest version of why, you start with purchasing power.

The Bureau of Labor Statistics CPI-U index, not seasonally adjusted, was 300.840 in Feb 2023, according to the BLS.

The latest complete CPI-U print we have as of now is Dec 2025 at 324.054 on FRED. That is the slow part of the loss, the part you do not feel on any single morning.

Do the math, 300.840 divided by 324.054, and the Feb 2023 dollar has about 92.8 cents of purchasing power by Dec 2025, before you even bring foreign exchange into it.

Now layer the dollar’s external value on top, since the whole point of DXY-style talk is that the world prices you in real time.

The chart shows a roughly 4.56% drop in DXY over the three-year window, and using that FX leg with the CPI leg is how you get the “my dollar is really 88.7 cents” gut punch.

0.955 times 0.928 lands around 0.887, call it 88.7 cents, and that is before you make the more complicated argument about how people experience inflation unevenly, depending on what they buy.

There is a more conservative way to do the same comparison, and it matters because critics will try to poke holes in the index we choose.

The broad trade-weighted dollar index, DTWEXBGS on FRED, is close to flat over the comparable window, it nudges the composite “cash reality” toward about 92.5 cents instead of 88.7.

So, at the very least we can put it within that range, and it is hard to argue with, your $1 bill is still a $1 bill, and in real terms it buys something closer to $0.89 to $0.93 of what it used to, depending on whether you use DXY or a broad trade-weighted basket.

That is the baseline, and it has nothing to do with crypto, it is just the quiet math of living through time.

And then there is Bitcoin.

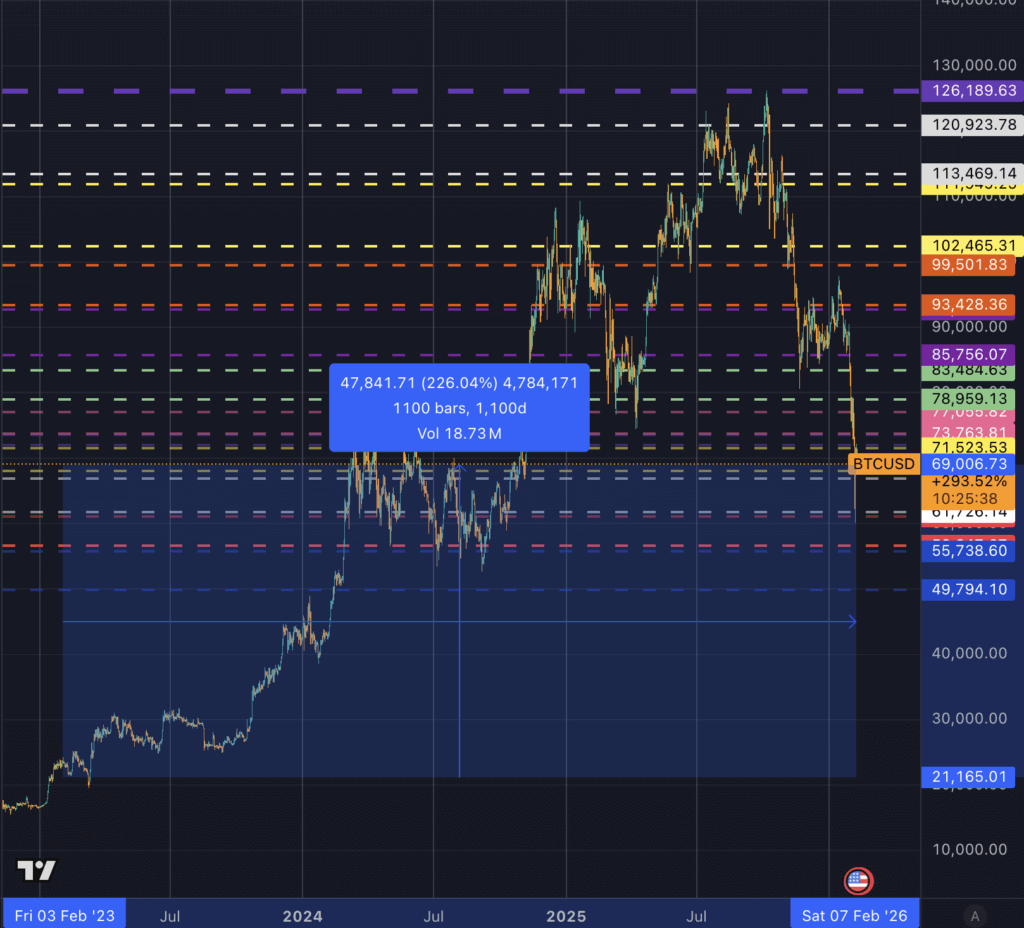

On Feb 3, 2023, BTC was around $23,424. Using that starting point offers a perspective everyone forgets during a pullback, up about 226% from then to now.

A 226% gain means something simple, $1 becomes about $3.26.

That is not a prediction, it is not a pep talk, it is just arithmetic, 1 plus 2.26.

A $1 “Bitcoin purchase” in early Feb 2023 becomes roughly $3.26 today, even after the recent dump.

A $1 bill from early Feb 2023 becomes roughly $0.89 to $0.93 in real terms by late 2025, depending on whether you want the DXY punch or the broad trade-weighted caution.

People can hate Bitcoin for a lot of reasons, and plenty of those reasons are fair, but it is difficult to look at that scoreboard and pretend cash is the safe thing just because it does not move on a chart every minute.

The part nobody wants to say out loud, cash has volatility too

Most people think volatility looks like red candles.

They do not think volatility looks like groceries creeping up while your paycheck stays the same, or like a vacation that costs more every year, or like rent climbing even when your apartment does not get any bigger.

That is still a price chart, it just lives inside your life.

CPI is the public version of that story, it is imperfect, it is averaged, it is political in the way all measurements become political, and it is still the best widely used yardstick we have.

When CPI-U rises from 300.840 to 324.054, that is the world telling you the same dollar buys less. There is no drama, no liquidation cascade, no influencer with a shocked face thumbnail, and there is a steady leak.

A lot of the public debate about Bitcoin gets stuck on whether it is “money.”

I do not even think you need that argument for this. The human interest angle is simpler, people save, people wait, people try to hold onto the value of their work, and the default savings technology for most people has been cash, or cash-adjacent, and they are shocked when they realize the definition of “safe” has quietly shifted.

You can see why Bitcoin keeps coming back into the conversation even after every crash. It offers a different kind of risk. It is loud, and it is social, and it is the kind of thing you can stare at in real time, and that visibility makes it emotionally harder.

Cash feels calm, and that calm is the point, and the math shows the calm has a cost.

To be clear, this is not a pitch for everyone to become a Bitcoin maximalist. It is a reminder that the thing we treat as neutral is not neutral.

What today’s drop actually tells you about the next year

Bitcoin dropping 3% overnight is not the story, it is the entry point.

The real story is the macro backdrop that makes moves like this cluster, and what it implies for the months ahead. When real yields are high, risk assets tend to feel heavier.

TradingEconomics has the 10-year TIPS yield near the high 1% area recently, a sign that “real return” is available in the traditional system, which can siphon attention away from speculative assets, and tighten the financial oxygen Bitcoin often thrives on.

Liquidity matters too. The Federal Reserve’s balance sheet, tracked as total assets on FRED, has been a decent weather vane for broad financial conditions, not because it is magic, and because it is one of the clearer public signals of how tight or loose the system is.

When liquidity is draining, leverage becomes expensive, and the marginal buyer gets cautious.

Then you add the new market structure, which is ETFs.

That plumbing changes the shape of Bitcoin’s demand, and it changes how narrative turns into flows. Spot Bitcoin ETFs saw about $5.7 billion in withdrawals between November and January.

Sentiment can swing quickly when the “easy access” vehicle is also the “easy exit” vehicle. Whether you agree with the framing or not, the data point matters because it tells you where the marginal pressure can come from.

Put those three together, real yields, liquidity, and flows, and you get a useful way to think about the next 3 to 12 months without pretending you can predict Tuesday.

If real yields stay elevated, and liquidity stays tight, Bitcoin can still perform well over longer horizons, and it may chop, it may scare people, it may have more sharp down days.

If the macro regime shifts toward easier policy, and yields fall, Bitcoin tends to get its legs back.

If risk-off hits, and leverage unwinds, Bitcoin gets dragged around with everything else for a while, and the long-term comparison to cash does not disappear, but it does stop being emotionally satisfying in the moment.

The takeaway I keep coming back to

Most people think they are choosing between stability and volatility.

They are choosing between visible volatility and invisible volatility.

Over the last three years, Bitcoin has been the loud asset that still turned $1 into roughly $3.26, even after a nasty pullback.

Cash has been the quiet asset that turned $1 into something like $0.89 to $0.93 in real terms, depending on whether you prefer the DXY framing or the broad trade-weighted dollar approach, anchored on CPI and the broad dollar.

That is why this moment matters. Not because Bitcoin dipped, it always dips. It matters because every dip creates the same psychological trap, people look at the red candles and forget the slow bleed in the background.

They wake up and feel poorer, and they blame the thing that moved.

They almost never blame the thing that stayed still.