European stocks rebound but DAX dragged down by SAP, Deutsche

2026-01-29 09:48:00

European equities had a poor showing yesterday with France’s benchmark CAC 40 index leading the drop. Luxury stocks were the main culprits after LVMH disappointed on earnings with a reported 13.3% drop in profit last year. Things are looking better today with most major indices recovering a chunk of the declines already. The only exception being Germany’s benchmark DAX index, which is keeping lower once again.

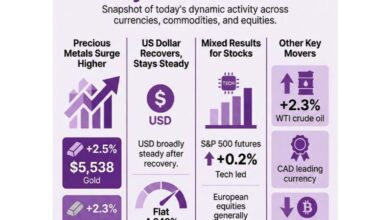

Here’s a snapshot before we dive into the drag in Germany:

- Eurostoxx +0.3%

- Germany DAX -1.0%

- France CAC 40 +0.6%

- UK FTSE +0.5%

- Spain IBEX +0.3%

- Italy FTSE MIB +0.6%

In terms of top performers, shares of miners are once again outperforming amid another surge higher in precious metals today. The Eurostoxx basic resources index has been on a one-way climb since last year, in mirroring the run in gold and silver prices. Things have also gone parabolic to start the year as seen below:

While big tech results in Wall Street were mixed, German software maker SAP is enduring a rough morning with shares down over 11%. That will mark its biggest daily drop since 2020, even as Q4 revenue was in-line with mark estimates.

However, there were several concerns for investors. The company signaled that cloud backlog growth would slightly decelerate in 2026, instead of investor hopes that it would point to an acceleration instead. And touching on cloud backlog, SAP’s current cloud backlog only grew by 25% – missing on analyst estimates of at least 26% or higher.

To cushion the blow at least, SAP did announce a massive €10 billion share buyback program for February but it’s not enough to lift sentiment it would seem. That especially with concerns and massive scrutiny on AI-related companies to “show me the money” now instead of waiting for longer, which was the phase last year.

Besides that, Deutsche Bank is also seeing shares down over 2% despite posting its largest annual profit since 2007. That as German prosecutors raided the bank’s offices in Frankfurt and Berlin amid an inquiry into money laundering. That brought the shares of Germany’s largest bank down yesterday and is again proving to be a drag again today.

This article was written by Justin Low at investinglive.com.