Grayscale Files for Spot BNB ETF With SEC

The product, if approved, would give US investors access to regulated BNB exposure without needing to hold the token themselves.

Grayscale has filed with the US Securities and Exchange Commission to launch a spot exchange-traded fund tracking BNB, marking one of the asset manager’s most ambitious moves beyond Bitcoin and Ether.

According to a registration statement filed on Friday, the proposed Grayscale BNB ETF would hold BNB (BNB) directly and issue shares designed to reflect the token’s market value, minus fees and expenses. The filing indicates the fund is intended to trade on Nasdaq under the ticker symbol GBNB, subject to regulatory approval.

If approved, the product would give US investors regulated exposure to BNB without needing to custody the token themselves or hold it on crypto exchanges.

A filing tied to BNB is notable, as the token is the fourth-largest cryptocurrency by market capitalization, with a total value of $120.5 billion at the time of filing.

BNB is the native token of the Binance ecosystem and plays a central role across its products. The token is used to pay transaction fees on the BNB Smart Chain, participate in onchain governance and receive trading fee discounts on Binance’s platform, among other use cases.

Related: BNB Chain targets ‘around one second’ finality with Fermi hard fork

Expansion beyond Bitcoin and Ether

Grayscale’s filing does not represent the first attempt to bring a BNB-linked ETF to the US market.

Investment manager VanEck submitted a registration statement for its own proposed BNB ETF, including an amended Form S-1 seeking a Nasdaq listing under the ticker VBNB, placing it further along in the regulatory review process than Grayscale’s proposal.

Still, the filing highlights Grayscale’s broader strategy to expand its lineup of crypto investment products following the approval and successful launches of spot Bitcoin (BTC) and Ether (ETH) ETFs in the United States.

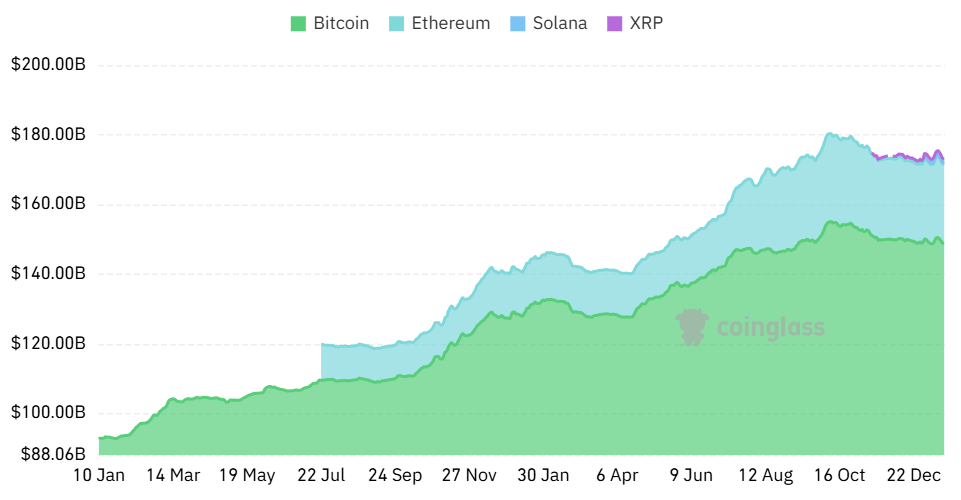

Spot Bitcoin and Ether ETFs together hold more than $100 billion in assets under management, underscoring investor demand for regulated crypto exposure. A BNB-linked product would extend that access beyond base-layer networks, offering exposure to a token closely tied to a major crypto exchange ecosystem.

Related: Grayscale forms trusts tied to potential BNB and HYPE ETFs