The macro view from the railroads: CSX says they don’t see any macro improvement coming

2026-01-23 16:15:00

US railway CSX isn’t seeing a macro rescue in 2026. Management is planning for flat industrial production, modest GDP growth and sticky inflation within the firm above 3%, with customers cautious under tariff pressure. Housing and autos remain headwinds, trucking is soft, and there’s no near-term catalyst—leaving infrastructure spending and power demand as the lone offsets nationally.

The shares are up 4.5% today on a mix of solid execution and M&A chatter but have been flat since 2021.

Here are some revealing comments on the macro outlook from the conference call.

Stephen Angel – CEO

- “This has been a challenging year for CSX and for our industry overall with subdued demand and limited growth opportunities persisting across many of our key markets.”

- “As we plan for 2026, we do not anticipate any meaningful improvement in macroeconomic conditions.”

- “We are assuming low single-digit revenue growth for the year based on flat industrial production, modest GDP growth and fuel and benchmark coal prices consistent with current levels.”

- “Obviously, any time you get a little help from the economy, that would certainly help, but I really don’t sit here and think I need to have a lot of help from the economy.”

Maryclare Kenney — Chief Commercial Officer

-

“We continue to navigate the challenges of a mixed industrial demand environment.”

-

“There’s no short-term catalyst on the horizon to lift the major industrial markets.”

-

“Many of our customers are carefully controlling freight spend as they manage through inflation and tariff pressures.”

-

“Consensus forecasts call for a modest decline in housing starts this next year.”

-

“Affordability and overall demand levels continue to impact the prospects for North American light vehicle production.”

-

“Minerals volume remains supported by demand for aggregates and cement for infrastructure projects.”

-

“The markets reflect the reality of a still soft trucking market, and we also need to be aware of the risk of a slowdown in imports after the pull forward of activity that occurred through 2025.”

-

“Global steel markets and benchmark prices remain subdued.”

Kevin Boone — CFO

-

“Overall, I would look at inflation probably being in that 3% to 3.5% range.” (this is corporate level, not nationally)

That’s a revealing picture and it runs counter to some of the early-year optimism.

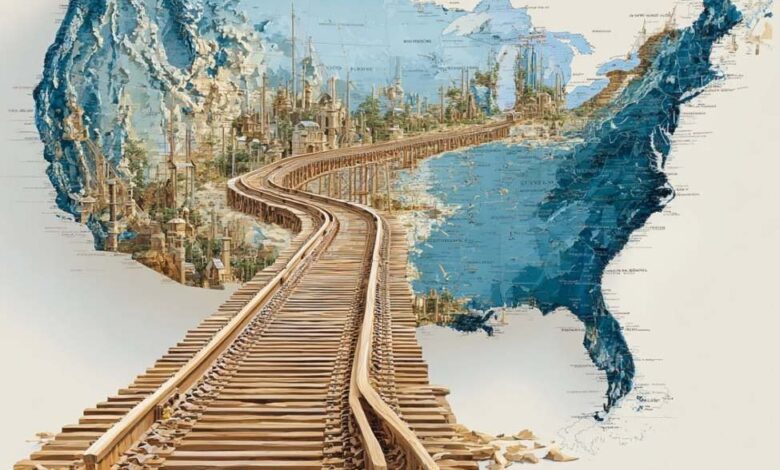

CSX stock daily