China currency controls are pushing traders toward USDT and Bitcoin while Renminbi keeps slipping in global reserves

China seeks to make the renminbi a true reserve currency, but the numbers reveal a story in which Beijing’s capital controls create conditions for Bitcoin and dollar stablecoins to thrive as workarounds rather than competitors.

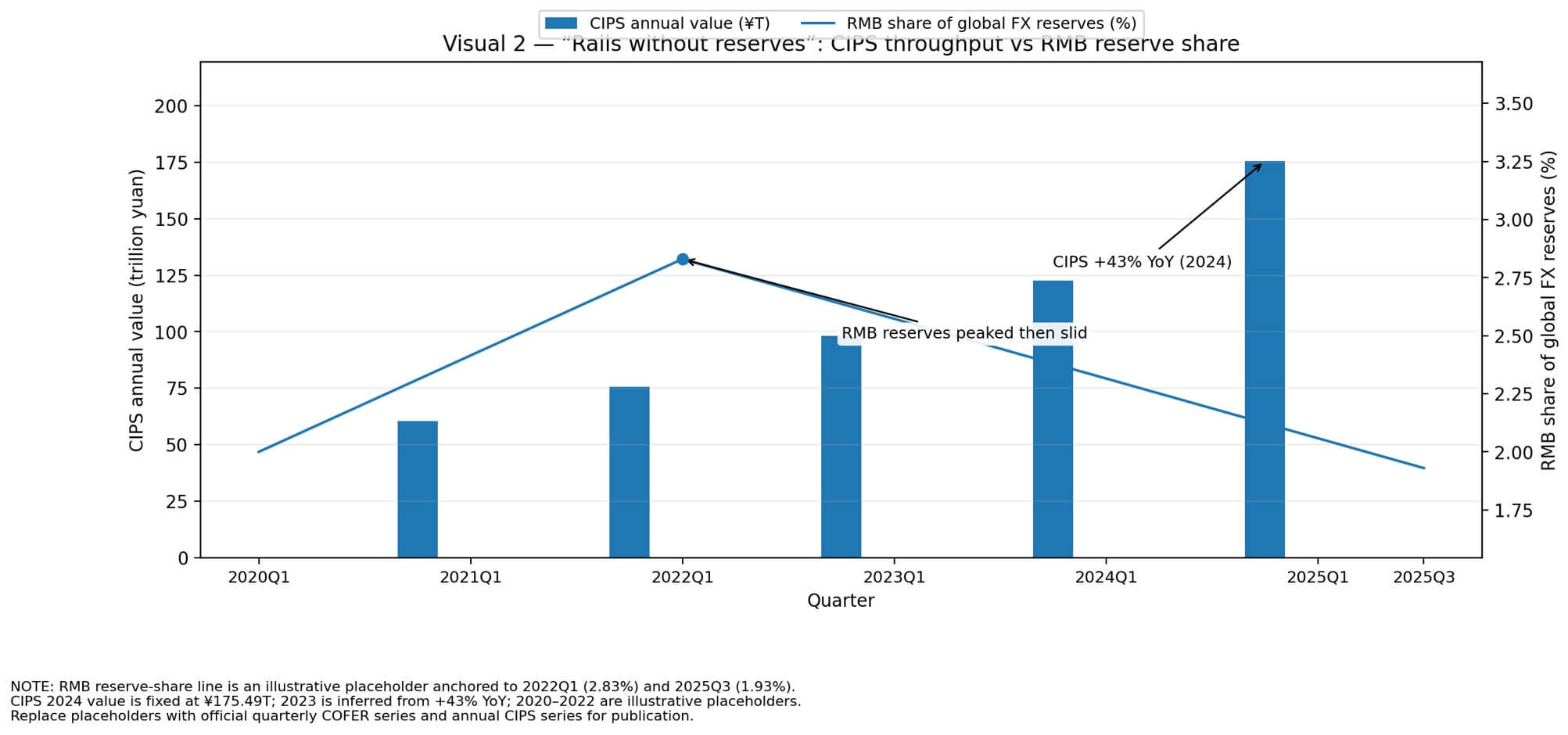

The International Monetary Fund’s latest reserve data shows the renminbi holding just 1.93% of global foreign exchange reserves in the third quarter of 2025, down from a 2.83% peak in early 2022.

That translates to approximately $251 billion in a $13 trillion reserve pool, where the dollar still accounts for 56.92% and the euro for 20.33%.

The renminbi’s share has been sliding for three years, even as China builds faster payment rails and pushes its digital currency into cross-border settlement.

The gap between what Beijing can control (the infrastructure) and what it cannot (actual reserve demand) is where crypto finds its opening.

Rails without reserves

China’s Cross-Border Interbank Payment System processed 175.49 trillion yuan in 2024, up 43% year-over-year across 8.2 million transactions. The network now reaches 4,900 banks through 190 direct participants and 1,567 indirect members spanning 189 countries.

The People’s Bank of China frames this expansion as insurance against payments infrastructure that Western powers can weaponize, and the digital yuan reinforces that bet.

Domestic e-CNY transactions hit 3.4 billion in 2024, moving 16.7 trillion yuan, an 800% jump from 2023. The mBridge platform, designed for wholesale cross-border central bank digital currency settlement, has processed $55.5 billion across 4,000 transactions, with e-CNY accounting for 95% of volume.

However, faster pipes don’t automatically create reserve demand.

Central banks hold reserves in liquid, convertible assets that they can deploy without permission, exactly what China’s capital account restrictions prevent.

Beijing can increase CIPS transaction volume and mBridge adoption without materially affecting reserve accumulation, because reserves depend on counterparties willing to hold renminbi-denominated securities at scale.

The renminbi’s reserve share rose from $90.8 billion at the end of 2016 to $337.3 billion in late 2021 before retreating, a trajectory that shows central banks testing the asset class and then pulling back as convertibility constraints became clearer.

The IMF changed its reserve methodology in the third quarter of 2025 by imputing previously unallocated holdings back to 2000, which makes clean historical comparisons more difficult.

Yet the trend is unambiguous: the dollar’s share drifts lower, while the renminbi fails to sustain the delta. That creates a vacuum, and markets fill vacuums with tools that work.

The shadow dollar infrastructure

Dollar-denominated stablecoins now exceed $305 billion in circulation and account for more than 99% of all stablecoin issuance, according to data from Artemis.

Visa and the blockchain analytics firm Allium track $56.7 trillion in total on-chain stablecoin volume, with $11.1 trillion in adjusted volume after high-frequency trading and arbitrage noise are filtered out.

The IMF estimates $2 trillion in international stablecoin flows for 2024, using a methodology that captures cross-border flows, with $633 billion in North America and $519 billion in the Asia-Pacific leading regional totals.

A separate IMF departmental paper estimates cross-border stablecoin payment flows at approximately $1.5 trillion, narrowing the definition to transactions that resemble traditional payment use cases.

Those numbers matter because stablecoins function as offshore dollar wrappers with 24/7 settlement and no permission layer.

Chinese exporters increasingly receive payment in Tether’s USDT to sidestep capital controls and currency conversion friction, according to Hong Kong over-the-counter desk Crypto HK, which reports that monthly USDT trade settlement by Chinese clients has risen fivefold since 2021.

At the same time, the renminbi’s share of global payments tracked by SWIFT fell to 2.89% in May, a two-year low, while the dollar accounted for 48.46%.

The faster China builds renminbi payment rails, the more those rails compete with an already liquid, already global dollar alternative that operates outside the traditional banking system and reinforces demand for US short-term assets through stablecoin reserve backing.

The IMF notes that cross-border flows of stablecoins overtook those of unbacked crypto assets in 2022, and the gap has widened since, reflecting a shift from speculative instruments to settlement infrastructure.

Net stablecoin outflows correlate with global dollar demand and tend to rise when the dollar strengthens, suggesting that the market treats stablecoins as a means of accessing dollars when traditional channels tighten.

China’s restrictions don’t eliminate demand for dollar liquidity, they redirect it to instruments Beijing can’t control.

| Layer | What it measures | Value | Scale vs RMB reserves ($251B = 1.0x) | Why it matters |

|---|---|---|---|---|

| Official reserve anchor | RMB share of global FX reserves (2025Q3) | $251B | 1.0x | This is the “real” reserve demand Beijing wants to grow |

| Shadow-dollar stock | USD stablecoins in circulation | >$305B | >1.22x | The stock of offshore dollars on-chain already rivals RMB’s reserve stock |

| Shadow-dollar activity | Stablecoin on-chain volume (adjusted) | $11.1T | 44.2x | “Payment-like” on-chain activity scale (after filtering HFT/arbitrage-style noise) |

| Shadow-dollar activity | Stablecoin on-chain volume (total) | $56.7T | 225.9x | Gross throughput: highlights the sheer velocity/liquidity of the stablecoin layer |

| Cross-border significance | IMF international stablecoin flows (2024) | ~$2.0T | 8.0x | Cross-border flow proxy at multiples of RMB’s entire reserve stock |

| Cross-border significance | IMF “payment-like” cross-border stablecoin flows (2024) | ~$1.5T | 6.0x | Narrower definition closer to “payments,” still several times RMB reserves |

| Regional cross-border | North America share of international stablecoin flows (2024) | $633B | 2.5x | One region’s cross-border stablecoin flow exceeds RMB’s whole reserve stock |

| Regional cross-border | Asia-Pacific share of international stablecoin flows (2024) | $519B | 2.1x | Relevant to your China corridor argument: flows are already huge in APAC |

| Comparator (trad rails) | SWIFT payments share (May): RMB vs USD | RMB 2.89% vs USD 48.46% | — | Traditional rails still USD-dominant; stablecoins expand that dominance off-rail |

Two futures, one trade-off

If global reserves grow to $15 trillion later this decade, a 5% renminbi share would require roughly $500 billion more than today’s holdings, which means doubling from current levels.

An 8% share would need $950 billion in net new accumulation. Those are large moves, but not impossible. The renminbi added $246 billion to its reserve holdings between the end of 2016 and late 2021, before the reversal began, proving that central banks will test diversification when conditions align.

The question is whether China opens convertibility enough to sustain that momentum or whether it doubles down on controlled rails.

Beijing has signaled interest in both. JD.com and Ant Group are lobbying for offshore yuan stablecoins in Hong Kong, and the city expects to issue its first stablecoin licenses in March 2026.

That strategy would enable China to compete directly with dollar stablecoins by offering a tokenized, partially convertible renminbi instrument that operates on-chain while remaining within a regulatory perimeter.

It’s a middle path: not full capital account liberalization, but enough flexibility to make renminbi-denominated settlement viable in corridors where dollar stablecoins currently dominate.

If it works, it erodes the dollar’s share of the stablecoin market without requiring China to relinquish control over domestic capital flows.

The alternative scenario, in which China expands CIPS and mBridge but renminbi reserves remain near 2%, favors dollar stablecoins and Bitcoin as the default workaround.

Forecasts of the stablecoin market size by 2028 range from $500 billion at JPMorgan to roughly $2 trillion at Standard Chartered, with the IMF reporting similar estimates.

The wider the range, the more stablecoins behave like money market fund wrappers for offshore dollars, reinforcing dollar dominance even as official reserves diversify.

And Bitcoin benefits as a neutral, non-sovereign asset that neither China nor the US controls, positioned as a hedge against both renminbi restrictions and dollar weaponization.

What’s at stake

The question of reserve plumbing is not whether China can build faster rails, as it already has.

The question is whether Beijing can convince central banks and market participants to hold renminbi assets at scale without opening the capital account in ways that threaten domestic financial control.

Each quarter that gap persists, dollar stablecoins and Bitcoin solidify themselves as the infrastructure of choice for actors who require settlement speed and cross-border reach without permission.

The renminbi’s reserve share can inch higher, but unless China solves the convertibility constraint, the real winners are the assets that route around it.