Canada Inflation Jumps to 2.4%, But Core Measures Drop Below 3% for First Time Since March

2026-01-20 02:51:00

While the uptick exceeded the 2.2% consensus forecast, the Bank of Canada’s (BOC) preferred core measures continued their cooling trend for the third consecutive month, reinforcing expectations that the central bank will maintain its 2.25% policy rate through 2026.

The Canadian dollar strengthened modestly following the release, with traders interpreting the softer core inflation readings as confirmation that underlying price pressures remain contained despite the headline surprise.

Key Takeaways

- Headline CPI rose to 2.4% y/y from 2.2% in November, above the 2.2% consensus, driven by the base-year effect of last year’s GST/HST exemption, which affected approximately 10% of the CPI basket

- Core inflation measures continued cooling: CPI-median fell to 2.5% from 2.8%, while CPI-trim declined to 2.7% from 2.9%, both reaching their lowest levels since December 2024

- Monthly CPI declined 0.2%, less than the expected 0.3% drop, while seasonally adjusted CPI rose 0.3%

- Restaurant prices surged 8.5% y/y, the largest increase since 1991 when the GST was first implemented, as December 2024’s tax exemption fell out of comparisons

- Gasoline prices fell 13.8% y/y, down from a 7.8% decline in November, as crude oil prices hit four-year lows amid global oversupply concerns

- Grocery inflation accelerated to 5.0% y/y from 4.7%, with coffee up 30.8% and fresh or frozen beef rising 16.8%

- Three-month annualized core measures plunged to 1.7% from 2.3% in November, falling below the BOC’s 2% target

Link to official Statistics Canada Consumer Price Index (December 2025)

Other categories affected by the tax holiday also showed sharp accelerations: toys and games (+7.5% y/y), children’s clothing (+4.8%), alcoholic beverages in licensed establishments (+6.5%), and confectionery (+14.2%).

Most analysts agreed the headline jump was distorted by tax-related base effects, while the underlying inflation trend supports an extended pause—ruling out both further cuts and the rate hikes some had been pricing in earlier this year.

Markets continue pricing in a hold at the January 28 BOC meeting, with most economists agreeing that rates will remain unchanged through 2026.

Market Reactions

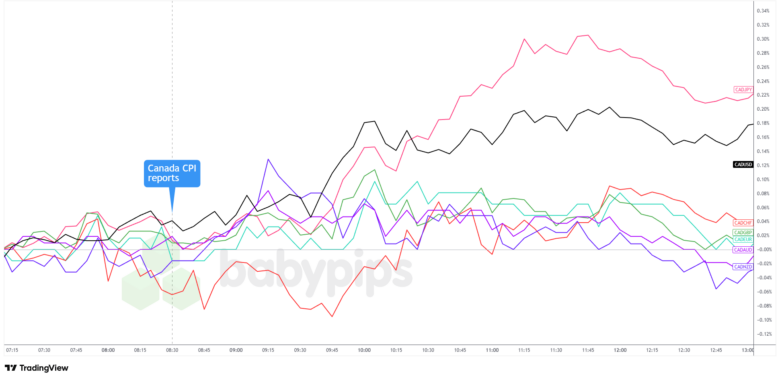

Canadian Dollar vs. Major Currencies: 5-min

Overlay of CAD vs. Major Currencies Chart by TradingView

The Canadian dollar, which had been trading near its session lows ahead of the release, rallied immediately after the release, with traders looking past the headline surprise to focus on the encouraging drop in core inflation measures.

The Loonie’s pop likely came from trader relief that the BOC’s preferred core measures are finally making real progress toward the 2% target. At just 1.7% on a three-month annualized basis, core inflation is now cooling faster than the central bank expected—contradicting the BOC’s own forecasts that see core measures staying above 2% well into 2027.

By early afternoon, CAD settled into ranges, holding gains of about 0.3% against the Greenback while trading mixed against the other majors. The lack of follow-through suggested traders see the report as maintaining the status quo rather than shifting BOC policy.

Markets continue to price in a hold at the January 28 meeting, where the central bank is all but certain to keep rates at 2.25%. Governor Tiff Macklem made clear at December’s decision that policy is “about the right level,” with U.S. trade uncertainty limiting room for additional stimulus despite cooling inflation.