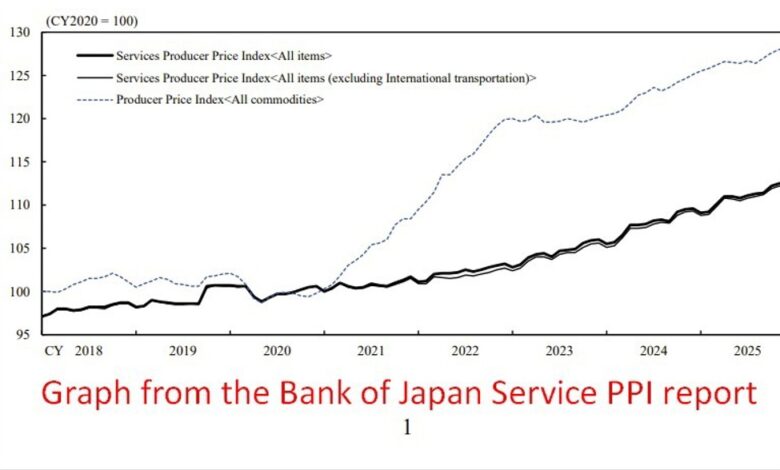

Japan service inflation holds near highs as wage pressures persist

2026-01-27 02:28:00

Japan’s service inflation signal stayed firm in December, underscoring wage-driven price pressure and keeping the BoJ alert to further tightening.

Summary:

Japan’s leading indicator of service-sector inflation remained elevated in December, reinforcing the view that labour shortages and rising wages continue to generate underlying price pressure, according to data released on Tuesday.

Figures from the Bank of Japan showed the services producer price index rose 2.6% year-on-year in December, following a 2.7% increase in November. The index tracks prices companies charge each other for services and is closely watched as an early signal of domestically driven inflation.

Price increases were concentrated in labour-intensive industries such as hotels and construction, highlighting the impact of a tight labour market and supporting the BoJ’s assessment that wage growth is feeding through into service-sector prices.

The data comes after the BoJ ended its decade-long stimulus programme in 2024 and raised short-term interest rates to 0.75% in December, judging that Japan was nearing a durable achievement of its 2% inflation target. Consumer inflation has now exceeded that threshold for nearly four years.

BoJ Governor Kazuo Ueda said last week the central bank would closely monitor whether steady wage gains prompt broader cost pass-through, a key factor in assessing the timing of further rate hikes.

In a separate analysis released Tuesday, the BoJ said yen weakness is increasingly influencing inflation not only through higher import costs but via second-round effects, including rising labour costs passed on through service prices. The findings strengthen the case that inflation pressures are becoming more domestically entrenched.