GBP Gives Up Gains as UK Unemployment Holds at Four-Year High, Wage Pressures Ease

2026-01-20 23:48:00

The U.K. labor market showed further signs of deterioration in the latest employment report, with the unemployment rate climbing to 5.1% for the three months to November while wage growth slowed to its weakest pace in over three years.

The Office for National Statistics reported that payrolled employees fell by 43,000 in December—the steepest monthly decline since November 2020—while average earnings excluding bonuses decelerated to 4.5% from 4.6% in the previous quarter.

Key Takeaways

- Unemployment rate held at 5.1% for the three months ending November 2025, matching October’s four-year high and slightly above the 5.0% market forecast

- Payrolled employees decreased by 43,000 (0.1%) in December from November, with an annual decline of 155,000 (0.5%)—the largest monthly drop since the pandemic

- Average earnings excluding bonuses slowed to 4.5% in the three months to November, down from 4.6% and matching economist expectations

- Private sector wage growth fell to 3.6%—the lowest rate in five years—while public sector pay growth remained elevated at 7.9%

- Redundancy rate climbed to 4.9 per 1,000 employees, with December notifying 21,192 potential redundancies—the highest for the month in at least six years

The deteriorating employment picture reflects mounting pressures on British businesses following the implementation of higher employer National Insurance contributions and an increased minimum wage announced in Chancellor Rachel Reeves’ November budget.

Link to the official U.K. December 2025 nLabour Market Overview

Market Reactions

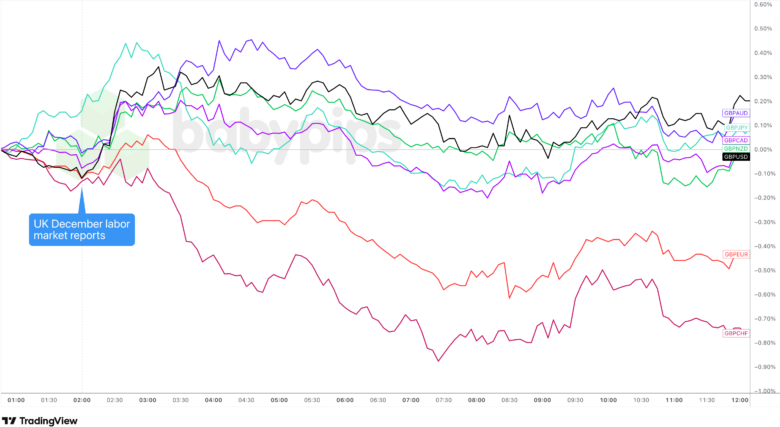

British Pound vs. Major Currencies: 5-min

The British pound, which had been trading with mixed results ahead of the report, shot up broadly at the 7:00 GMT release. Sterling’s initial surge appeared driven by the in-line wage growth figures, which traders viewed as removing some pressure on the Bank of England (BOE) to accelerate interest rate cuts despite the weaker employment backdrop.

GBP/USD jumped approximately 0.2% in the immediate aftermath, while gains were similarly pronounced against commodity currencies, including the Australian and New Zealand dollars. The relief rally suggested markets had positioned for a worse outcome on wage growth, which remains a key metric for BOE policymakers assessing domestic inflation pressures.

However, the pound lost momentum within an hour as the initial reaction faded and Sterling reverted to reflecting other major currencies’ relative performances. GBP saw minimal pullback against most majors during the European session, though the euro, Swiss franc, and Japanese yen began outperforming as safe-haven flows picked up.

The divergence became more pronounced during the U.S. trading session. Sterling swung higher at the New York open but soon surrendered its gains amid broad risk aversion that weighed on growth-sensitive currencies. By the close, GBP finished in the red against most majors except the relatively weaker US dollar and Japanese yen.

The afternoon reversal likely reflected growing concern that the combination of elevated unemployment, falling payrolls, and weak private sector wage growth strengthens the case for BOS easing in the coming months. Markets are currently pricing approximately 67 basis points of cuts through end-2026, with the March meeting increasingly viewed as a likely starting point for further reductions.

Attention now turns to Wednesday’s inflation data, which could prove more decisive for near-term rate expectations and Sterling’s direction.