RedStone Expands Oracle Business with RWA Data and TokenizeThis Acquisition

Blockchain oracle provider RedStone has acquired Security Token Market (STM) and its TokenizeThis conference, adding a large dataset on tokenized real-world assets to its existing oracle business.

According to an announcement, the acquisition brings STM’s historical data, covering more than 800 tokenized products across equities, real estate, debt and fund structures, under RedStone’s ownership, along with control of the TokenizeThis conference brand.

STM founder Herwig Konings will join RedStone as an adviser and head of TokenizeThis, while STM chief operating officer Jason Barraza will take on an institutional business development role focused on asset managers, banks and tokenization platforms.

RedStone operates a modular oracle network that supplies price and reference data to decentralized applications, enabling smart contracts to access offchain information. Its data feeds support pricing, collateral valuation and risk management for onchain financial products.

The company reports securing more than $6 billion in onchain value and provides data feeds used by protocols and issuers including Securitize, Ethena, Morpho, Compound, Drift and ether.fi.

TokenizeThis will continue operating as a standalone conference focused on tokenized securities and RWAs, with RedStone assuming ownership of the event. The conference has historically convened banks, asset managers, issuers, blockchain networks and infrastructure providers.

Marcin Kazmierczak, co-founder of RedStone, told Cointelegraph:

Institutions have struggled finding trustworthy, comprehensive datasets on tokenized RWAs. STM’s 7-year tracking of 800+ products gives us that unified view of the $60B+ market. Importantly, it also gives us the historical advantage of the data sets we acquire.

Related: RedStone unveils DeFi risk ratings weeks after $20B crypto market wipeout

Tokenized RWAs across public and permissioned networks

The acquisition comes as tokenized real-world assets (RWAs), traditional assets represented on blockchains, have become a prominent theme across the crypto industry.

According to data from RWA.xyz, Ethereum hosts the largest share of tokenized real-world assets issued on public blockchains, with $13 billion in value at time of writing, representing about 60% of public-blockchain RWA issuance.

However, most institutional tokenization activity takes place outside public blockchains, with the Canton Network emerging as a key venue for tokenized, regulated assets issued by major financial institutions.

In January, Temple Digital Group launched a private institutional trading platform on the Canton Network, enabling 24/7 trading of digital assets through a central limit order book and a non-custodial market structure.

The Depository Trust & Clearing Corporation is planning to bring a subset of US Treasury securities onchain through Canton. In 2024, DTCC said its subsidiaries processed $3.7 quadrillion in securities transactions .

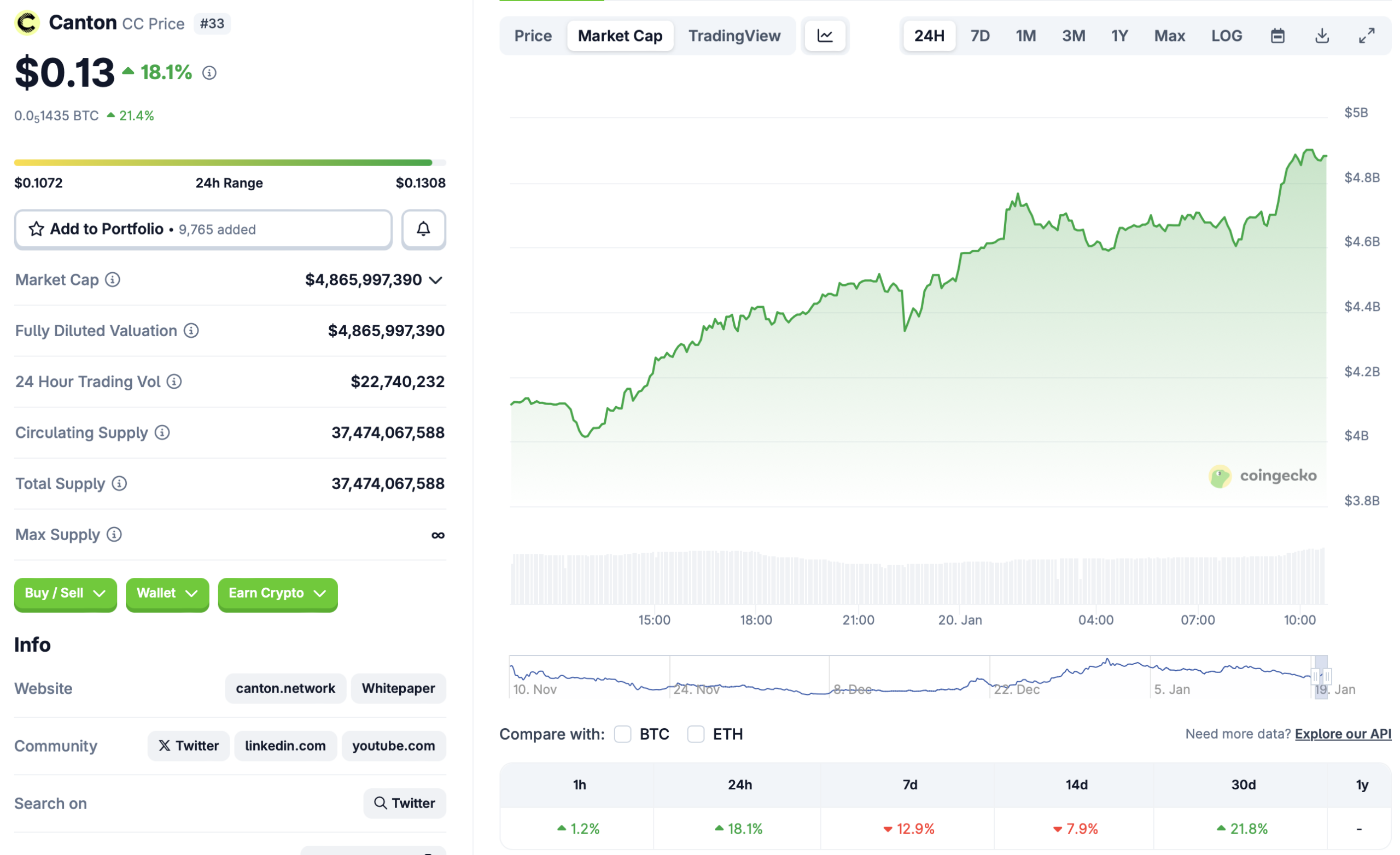

Canton’s native token, CC, has risen in recent weeks. Data from CoinGecko shows the token is up over 20% during the past 30 days and roughly 18% in the last 24 hours.

Magazine: One metric shows crypto is now in a bear market: Carl ‘The Moon’