Australian Unemployment Fell to 4.1% in December, AUD Drifted Higher

2026-01-22 04:34:00

Australia’s labor market delivered a robust performance in December 2025, with employment surging stronger than expected at 65.2K versus the 28.3K consensus and the unemployment rate falling more than anticipated from 4.3% to 4.1%.

Key Takeaways

- Employment jumped by 65,200 in seasonally adjusted terms (vs. modest expectations), driven by strong gains in both full-time (+54,800) and part-time (+10,400) positions

- Unemployment rate declined to 4.1% from 4.3% in November, beating expectations and marking a 0.2 percentage point improvement

- Participation rate edged higher to 66.7%, suggesting continued labor market engagement despite economic headwinds

- Underemployment fell sharply to 5.7% from 6.2%, indicating improving job quality and hours availability

- Hours worked increased to 2,001 million, up 0.4% month-over-month, signaling sustained economic activity

The composition of employment growth was notably positive. Full-time positions accounted for the bulk of gains, rising by 54,800 in seasonally adjusted terms and 13,300 in trend terms. This suggests employers are confident enough to commit to permanent, full-hour positions rather than merely adding marginal part-time work.

Link to official ABS Labour Market Survey (December 2025)

Underlying metrics such as participation rate and underemployment also showed notable improvements, reinforcing the view that the Australian economy continues to recover and that labor market slack has been diminishing.

Market Reactions

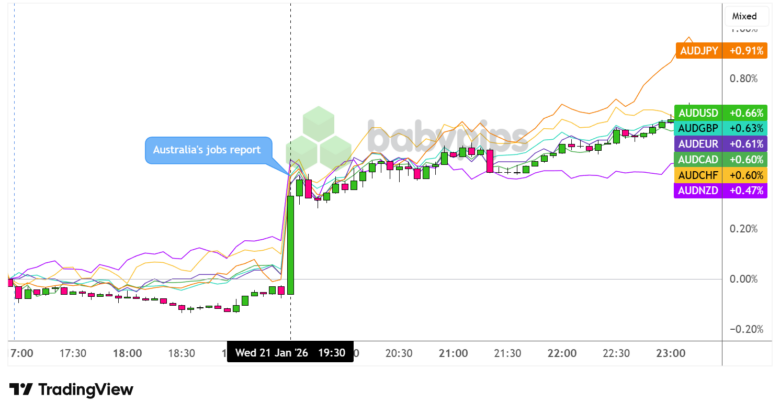

Australian Dollar vs. Major Currencies: 5-min

The Australian dollar rallied broadly following the jobs release, with traders interpreting the data as evidence of continued labor market resilience.

Within the first 30 minutes, AUD/JPY led the charge with a +0.91% gain, while AUD/USD (+0.66%), AUD/GBP (+0.63%), AUD/EUR (+0.61%), and AUD/CHF (+0.60%) all posted solid advances. Even the traditionally more stable AUD/NZD climbed +0.47%.

Currency strategists noted that the data reduces the probability of near-term RBA rate cuts, with money markets repricing expectations for the timing of potential easing. The pickup in risk-taking over the past trading sessions, likely buoyed by easing geopolitical tensions after Trump’s Davos speech, also provided tailwinds for AUD.