BOC Hold Decision Lifted CAD, But Gains Erased During Presser

2026-01-29 03:39:00

The Bank of Canada kept its policy rate unchanged at 2.25% in their January decision as widely expected while acknowledging heightened uncertainty from U.S. trade restrictions.

During the press conference, Governor Tiff Macklem emphasized the bank remains content with current monetary policy settings, though officials stressed they are prepared to adjust if conditions change.

Key Takeaways

- Policy rate held steady at 2.25%, with the Bank Rate at 2.5% and deposit rate at 2.20%

- Growth outlook remains modest at 1.1% for 2026 and 1.5% for 2027, broadly unchanged from October projections

- Inflation expected to stay close to 2% target, with recent readings around 2.5% (excluding tax effects)

- Trade disruption continues with exports about 4% lower than pre-tariff levels

- Labour market shows mixed signals – employment rising in recent months but unemployment elevated at 6.8%

- Uncertainty elevated around CUSMA review and geopolitical risks, making future rate path unpredictable

- Structural adjustment underway as businesses reconfigure supply chains and seek new markets

In their official statement, the bank identified several key risks to the outlook, with uncertainty around the CUSMA (Canada-United States-Mexico Agreement) review representing the most significant near-term concern. The agreement is scheduled for review in 2026, with outcomes ranging from a straightforward extension to substantial renegotiation or even potential withdrawal by member countries.

Another central theme in the January BOC statement is the ongoing structural adjustment to the new trade environment. Canadian businesses are actively working to reconfigure supply chains, seek new export markets, and reduce dependence on U.S. inputs, reflecting a transition process that is proving costly and time-consuming.

Link to official Bank of Canada Statement (January 2026)

In their quarterly Monetary Policy Report, policymakers projected that inflation will temporarily dip below 2% in February-March as energy prices moderate and shelter cost growth slows, before settling near target for the remainder of the projection horizon.

Furthermore, the BOC expects the unemployment rate to remain elevated in the near term before declining gradually as economic growth picks up and population growth slows. The projection assumes population growth of those 15 and over declines from 1.4% in 2025 to around 0.2% in 2026, substantially reducing labor supply growth.

They also estimated that the output gap currently sits in the -1.5% to -0.5% range, unchanged from October despite upward revisions to historical GDP data.

Link to Quarterly Bank of Canada Monetary Policy Report

In the press conference, BOC Governor Macklem emphasized that while the current 2.25% policy rate is judged appropriate based on the central outlook, “elevated uncertainty makes it difficult to predict the timing or direction of the next change in the policy rate.”

He also mentioned that monetary policy can play a supporting role by “helping the economy through this period of structural change, while maintaining inflation close to the 2% target.” This suggests that the March meeting remains live, with the path forward heavily dependent on how the CUSMA review unfolds and whether trade-related uncertainty begins to meaningfully affect domestic demand.

Link to BOC Press Conference (January 2026)

Market Reaction

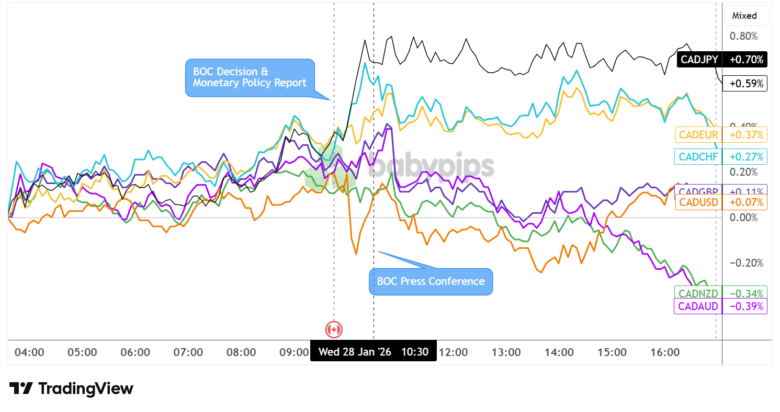

Canadian Dollar vs. Major Currencies: 5-min

CAD vs. Major Currencies 5-min – Chart Faster with TradingView

The Canadian dollar, which had slowly been grinding higher in the hours leading up to the BOC announcement, had a mixed but mostly bullish reaction to the decision to keep interest rates on hold.

The Loonie initially saw sharp gains against the Japanese yen (+0.70%), Swiss franc (+0.27%) and euro (+0.37%), though some pips were returned around the time of the press conference as Macklem hinted that they’re keeping the door open for further easing if needed.

CAD wound up retreating from its brief rally against GBP (+0.11%), NZD (-0.34%) and AUD (-0.39%) while undergoing additional volatility against the U.S. dollar (+0.07%) leading up to the highly-anticipated FOMC decision.

Interested in fundamental analysis made for newbies and how to pair it up with technical analysis to find high quality opportunities that may match your trading and risk management style? Check out our Premium membership for event trading guides, short-term strategies, weekly recaps and more!

BabyPips.com Annual Premium Members also get an exclusive 30% discount on the annual subscription for the first year on Tradezella–the top rated journaling app! ($120 in savings)! Click here for more info!