The storage supercycle is going parabolic. Huge moves in STX and SNDK stock

2026-01-28 17:20:00

The “AI infrastructure” trade has moved from chips to storage, and the moves are becoming meme-like.

We have seen a historic repricing in the memory and storage sector in the past few months. If you thought the semiconductor rally was tired, look at the hardware board today. Money is rotating aggressively into legacy storage names on bets that data center capacity is the new bottleneck for generative AI.

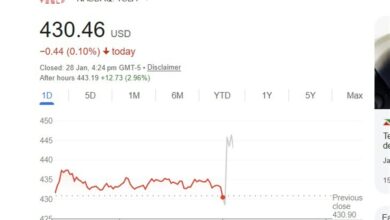

Seagate (STX) is the standout leader, skyrocketing 19% to smash through the $440 level. The stock has gone vertical, currently trading at $443.79. Seagate reported fiscal Q2 2026 results this morning that crushed Wall Street expectations with HAMR hard drives sold out through end-2026. The catalyst appears to be a mix of short covering and fears of an HDD shortage for hyperscale data centers.

STX stock, daily

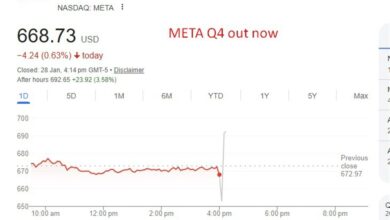

But the real story continues to be the post-spin-off performance of Sandisk (SNDK).

Since separating from Western Digital last year, Sandisk has been a relentless compounder, but today’s move is something else. Shares are up another 7.8% to $519.00, extending a run that is starting to look crowded but shows no sign of stopping. It’s up 960% in just 11 months. The narrative is simple: AI needs fast storage, and NAND pricing power has returned with a vengeance. It’s gotten so bad the PC builders are fearful that home PCs will be a thing of the past as prices get too high. The multiple has jumped to 30-40x from 8-10x for years.

Western Digital (WDC) is joining the party, up 10% to $278.54, finally catching a bid as the valuation gap between it and its former unit narrows.

Even Intel (INTC) is finding friends, reclaiming the $49 handle (up 11%) as the rising tide lifts all hardware boats. That’s become something of a state-backed driver.

For now, the trend is your friend, but the verticality of these moves suggests we are in the “panic buying” phase of the cycle.