Gold Price Today at All-Time=High but Profit-Taking Risk at $4,760

2026-01-20 08:12:00

Date: August 20, 2026

Asset: Gold Futures (GC1!)

Market: COMEX

Analyst: Itai Levitan, InvestingLive.com, see my gold futures technical analysis video, for today and this week, below:

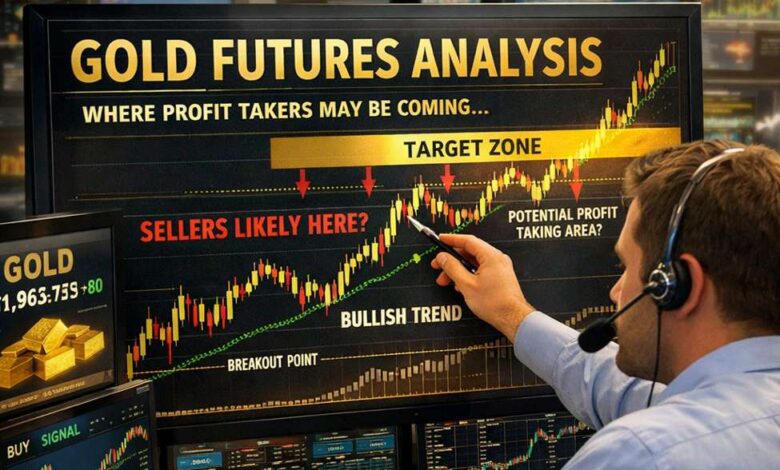

This gold technical analysis focuses on a critical moment for gold futures today, as prices surge +2.84% to trade near $4,725.7, effectively matching the 52-week high at $4,727.6. With gold sitting at record territory after a historic rally, traders and investors are now asking whether upside momentum can continue – or whether profit-taking risk is beginning to rise.

Gold is up nearly 71% year-on-year and almost 38% over the past six months, an extraordinary move for a traditionally defensive asset. That context is essential for any realistic gold price forecast going forward.

Global markets are in a state of heightened volatility as Gold tops $4,700 for the first time as the surge higher continues amidst a scramble for safe-haven assets. This rally is largely driven by escalating geopolitical tensions, specifically reports that Trump is threatening tariffs on Greenland if European allies block his bid to purchase the territory—a move Treasury Secretary Scott Bessent argues is “very different” from typical trade disputes due to its national security implications. As investors hedge against this uncertainty, Silver jumps to a new all-time high, riding the same wave of fear that is lifting gold. Meanwhile, in South America, a different resource strategy is unfolding as Venezuela plans to boost gold and iron mining output in a bid to secure much-needed foreign currency. In the battery metals sector, volatility is also the theme, as Lithium prices go parabolic, though analysts at Scotiabank have warned that the rally may be moving “too fast, too furious” for fundamentals to support.

Gold Futures Today: Key Market Data at a Glance

-

Current price: $4,725.7

-

Daily range: $4,622 – $4,727

-

1-year performance: +70.96%

-

6-month performance: +37.81%

From a short-term perspective, gold futures today are trading at the top of the session range, signaling strong bullish control. At the same time, this type of positioning historically coincides with heightened sensitivity to profit-taking flows.

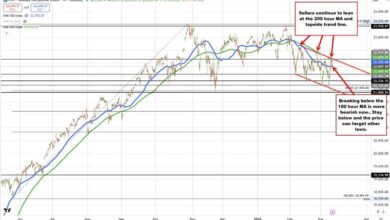

Gold Technical Analysis: Why This Area Is a Critical Junction

In this gold technical analysis, the focus is not on predicting an immediate reversal, but on identifying a junction zone where risk dynamics change.

The $4,750 – $4,760 region represents a technical convergence of:

-

Upper channel resistance from a well-defined trend structure

-

Parallel alignment with a modified pitchfork projection

-

Proximity to record highs, where historical resistance is limited

Junction zones are areas where institutional participants reassess exposure. They are areas to watch, not levels to trade blindly. This distinction is crucial for maintaining discipline during extended trends.

Gold Price Forecast: What Confirmation Would Actually Look Like

For traders forming a gold price forecast, confirmation matters more than anticipation.

Bearish confirmation would not come from price simply touching resistance. Instead, it would likely appear as:

-

A brief overshoot above resistance followed by a red 4-hour candle closing back below the channel

-

Two consecutive higher-timeframe closes failing to hold above the breakout area

-

Momentum flattening rather than accelerating after the test of highs

Until such signals appear, the dominant trend in gold futures today technically remains intact.

Gold Technical Analysis and Momentum Risk at Extremes

One of the biggest misconceptions among retail traders is that strong momentum allows for very tight stops. In reality, extended momentum often increases volatility.

In advanced gold technical analysis, this means:

-

Pullbacks can be deeper than expected

-

Tight stops are more vulnerable to noise

-

Late-stage longs often face poor probability despite attractive reward-to-risk ratios on paper

This is why professional traders tend to reduce size, take partial profits, or wait for confirmation rather than chase strength at record levels.

Gold Futures Today: Risk Management and Instrument Choice

Gold futures require careful risk calibration. When a technically sound setup requires a wider stop, traders must adapt rather than force the trade.

Many participants manage this by using micro gold futures (MGC), which allow:

-

More flexible stop placement

-

Better alignment between technical structure and dollar risk

-

Reduced pressure to trade with unrealistic sizing

Instrument choice is an underappreciated but essential component of any sustainable gold futures today strategy.

Gold Price Forecast: Is the Upside Still Valid?

From a structural perspective, the long-term gold price forecast remains constructive as long as price holds above key trend supports. However, from a tactical standpoint:

-

Upside extension from current prices offers diminishing reward

-

Downside risk from volatility-driven pullbacks is increasing

-

Probability is no longer as favorable as it was earlier in the trend

This does not imply immediate bearishness. It simply reflects a less attractive entry location for new longs.

Gold Technical Analysis Summary: Observe, Don’t Anticipate

At InvestingLive, gold analysis is framed as decision support, not financial advice or prediction.

This is a close and junction area:

-

Not a guaranteed reversal

-

Not a signal to chase strength

-

A zone where price behavior provides information

For traders already long, this is a moment to reassess exposure and risk. For those waiting for opportunities, patience and confirmation are likely to offer better odds than anticipation.

For continued updates, intraday commentary, and forward-looking gold price forecasts, visit InvestingLive.com and follow our market channels. You are also invited to join investingLive Stocks Telegram channel (it’s free) where we dish out more gems and trade ideas to consider.

Trade at your own risk. Always at your risk only. We may be wrong and it’s your money, your decisions, your accountability. We’re just here sharing our experience, knowledge and opinions. See you on the next one.