Yen weaker early trade. Japan markets brace for renewed Takaichi trade after landslide win

2026-02-08 20:27:00

Takaichi’s landslide election win revives reflation trades, lifting stocks but renewing pressure on the yen as officials warn intervention remains firmly on the table.

Yen is weaker in very early trade:

As is usual for a Monday morning, market liquidity is very thin until it improves as more Asian centres come online … prices are liable to swing around, so take care out there.

Summary:

-

Sanae Takaichi secures a decisive snap election victory, cementing her mandate

-

Landslide win revives expectations of aggressive fiscal reflation

-

‘Takaichi trade’ favours equities but pressures the yen and JGBs

-

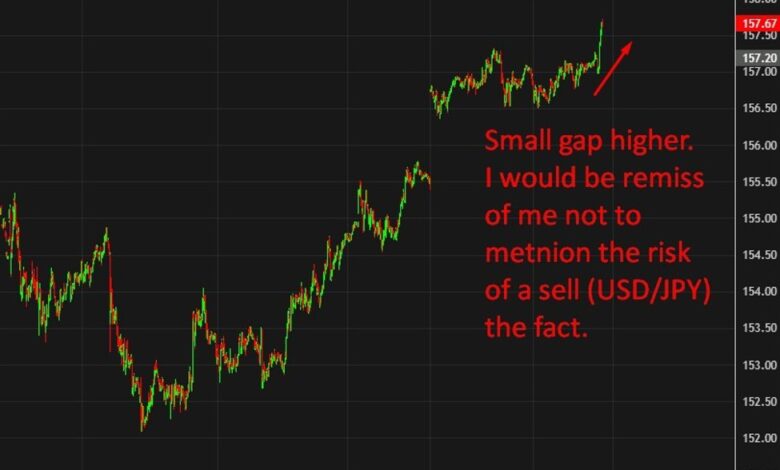

Yen weakness back in focus as USD/JPY tests upper ranges

-

Finance Minister Satsuki Katayama warns markets intervention remains an option

Japan’s financial markets are set to reopen under renewed pressure after Prime Minister Sanae Takaichi delivered a landslide victory in Sunday’s snap election, handing her a powerful electoral mandate to pursue reflationary economic policies.

Voters turned out in heavy snow across Tokyo and other regions to deliver what exit polls suggest was the ruling Liberal Democratic Party’s most decisive win since the mid-1990s. The result places Takaichi firmly in control after taking office in October, removing her reliance on opposition parties and significantly strengthening her policy credibility.

For investors, the outcome revives the so-called “Takaichi trade”, a dynamic that has driven Japanese equities to record highs while simultaneously punishing the yen and government bonds. Since her rise, domestic stocks have surged, supported by expectations of higher fiscal spending, defence outlays, and targeted investment in technology, artificial intelligence, and semiconductors.

Takaichi, a committed supporter of the late Shinzo Abe’s Abenomics framework, has pledged proactive fiscal policy funded largely through bond issuance. Markets now face the question of whether her enlarged mandate emboldens further stimulus or allows for a more measured approach. While some strategists argue political stability reduces the need for excessive fiscal giveaways, concerns around Japan’s already-heavy debt burden remain acute.

Those concerns were evident earlier this year when long-dated JGB yields surged after Takaichi floated suspending the food sales tax. Although yields have since retraced from record highs, they remain elevated, and investors remain sensitive to any renewed signals of expansionary policy.

The yen, meanwhile, has been one of the clearest pressure points. It has fallen roughly 6% against the dollar since October and has touched record lows versus the euro and Swiss franc. Early Asia trade on Monday saw USD/JPY probe the upper 157 handle before stabilising, with analysts noting the election outcome was partly priced but still supportive of further weakness.

That weakness drew an early response from Finance Minister Satsuki Katayama, who moved swiftly to warn markets against excessive moves. Speaking during television appearances as results were confirmed, Katayama said she stood ready to communicate with markets if needed and confirmed she remained in close contact with US Treasury Secretary Scott Bessent regarding dollar-yen stability.

Katayama also flagged that Japan must take a “professional” approach when considering the use of its vast foreign reserves, noting that while tapping reserves could be an option amid sharp currency moves, it carries risks given their role in intervention operations. She stressed that decisions would be guided by market conditions and asset-management effectiveness, reiterating that dialogue with markets could begin as early as Monday if volatility escalates.