When Japan Sneezes, Global Bonds Catch a Cold

A snap election announcement in Tokyo sent shockwaves through bond markets worldwide, teaching traders a painful lesson about financial contagion

What Happened With Bonds Today?

If you woke up Tuesday morning and checked your trading screens, you might’ve thought someone hit the “sell everything” button on the global bond market. Japanese government bonds experienced their worst day in years, U.S. Treasury yields spiked to four-month highs, and even European debt joined the carnage. The culprit? A single announcement from Tokyo that appears to have triggered what market watchers are calling a textbook case of financial contagion.

Here’s the spark: On Monday, Japanese Prime Minister Sanae Takaichi declared she’d dissolve parliament on Friday and call a snap election for February 8. Her campaign pitch? Cutting taxes on food to help struggling households. Sounds voter-friendly, right? There’s just one problem: she didn’t explain how Japan—already drowning in debt at a staggering 230% of GDP—would pay for it.

Bond investors took one look at this promise of unfunded spending and hit the panic button. By Tuesday, Japan’s 40-year government bond yield rocketed past 4% for the first time since these bonds were introduced in 2007. In fact, this marked the first time ANY Japanese bond touched 4% since December 1995—a 30-year milestone nobody wanted to celebrate. The 10-year yield surged to 2.38%, the highest since 1999, while 20-year yields jumped a massive 22 basis points (that’s financial-speak for 0.22 percentage points) to 3.47%.

But here’s where things get interesting for forex traders: this wasn’t just a Japanese problem. Within hours, the selloff spread like wildfire across the Pacific and Atlantic.

Why Did This Happen? The Domino Effect Explained

To understand why a Japanese election announcement crashed bond markets globally, you need to grasp three concepts: bond market interconnection, capital flows, and what traders call “contagion risk.”

First, let’s talk about how bonds work. When investors get nervous about a government’s ability to repay its debts (what fancy folks call “fiscal sustainability”), they demand higher interest rates as compensation for that risk. Bond prices and yields move in opposite directions—so when everyone’s selling bonds, prices fall and yields rise. Think of it like a fire sale: desperate sellers mean rock-bottom prices.

Now, here’s the connection. Japan isn’t just another country struggling with debt—it’s the world’s largest foreign holder of U.S. Treasury securities, owning approximately $1.2 trillion worth. For decades, Japanese investors have been massive buyers of overseas bonds, particularly American debt, because their domestic yields were stuck near zero thanks to the Bank of Japan’s ultra-loose policies.

But when Japanese bond yields started climbing—10-year yields are now offering 2.38% compared to near-zero just two years ago—something fundamental changed. Suddenly, Japanese investors could get decent returns at home. Why take the currency risk and hassle of buying U.S. Treasuries when you can get solid yields in your own backyard?

This shift appears to have spooked global bond markets. If Japan, historically one of the most reliable buyers of foreign debt, starts keeping its money at home (a process called “repatriation”), who’s going to pick up the slack? The mere possibility of reduced Japanese demand likely contributed to selling pressure in U.S. Treasuries, which saw 10-year yields spike to 4.29%—the highest since August—and 30-year yields approach the psychologically critical 5% threshold at 4.93%.

Market strategists noted that ultra-long Japanese government bond yields appeared to be driven higher by a combination of structural supply-demand imbalances and a repricing of risk as markets absorbed the prospect of more expansionary fiscal policy and persistent inflation pressures.

What Does This Mean for Markets? The Currency Ripple Effect

For currency traders, this bond market chaos creates several important dynamics worth watching.

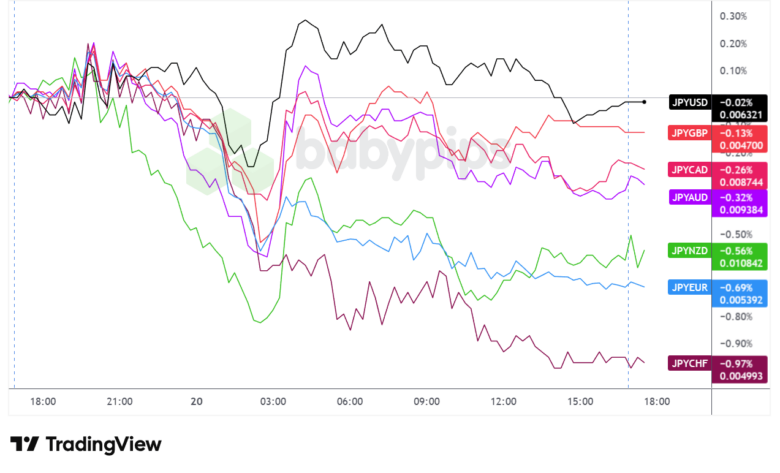

Overlay of JPY vs. Major Currencies Chart by TradingView

The Japanese yen experienced a volatile session that highlighted competing market forces. During the Asian session, the yen initially dipped as domestic bond yields surged—a counterintuitive move that likely reflected immediate concerns about Japan’s fiscal situation overwhelming the typical yield-support dynamic. However, the currency staged a notable rebound after the London open, apparently drawing safe-haven flows as the bond market turmoil spread globally. This pattern suggests traders were reassessing the yen’s role: while higher domestic yields should theoretically support the currency, the safe-haven bid may have provided additional support as broader market stress intensified.

The interplay between these factors—rising yields, fiscal concerns, and safe-haven demand—creates a complex picture for the yen going forward. The political uncertainty surrounding the snap election adds another layer of volatility that may keep the currency choppy in coming weeks.

The Bottom Line: Key Lessons for Traders

This episode offers several valuable takeaways for anyone trading currencies or following global markets:

- Markets are interconnected in ways that aren’t always obvious. A political announcement in Tokyo can ripple through New York and London within hours. The global financial system operates like a massive network where stress in one node can quickly spread to others, particularly in the bond market where yields serve as the foundation for pricing almost every other asset.

- Capital flows matter more than ever. Japan’s role as a major buyer of foreign bonds means changes in Japanese investor behavior can have outsized effects on global markets. When the world’s largest foreign creditor starts reconsidering its investment strategy, everyone pays attention.

- Political risk is financial risk. Takaichi’s unfunded tax cut proposal shows how quickly political promises can translate into market turbulence. Bond investors tend to punish governments that make spending commitments without credible funding plans, and in our interconnected world, that punishment rarely stays contained.

- Watch the yield differentials. The spread between Japanese and U.S. yields, or between any two countries’ bond markets, helps determine capital flow patterns. As these spreads narrow or widen, money moves, and currencies respond.

- Contagion is real, even in “safe” assets. Government bonds are supposedly the safest investments available, yet Tuesday’s action demonstrated that even these markets can experience rapid, correlated selloffs when investor sentiment shifts.

What to Watch Next

Several catalysts could determine whether this bond market stress continues or fades:

Japan’s election campaign (now through February 8) will likely keep volatility elevated. Any additional spending promises or fiscal policy announcements could trigger renewed selling in Japanese government bonds.

U.S. economic data releases this week, including the PCE inflation report (the Federal Reserve’s preferred inflation gauge), may influence whether Treasury yields continue climbing or stabilize.

Central bank responses matter. If the Bank of Japan signals concern about rising yields or the Federal Reserve comments on Treasury market functioning, it could calm or inflame the situation.

The old market saying goes: “When the U.S. sneezes, the world catches a cold.” Tuesday’s action suggests we might need to update that wisdom. In today’s interconnected financial system, a sneeze from Tokyo can apparently spread just as quickly—and currency traders would be wise to keep the tissues handy.

Interested in fundamental analysis made for newbies and how to pair it up with technical analysis to find high quality opportunities that may match your trading and risk management style? Check out our Premium membership for event trading guides, short-term strategies, weekly recaps and more!

BabyPips.com Annual Premium Members also get an exclusive 30% discount on the annual subscription for the first year on Tradezella–the top rated journaling app! ($120 in savings)! Click here for more info!