Tech stocks mixed: Communication services buoy market amid semiconductor struggles

2026-01-26 14:46:00

Tech stocks mixed: Communication services buoy market amid semiconductor struggles

The US stock market presented a mixed bag today, with notable divergences across sectors. While technology stocks showed varying performance, the communication services sector provided a buoyant force, counterbalancing struggles within semiconductors.

🔍 Sector Overview

- Technology and Semiconductors: The semiconductor sector faced a challenging day, driven by declines from Micron Technology (MU) down 2.71% and Advanced Micro Devices (AMD) slipping 1.95%. Despite this, heavyweights Nvidia (NVDA) and Broadcom Inc. (AVGO) managed modest gains, both up 0.14%, signaling some resilience amid sector pressure.

- Software and Infrastructure: Microsoft (MSFT) saw a decline of 0.72%, contributing to a mixed sentiment in software and infrastructure, though Oracle Corporation (ORCL) posted a positive return of 1.47%.

- Consumer Electronics: Apple (AAPL) led gains with a 1.07% climb, reflecting positive investor sentiment and potentially strong product performance expectations.

- Communication Services: Google (GOOG) and Meta Platforms Inc. (META) experienced healthy increases, rising 0.66% and 1.12% respectively, showcasing optimism in this sector.

- Financials: Stable growth was observed here, with JPMorgan Chase (JPM) and Visa (V) experiencing gains of 0.47% and 0.88% respectively, pointing towards investor confidence in financials amidst economic uncertainties.

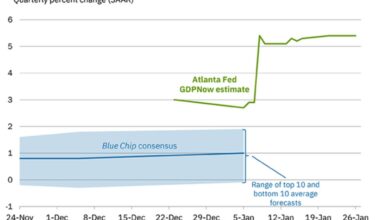

📈 Market Mood and Trends

The market displayed a cautious yet optimistic sentiment, with a clear divide between up-and-coming sectors and those facing headwinds. Communication services continue to attract investor confidence, buoyed by steady performances from giants like Google and Meta.

Conversely, the semiconductor sector’s difficulties suggest caution among investors, potentially driven by macroeconomic factors or shifts in consumer demand. Investors appear to be navigating volatility with strategic reallocations.

💡 Strategic Recommendations

In light of today’s market dynamics, investors are advised to:

- Monitor the semiconductor sector carefully for signs of recovery or further dips, which could indicate broader tech sector trends.

- Consider increasing exposure in the communication services sector, which may continue to benefit from digital transformation and advertising revenues.

- Look to diversification within financials and consumer staples to balance portfolios against the volatility seen in tech.

As always, stay updated with real-time market data and visit InvestingLive.com for expert market analyses and insights. Keeping a diversified portfolio will be key in navigating the present economic environment effectively.