Premium Watchlist Recap: U.K. CPI (December 2025)

The U.K. December CPI report came in slightly better than expected, briefly spurring pound rallies before overall risk aversion overshadowed fundamentals on worsening EU-US tariffs tensions.

Which GBP strategies moved beyond the watchlist stage, and how did shifting overall market sentiment impact the outcomes?

Watchlists are price outlook & strategy discussions supported by both fundamental & technical analysis, a crucial step towards creating a high-quality discretionary trade idea before working on a risk & trade management plan.

If you’d like to follow our “Watchlist” picks right when they are published throughout the week, check out our BabyPips Premium subscribe page to learn more!

We’re breaking down our pound setups this week and examining how each pair performed after the upbeat CPI release while markets navigated Greenland-related tensions and Trump’s threats to impose higher tariffs on European nations.

The Setup

What We Were Watching: U.K. CPI (December 2025)

Event Outcome

Headline CPI rose from 3.2% to 3.4% year-on-year while core inflation held steady at 3.2% instead of dipping to 3.1%, suggesting that inflationary pressures remain elevated and that the BOE could hold off easing in the immediate future.

Key Takeaways:

- Services inflation rose to 4.5% from 4.4%, in line with expectations and closely watched by the BOE as a gauge of domestic price pressures

- Food inflation accelerated to 4.5% from 4.2%, with bread, cereals, and vegetables contributing to the increase

- Tobacco prices surged 3.0% on a monthly basis following duty increases implemented on November 26, 2025, compared to a 0.7% rise in December 2024 when duties were raised in late October

- Airfares jumped 28.6% in December 2025 versus a 16.2% increase in December 2024, with the ONS noting the timing difference in return flight collection dates affecting the comparison

Sterling initially swung higher upon seeing higher-than-expected inflation readings, as these likely reminded traders of the BOE’s hawkish cut back in December. However, the rally was short-lived as traders focused on how underlying inflation remained below BOE projections, leading gains to be returned less than an hour after the release.

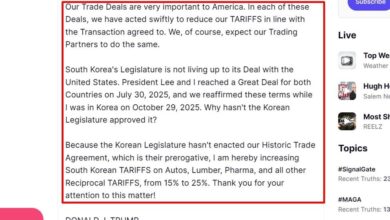

Afterwards, the market attention quickly returned to worsening relations between the US and the EU when Trump threatened 10% tariffs on European countries, including the UK. This sparked a broad risk-off move that wound up erasing GBP’s post-CPI gains and more.

Fundamental Bias Triggered: Bullish GBP

Broad Market and Exogenous Drivers:

Greenland Geopolitical Drama (Monday-Tuesday): Markets opened to weekend news of Trump threatening 10% tariffs on eight NATO allies against his Greenland takeover bid, which prompted retaliatory threats from Europe to dump Treasuries. Traders spent the early part of the week biting their nails ahead of Trump’s Davos testimony, while mostly downbeat data points from China and a spike in global bond yields from Japan’s tax cuts rumors also weighed on risk-taking.

Davos De-Escalation Turnaround (Wednesday): Risk assets caught a bid in anticipation of a Supreme Court ruling against Trump’s tariffs, followed by an even more pronounced rally after the U.S. President clarified that he wouldn’t use military force on Greenland. Markets also cheered Trump’s announcement of a framework for a deal on tariffs, prompting a steady unwinding of safe-haven positions midweek, along with talks of progress in Ukraine-Russia negotiations.

Fundamentals Refocus (Thursday-Friday): Although the U.S. economy printed net positive GDP and jobs data on Thursday, de-dollarization seemed to be the name of the game while risk-taking dominated and “Sell America” vibes lingered. At the same time, other major economies like Australia, Japan, the U.K., and Canada continued to print upbeat data points that further stoked risk rallies.

EUR/GBP: Bearish GBP Event Outcome + Risk-On Scenario = Arguably good odds of a net positive outcome

EUR/GBP 1-hour Forex Chart by TradingView

Our bullish EUR/GBP watchlist setup looked for a range break if U.K. CPI failed to deliver a clear hawkish signal, especially against a backdrop of potential geopolitical de-escalation under a TACO scenario.

While headline CPI printed slightly above forecasts at 3.4% versus 3.3% expected, the modest 0.1% beat and unchanged core inflation at 3.2% provided limited support for a more hawkish BOE stance. The initial Sterling rally was brief, suggesting markets recognized the upside surprise was driven primarily by seasonal factors—elevated air fares during Christmas travel (up nearly 30% year-over-year), tobacco duty increases, and alcohol price rises—rather than fundamental shifts in underlying inflation dynamics.

However, the immediate post-CPI environment presented conflicting intermarket signals that complicated our directional conviction. Equities and Bitcoin moved lower while gold rallied—typical risk-off behavior—yet the dollar weakened and bond yields rose, contradicting traditional safe-haven flows. This “muddled middle” market environment initially warranted patience rather than immediate directional bias.

In our Watchlist update post event, “UK CPI Alert: Mixed Signals Call for Patience on EUR/GBP” we discussed how the unusual environment warranted “no bias,” but we leaned bearish on EUR/GBP on relative value. And if we saw a certain set of conditions were triggered (mainly rejection at current 0.8720-0.8730 resistance zone) then our bearish bias was actionable.

The turning point came during Trump’s Davos remarks, which sparked a decisive risk-on move and eased U.S.-EU tensions. That reduction in geopolitical risk lifted the pound and allowed EUR/GBP to move beyond watchlist stage as the technical rejection at the 50-61.8% Fibonacci retracement area (0.8720-0.8730) that we had flagged for caution ultimately held, validating our approach of waiting for clearer market regime definition before committing to direction.

The move faded late in the week after stronger U.K. retail sales pulled the pair back below 0.8690, while mixed Euro Area PMIs reinforced the ECB’s cautious stance. EUR/GBP ended the week in the previous consolidation range between 0.8650 – 0.8690.

Not Eligible to Move Beyond Watchlist – GBP/USD & Bullish GBP Setups

GBP/USD: Bearish GBP Event Outcome + Risk-Off Scenario

GBP/USD 1-hour Forex Chart by TradingView

Our bearish GBP/USD watchlist flagged the pair trading in a downtrend with resistance around the 1.3450-1.3460 zone, aligning with the R1 Pivot Point, 78.6% Fibonacci retracement, and the top of a descending channel. The setup anticipated that weaker UK inflation, combined with continued U.S.-EU tariff concerns, could extend Sterling’s downtrend toward 1.3400 mid-channel or 1.3350 January lows.

The CPI came in significantly stronger than our bearish scenario required, with headline at 3.4% versus 3.1% expected, immediately invalidating the fundamental basis for GBP weakness. Sterling rallied sharply on the release, pushing toward our identified resistance zone rather than breaking lower.

Then, geopolitical de-escalation during Trump’s Davos speech created the opposite market dynamic from our risk-off scenario. GBP/USD traded range-bound between 1.3400-1.3450 through most of the week as traders assessed the mixed signals: hotter headline inflation supporting hawkish BOE expectations versus unchanged core inflation suggesting underlying pressures remain contained.

The pair ultimately closed the week higher, with Sterling caught between the marginally firmer inflation data and broader risk sentiment shifts. The setup never progressed from watchlist stage as both the fundamental outcome (hotter, not cooler CPI) and risk environment (risk-on, not risk-off) contradicted our scenario requirements.

GBP/CHF: Bullish GBP Event Outcome + Risk-On Scenario

GBP/CHF 1-hour Forex Chart by TradingView

Our analysts anticipated a GBP/CHF bounce off the confluence of technical levels (61.8% Fib, S1 and rising trend line) should the U.K. CPI meet or beat estimates in a risk-on setting that would likely weigh on the safe-haven Swiss franc.

Although the headline CPI turned out higher than consensus, the quick reversal of the initial pound rally suggested that markets caught on the weakness in underlying inflation metrics, which kept BOE policy expectations largely unchanged and ultimately weighed on the currency while risk sentiment was wobbly.

GBP/CHF had already tumbled below the watchlist support zone ahead of the CPI release since the U.K. jobs report turned out mixed, dipping to S3 (1.0600) before briefly rallying upon seeing the numbers. Gains were capped at S1 (1.0700) which then held as resistance until the next day, before risk rallies on geopolitical de-escalation and improving global data lifted the pair back to the area of interest.

GBP/AUD: Bullish GBP Event Outcome + Risk-Off Scenario

GBP/AUD 1-hour Forex Chart by TradingView

Our watchlist setup eyed a long-term triangle support test on GBP/AUD ahead of the U.K. CPI release, predicting that a bounce could take place if the U.K. inflation report beats estimates in a risk-off setting.

The headline results showed some green but not enough to boost hawkish BOE expectations, eventually leading to another wave lower for GBP/AUD while risk-on and pro-AUD flows surged in the sessions following the CPI release.

The pair had already been hovering below the 2.0000 major psychological level and S1 (1.9930) ahead of the report, as the market spotlight had been on geopolitical de-escalation that strongly favored the higher-yielding Aussie. Price barely found support on upbeat U.K. CPI, and another GBP/AUD wave lower to S2 (1.9850) followed on Trump’s tariffs framework announcement then on upbeat Australian jobs data that took it down to S3 (1.9740).

The best way to turn these strategy recaps into personal growth is to sync them with your own data. Import these setups into your trading journal to see how they would have interacted with your specific risk profile.

Still using spreadsheets (or nothing at all)? It’s time to automate! Check out TradeZella, the AI-powered journal that identifies your behavioral leaks for you.

Premium Perk: BabyPips Premium Annual members get an exclusive 30% discount on TradeZella Annual subscription—saving you $120 on your first year.

Click here to learn more about Babypips Premium and Tradezella!

The Verdict

The U.K. CPI report reflected a modest upside surprise in headline inflation driven by seasonal factors, while muted core price pressures kept the BOE policy outlook largely unchanged—a nuanced outcome that initially triggered sterling weakness amid wildly contradictory risk sentiment signals.

The week began with conflicting intermarket dynamics that made immediate directional bias development lower probability: equities and crypto declined while gold surged (risk-off signals), yet the dollar weakened and yields rose (risk-on signals). This environment reinforced the importance of patience—not every data release demands immediate positioning, particularly when traditional correlations break down.

What initially started as a risk-off week on fresh tariffs threats, particularly targeting Europe, transformed into a risk rebound story as the TACO scenario materialized. Trump’s Davos de-escalation remarks provided the clarity we were waiting for, prompting an unwinding of safe-haven positions and allowing EUR/GBP to move beyond the watchlist stage after certain price behavior conditions were met.

Fortunately for us, the result was EUR/GBP moving to the downside and with a little bit of luck, got a little bit of extra help at the end of the week with better-than-expected UK retail sales data.

Because we adapted to complex broad environment, we would argue that the potential outcome for those who lean bearish on EUR/GBP after the environment shift likely saw a positive outcome. But for those who didn’t and stuck to the original watchlist ideas, the probability would have been low of a net positive outcome, or even unlikely that any of the pairs warranted moving beyond the watchlist stage. Overall, we’d rate this week’s discussion at “neutral-to-likely” of potentially leading to a net positive outcome.

Key Takeaways:

Headline Results Don’t Guarantee Direction

Although the headline CPI turned out a notch higher than expected, pound bulls appeared to have set the bar much higher than the consensus estimate before positioning for more hawkish BOE expectations. The core CPI miss wound up being the main driver of the pound’s overall reaction, as markets judged that policy tightening isn’t likely to happen anytime soon.

Geopolitical and Political Developments Can Overwhelm Economic Data

Driving last week’s takeaway much further is the weak U.K. CPI data, which should have led to sustained sterling downside but instead saw initial moves reversed as the focus on geopolitical developments intensified. Risk-on flows picked up in the sessions following the target event, allowing the U.K. currency to regain some ground as a “risk asset” particularly as tensions in the European region eased.

Technical Levels Remain Relevant Even When Fundamental Scenarios Shift

GBP/CHF finding support precisely at the identified 1.0700 zone (61.8% Fib, rising trend line) before rallying to R1 targets demonstrated that well-defined technical structures can provide reliable entry and exit points even when the fundamental pathway differs from initial expectations. EUR/GBP holding support at 0.8670 and testing resistance at 0.8690 showed technical confirmation can validate directional bias when fundamental outcomes are mixed.

Currency Markets React to the Evolving Data Narrative

Wednesday’s UK CPI was the scheduled catalyst, but subsequent releases proved just as influential. Strong Australian employment data on Thursday, alongside firm U.S. growth and in line PCE readings, helped shape broader FX price action. By Friday, a sharp upside surprise in UK retail sales flipped the narrative, triggering EUR/GBP weakness as resilient consumer spending reinforced hawkish BOE expectations and undercut the earlier bearish GBP view that had been supported by the week’s risk on tone. In data dense weeks, markets respond to the cumulative macro story rather than any single release.