Fed’s Barkin: Inflation remains above target, expect more progress

2026-02-03 13:05:00

Richmond Fed President Barkin is usually a good barometer on where the core of the FOMC stands.

-

Rate cuts so far have helped insure health of job market while Fed completes “last mile” of returning inflation to target.

-

Economy remains “remarkably resilient.”

-

Given growth, low unemployment rate, hard to imagine either businesses or consumers moving to the sidelines.

-

Rise in productivity suggests firms can bear higher input costs without pressure to raise prices.

-

Firms say demand is fine and are not doing layoffs “at scale.”

-

“Significant stimulus” arriving in the form of deregulation, tax and withholding changes.

-

Inflation remains above target, expect more progress.

-

Both job growth and spending have been narrowly focused in the economy.

-

Sustained inflation miss since 2021 should be taken seriously, can influence inflation in the future.

-

Slow growth in labor supply, given declining immigration and low fertility rates, is a top long-term concern.

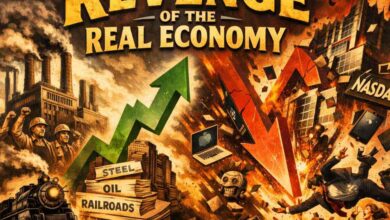

The ‘significant stimulus’ arriving line is the most-notable for me, as it argues for keeping rates where they are as that’s digested. We saw a big jump in the ISM manufacturing survey yesterday and it was combined with transports and real-economy stocks surging. Could there be a turn in that part of the economy already?

Barkin will speak in a Q&A following the delivery of these comments so that should give us a better idea of where he sees rates heading.