BitGo Stock Slides After IPO as Crypto Listing Volatility Returns

Shares of digital asset custodian BitGo Holdings (BTG) have swung sharply since the company’s public debut on the New York Stock Exchange on Thursday, with early gains quickly reversing as initial IPO enthusiasm cooled and investors moved to lock in profits.

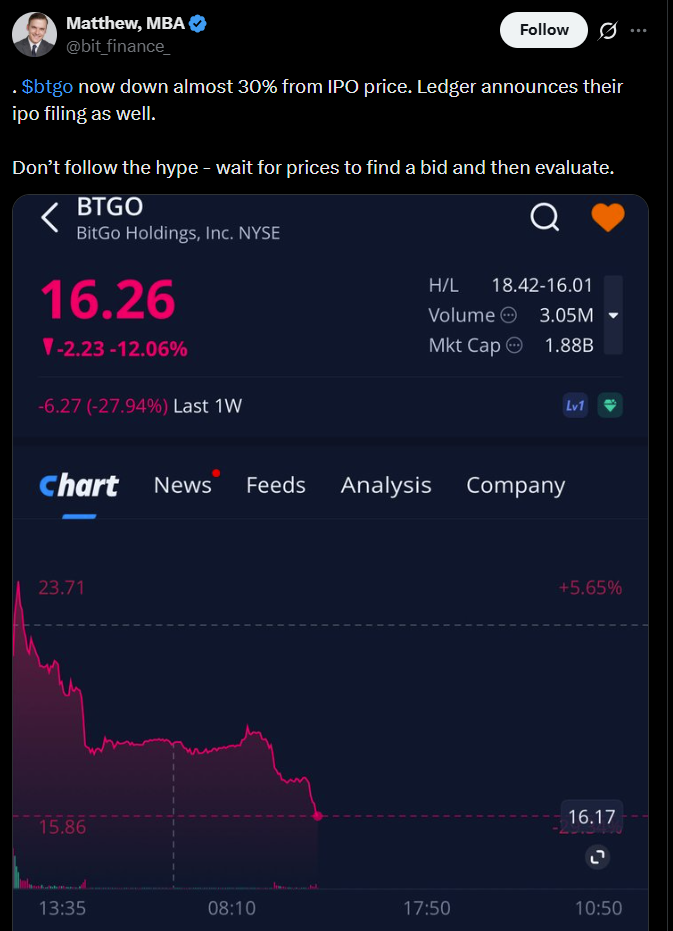

BitGo priced its initial public offering at $18 a share and it jumped about 25% in its first day of trading, reflecting strong early demand. While the stock closed only modestly higher in its first full session, the rally proved short-lived.

Shares have since fallen below their IPO price, declining as much as 13.4% on Friday, according to Yahoo Finance data.

The volatility appears to reflect profit-taking following the first-day surge, a relatively limited public float typical of newly listed companies and broader uncertainty surrounding crypto-related equities, which have been prone to sharp price movements amid shifting investor sentiment.

At its IPO price, BitGo was valued at $2 billion.

As Cointelegraph previously reported, the company first signaled its intention to go public in September 2025, after filing regulatory paperwork with the US Securities and Exchange Commission. BitGo, which provides digital asset custody and infrastructure services, reports more than $90 billion in assets under custody on its platform.

Related: Bitwise launches actively managed ETF pairing Bitcoin with gold

Crypto IPO momentum continues despite market pressure

Several high-profile cryptocurrency companies are reportedly exploring public listings despite persistent market headwinds, signaling continued confidence in long-term investor demand.

The Financial Times reported this week that hardware wallet provider Ledger is considering a US initial public offering at a valuation exceeding $4 billion.

Meanwhile, digital asset exchange Kraken recently raised $800 million at a $20 billion valuation, fueling renewed speculation about a potential IPO. Co-CEO Arjun Sethi has said the company is not rushing toward a public listing.

Still, recent IPO performance has been uneven. Shares of companies that went public in 2025 have underperformed the S&P 500, according to Bloomberg data, with mid-sized public listings struggling the most.

“The biggest takeaway is that we’re firmly back in a fundamentals-driven market,” said Mike Bellin, an IPO expert at PwC. “Investors have become far more selective, and companies must enter the market with a sharper story and stronger operational direction.”

Related: Kraken IPO, M&A deals to reignite crypto’s ‘mid-stage’ cycle: fund manager