Sterling Closes Lower Despite Upbeat November GDP Report

2026-01-16 02:05:00

The U.K. economy returned to growth in November 2025, posting a stronger-than-expected 0.3% m/m expansion and reversing October’s contraction. Production rebounded, and services activity picked up, even as pre-Budget uncertainty hung over the economy.

Still, the pound finished the day lower against most major currencies, as broader market forces ended up mattering more than the upbeat domestic data.

Key Points from the November GDP Report

- Monthly GDP grew 0.3%, beating consensus expectations of 0.1%, following a revised -0.1% decline in October

- Services sector expanded 0.3%, while production surged 1.1%, driven by a 25.5% jump in motor vehicle manufacturing as Jaguar Land Rover recovered from its cyber-attack

- Construction fell 1.3%, registering its largest three-monthly decline in nearly three years

- Three-month rolling GDP growth (September-November) rose to 0.1% from 0.0% in the three months to October, suggesting the economy maintained modest momentum

- September’s figure was revised up to 0.1% growth from an initial estimate of -0.1%

- Professional, scientific, and technical activities led services growth with a 1.7% increase, particularly in accounting and tax consultancy ahead of the November 26 Budget

Link to the November 2025 ONS GDP Monthly Estimate

The better-than-expected reading suggested businesses largely navigated pre-Budget uncertainty, with the economy showing resilience despite months of speculation about tax increases that had weighed on sentiment.

The manufacturing recovery, particularly from Jaguar Land Rover’s return to normal production levels, was a key driver of the November rebound.

Market Reactions

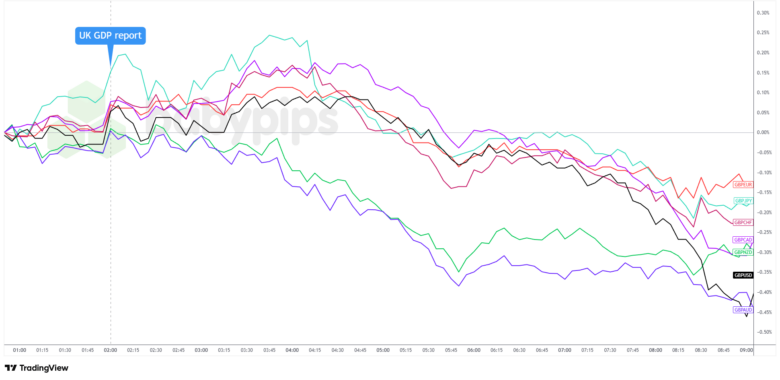

British pound vs. Major Currencies: 5-min

The British pound traded mixed ahead of the release before jumping on the stronger-than-expected GDP numbers. Sterling then gave back most of its gains within about 30 minutes as traders took profits.

From there, the pound managed one more push higher, setting fresh session highs against most majors except the AUD and NZD. That strength faded quickly, though, and sellers took control through the rest of the session, leaving Sterling as the weakest major currency by the end of Thursday.

Several factors may explain why positive GDP data failed to support the pound:

While the headline figure beat expectations, underlying details were mixed. Construction fell 1.3% in November and recorded its largest three-month decline since March 2023, undercutting hopes for a sustained building boom.

More critically, the report captured November activity during Budget uncertainty rather than its aftermath. Economists noted the real test would be the December data to assess whether the £26 billion in tax increases dampened growth or if confidence recovered once details were known.

The afternoon selloff appeared driven by broader market forces rather than UK-specific factors. Sterling’s decline against all currencies, particularly commodity-linked ones, suggested either a risk-off move or renewed concerns about UK prospects overshadowed the morning’s data surprise.

By day’s end, the disconnect between strong GDP figures and Sterling weakness underscored that markets were looking past November’s resilience toward a more uncertain 2026 outlook, with fiscal tightening, elevated rates, and weak business sentiment threatening to constrain growth momentum.