investingLive European markets wrap: Precious metals hit new peaks, dollar woes continue

2026-01-26 12:38:00

Headlines:

Markets:

- JPY leads, USD lags on the day

- European equities mixed; S&P 500 futures down 0.1%

- US 10-year yields down 2.2 bps to 4.217%

- Gold up 2.2% to $5,090.34, Silver up 7.2% to $110.35

- WTI crude oil up 0.1% to $61.10

- Bitcoin up 1.5% to $87,821

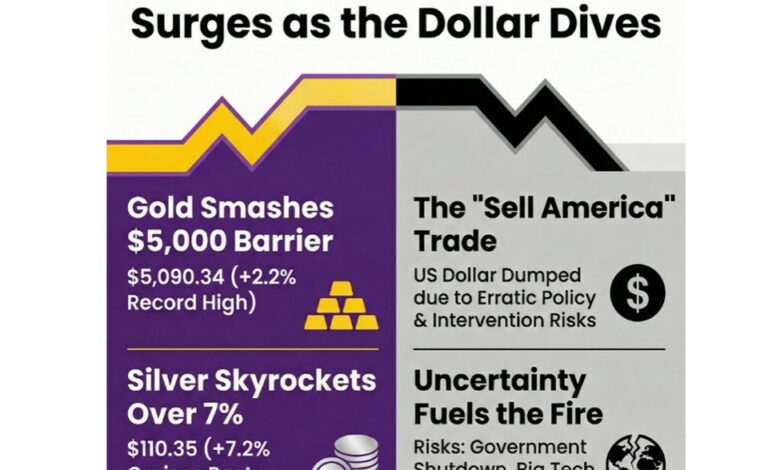

What a start to the new week. The volatility madness and chaos continues as market players stick with dumping the dollar and buying up precious metals. Gold and silver have gone parabolic for the past few weeks and the surge higher today builds on that and then some. Gold has comfortably jumped above $5,000 and eyes a break of $5,100 on the day while silver is in cruise control in breezing past the $100 mark and is now testing waters above $110. Absolutely wicked.

As for the dollar, it continues to be dumped hard across the board. Call it the sell America trade. Call it currency debasement. Call it de-dollarisation. It all fits as markets are continuing to punish the greenback for the US administration’s erratic and unpredictable policy handling domestically and on the international stage.

USD/JPY is the biggest loser, opening with a strong gap lower with yen-tervention fears putting a double whammy on the pair. After the speculated ‘rate check’ on Friday, there is a high chance Tokyo will step in as they did before previously back in July 2024 and September 2022 shortly after their ‘rate check’ plays.

That saw USD/JPY gap down in a big fall to 153.30 before keeping around the 154.00 level through European trading, down a little over 1% on the day.

Besides that, the dollar also struggled across the board with EUR/USD up 0.2% to 1.1850 and USD/CHF down 0.3% to 0.7777. That in turn is pushing EUR/CHF towards the pivotal 0.9200 mark, so do keep an eye out for that as well. Elsewhere, USD/CAD is down 0.1% to 1.3685 and AUD/USD up 0.4% to 0.6920 on the day.

In the equities space, the market volatility and uncertainty all around is keeping investors more nervous as we get the week going. US futures opened down by nearly 1% but have pretty much erased that drop in its entirety with S&P 500 futures now down by just 0.1%.

While it is Fed week, just be wary that we will have big tech earnings (Microsoft, Meta, Tesla, Apple) reporting this week and month-end shenanigans might also factor into play in the days ahead. That not to mention the potential US government shutdown, with odds now rising dramatically after the ICE shooting of civilian Alex Pretti.

It’s over to US trading now where the wild swings will continue with Wall Street set to enter the fray.