President Trump’s WLFI sold Bitcoin to pay off Aave debt and avoid liquidation as BTC price sinks

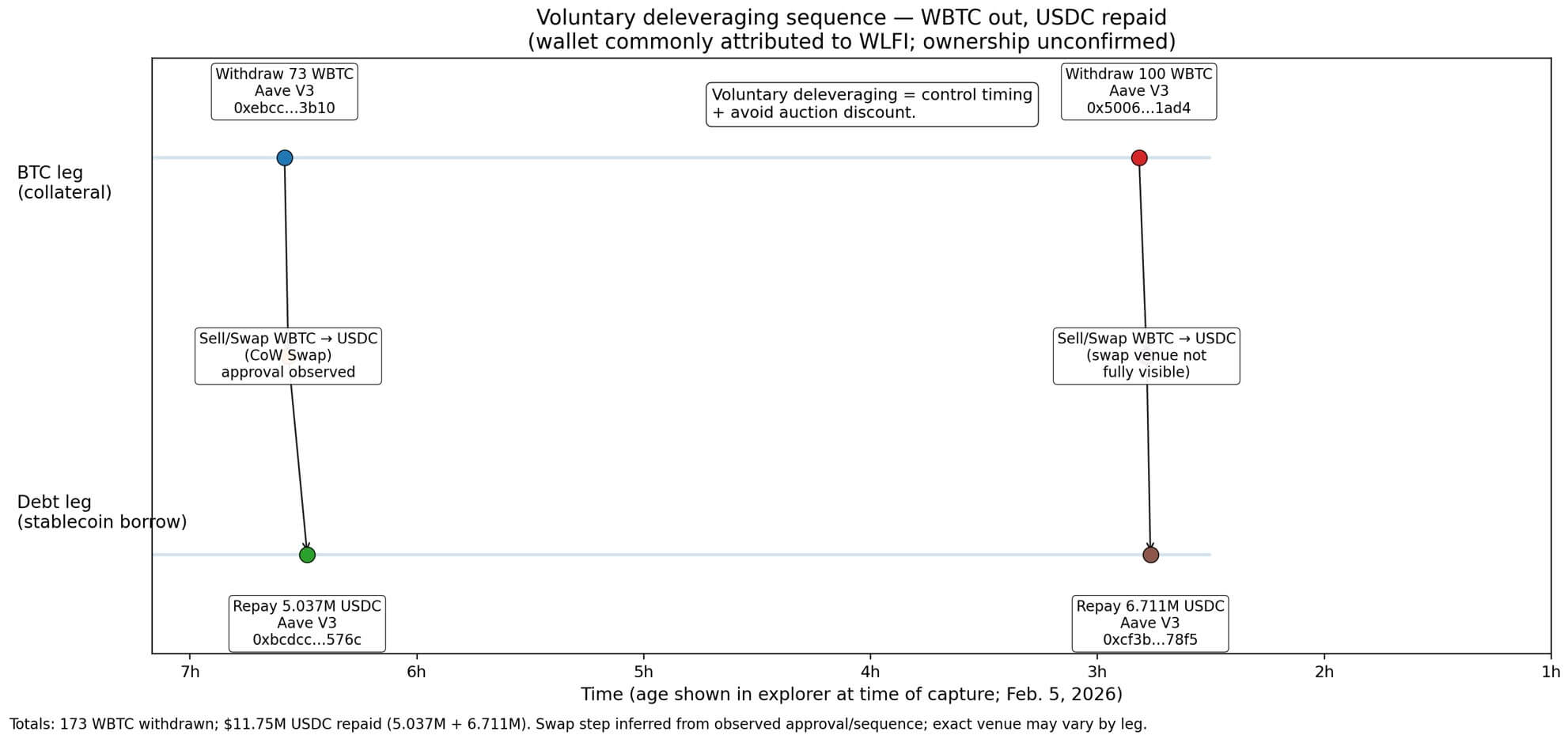

A wallet attributed to President Donald Trump’s World Liberty Financial, which is managed by his sons, withdrew approximately 173 wrapped Bitcoin from Aave V3 on Feb. 5 and sold them to repay $11.75 million in stablecoin debt.

This sequence reveals the mechanics of voluntary deleveraging: as Bitcoin’s drawdown below $63,000 forces whales to sell collateral and reduce leverage, protocol liquidation engines trigger at worse terms.

The address 0x77a…F94F6 withdrew roughly 73 WBTC and 100 WBTC from Aave V3’s collateral pool, then repaid 5,037,001 USDC and 6,710,808 USDC to the protocol in separate actions.

Although there is no confirmation regarding the wallet’s ownership, on-chain intelligence platforms and prior reporting have linked similar activity patterns to World Liberty Financial’s documented positions on Aave involving WBTC and ETH collateral.

Nevertheless, the wallet turned Bitcoin exposure into cash to reduce leverage and raise health factor buffers. The wallet still holds substantial exposure, with approximately 13,298 WETH and 167 WBTC as Aave collateral backing $18.47 million in variable-rate USDC debt.

However, its health factor now stands at 1.54, comfortably above Aave’s liquidation threshold of 1.0.

Why whales are selling collateral now

Chaos Labs reported approximately $140 million in Aave V3 liquidations over 24 hours during a recent wave. Meanwhile, 21shares flagged $3.7 billion in liquidations over the weekend.

Those figures reveal leverage being flushed system-wide, not just on Aave or decentralized lending, as positions hit health factor thresholds and protocols force collateral sales to cover bad debt.

The difference between voluntary and forced deleveraging is execution quality, not market impact.

Selling 173 WBTC at $69,000 generated roughly $12 million, enough to cover the debt repayment. Waiting until the health factor drops below 1.0 means Aave auctions the same collateral at 5-10% discounts during stress periods, leaving the whale unable to control the timing.

Both outcomes remove Bitcoin from the market and eliminate the leverage that would have recycled capital into future purchases.

At a health factor of 1.54, the wallet has runway but not comfort. A 38% drawdown in collateral value would trigger liquidation.

Bitcoin has already fallen by up to 50% from its peak, and technical models point to $38,000 as a potential support level, suggesting another 43% decline from current prices.

That makes selling collateral to raise health factor buffers rational risk management, even if it adds selling pressure.

The feedback loop across markets

Aave’s variable borrow rates respond to utilization. As whales deleverage and demand for stablecoin liquidity spikes, borrowing costs rise. That increases the carrying cost of leverage, pushing more whales to trim positions.

Simultaneously, exit liquidity deteriorates: bid-ask spreads widen, orderbook depth shrinks, and slippage on large trades increases. The result is a feedback loop where selling begets more selling, not from panic but from balance-sheet arithmetic.

Spot Bitcoin ETF flows compound the pressure. Crypto’s total market capitalization decreased to below $2.1 trillion from its Oct. 6 peak, coinciding with persistent ETF outflows as institutional allocators rotate toward safer assets.

21Shares flagged heavy redemption days in recent weeks. When ETFs were accumulating through 2024 and early 2025, they absorbed supply during volatility.

That bid has reversed, leaving DeFi whales as the marginal price-setters, and those whales are now selling collateral to repay debt rather than adding exposure.

Three paths forward

Orderly deleveraging is the base case.

Whales sell collateral gradually, repay debt, and reduce leverage without triggering mass liquidations. Markets stabilize at lower prices with less leverage, but persistent selling pressure from collateral sales and the disappearance of reflexive bids keep recovery attempts shallow.

Auction cascade is the downside scenario. Another sharp leg down triggers protocol liquidations before whales can act voluntarily. Aave, Compound, and other platforms compete to clear bad debt, processing collateral faster than markets can absorb it.

Liquidation volume spikes, spreads blow out, and forced sales at auction discounts amplify the drawdown.

Cross-market liquidity shocks constitute tail risk. ETF outflows accelerate, derivative open interest continues compressing, and whales rush to sell collateral before becoming the last through the exit.

Voluntary deleveraging and forced liquidations combine to create dislocations in which spot prices diverge from derivatives, or on-chain venues trade at discounts to centralized exchanges.

| Feature | Voluntary deleveraging (sell/repay early) | Forced liquidation (auction) | Why it matters in this drawdown |

|---|---|---|---|

| Timing control | High | None | Avoids selling into worst liquidity |

| Execution price | Market/slippage | Auction discount (stress) | Forced sales amplify downside |

| Position outcome | Reduced leverage, higher HF | Collateral seized | Changes behavior from “diamond hands” to “runway management” |

| Market impact | Distributed sell pressure | Spiky liquidation prints | Explains why drawdowns can accelerate |

What collateral sales signal

The 173 WBTC sale to generate debt repayment isn’t an isolated event but a data point within a broader pattern evident across liquidation metrics, open interest compression, and ETF flows.

Whales aren’t capitulating. Instead, they’re converting Bitcoin into stablecoins to manage health factors and extend runway. That prevents cascades, but it doesn’t stop drawdowns.

Lower leverage means less capital is recycled into purchases. The reflexive bid that drove Bitcoin from $30,000 to $100,000 operated through leverage: whales borrowed against collateral to buy more Bitcoin, amplifying gains.

In reverse, whales sell collateral to repay debt, removing both the exposure and the mechanism that would amplify recoveries.

Spot ETF outflows remove the institutional buyers who previously absorbed this supply. The liquidity vacuum left behind means sell pressure from deleveraging whales meets weaker demand from all buyer categories, as institutional allocators rotate to safety, leveraged traders cut risk, and retail participants wait for clearer signals.

The wallet’s $11.75 million debt repayment, funded by selling 173 WBTC, crystallizes the choice facing every leveraged position: manage the exit now or let protocol mechanics decide later.

Most are choosing now, and the cumulative impact of those individual decisions is a market where conviction plus scale no longer equals compounding. It equals orderly liquidation, one WBTC sale at a time.