SEC Task Force Posts Response Backing Ripple on Passive Interest

A response posted to the US Securities and Exchange Commission’s Crypto Task Force page echoed concerns raised by Ripple that speculation alone should not automatically subject cryptocurrencies to federal securities laws, as lawmakers continue debating the CLARITY Act.

The response, written by digital asset regulation attorney Teresa Goody Guillen and published Monday as public input on the SEC’s website, argued that holding a “passive economic interest,” such as buying a token in hopes its price rises, should not, by itself, trigger securities regulation. Guillen wrote that digital assets should instead be assessed using a broader set of factors applied on a sliding scale.

“I agree with Ripple’s assertion that “[f]rameworks suggesting that a ‘passive economic interest’ alone could trigger securities laws mistakenly conflate speculation with investment rights […],” Gullen said, citing prior academic work.

She added that her comments were not intended to set out a binding regulatory framework and do not reflect official SEC policy.

The letter is a response to Ripple’s Jan. 9 submission, which flagged multiple concerns in the existing market structure draft bill. It proposed that lawmakers should not consider the term “decentralization” as a governing legal metric, and that passive economic interests should not trigger securities laws, as they mistakenly conflate speculation with investor rights.

SEC proposes new crypto asset classification

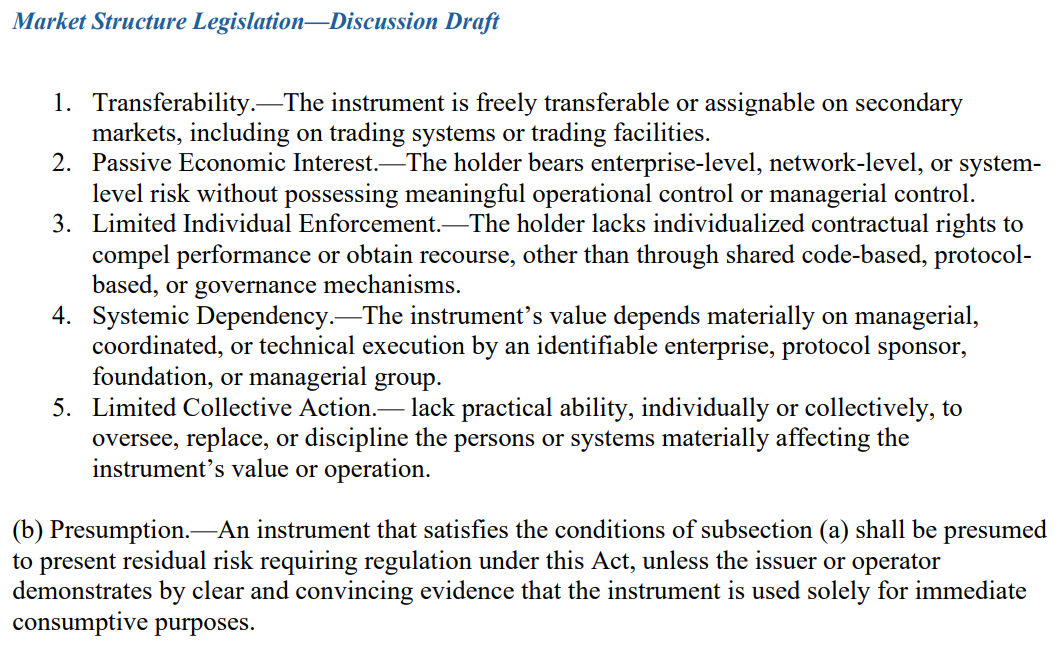

Separately, Guillen published a discussion draft for the “Digital Markets Restructure Act of 2026,” and has not been approved by leadership at the SEC or the Commodity Futures Trading Commission. The draft proposes classifying certain cryptocurrencies as “Digital Value Instruments” when they do not fit neatly into existing categories such as securities or commodities.

Related: NYSE develops 24/7 blockchain trading platform for tokenized stocks, ETFs

Cryptocurrencies would be deemed Digital Value Instruments if they exhibit at least three of five characteristics: free transferability, bearing a passive economic interest to holders, offering limited individual contractual rights to holders, holding a systemic dependency to the enterprise or protocol sponsor, or lacking the ability to discipline or replace the systems affecting the instrument’s value or operations.

The draft also calls for risk-based jurisdictions for the SEC and the CFTC, federal preemptions for inconsistent state law application and safe harbor provisions to support innovation.

Related: Polymarket hit by fresh European crackdowns as Hungary, Portugal block access

The publication of the submissions comes ahead of a joint SEC–CFTC meeting scheduled for Thursday to discuss regulatory coordination on digital assets.

Initially set for Tuesday, the “harmonization” event was delayed by two days and will also feature a fireside chat with SEC Chair Paul Atkins and CFTC Chair Mike Selig.

The US Senate Agriculture Committee also delayed its markup for the crypto market structure bill after the US was hit by a severe winter storm.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026