Breaking Down the Odds: Could Trump Really Take Greenland?

The Big Picture: President Trump wants the United States to control Greenland, a huge Arctic island currently owned by Denmark. After the U.S. military operation in Venezuela, traders are asking: could this actually happen? And what would it mean for markets?

What’s Actually Happening?

President Donald Trump has been talking about acquiring Greenland on and off since 2019. On January 6, 2026, the White House confirmed they’re discussing options to acquire Greenland—including potentially using the U.S. military. This came right after American forces captured Venezuelan President Nicolás Maduro, making Trump’s territorial ambitions seem more credible.

Here’s the simple version: Greenland is a self-governing territory within the Kingdom of Denmark (a U.S. ally and NATO member) with about 57,000 residents.. Trump says America needs it for national security. Denmark says it’s not for sale. And now traders are betting real money on what happens next.

Why Does Trump Want Greenland?

Strategic Location: Greenland sits between North America and Europe, positioned so that any Russian missiles aimed at the U.S. would fly over it. The U.S. already operates Pituffik Space Base there for missile detection. The island also guards the GIUK Gap (Greenland-Iceland-UK), a crucial maritime passage for monitoring Russian and Chinese naval activity.

Rare Earth Minerals: Greenland may hold 36-42 million metric tons of rare earth minerals needed for electric car batteries, wind turbines, smartphones, and military equipment. China currently controls about 70% of global rare earth production, making alternative sources attractive.

Arctic Shipping Routes: Climate change is opening new Arctic shipping routes that could save millions in fuel costs. Greenland’s location makes it strategically important for controlling these emerging trade corridors.

What Are the Roadblocks?

Local Opposition: Greenlandic officials have made it clear that the territory is not for sale. The population has its own government and consistently opposes joining the United States.

NATO Crisis: Denmark and the U.S. are both NATO members who promise to defend each other. Danish officials have warned that a U.S. attack on Greenland would effectively end NATO and the security architecture that has maintained European peace since World War II.

International Law: Taking another country’s territory violates international law and the UN Charter. Seven major European nations issued statements supporting Denmark and Greenland’s sovereignty.

Domestic Opposition: Even some Republican lawmakers have publicly opposed using military force, with Senate leaders calling it unrealistic.

Economic Reality: Mining experts suggest developing Greenland’s resources would require billions of dollars over decades. The harsh Arctic climate, mountainous terrain, lack of infrastructure, and strict environmental rules make extraction extremely difficult. And since China controls 90% of rare earth refining capacity, mined materials would still need Chinese processing—undercutting the goal of reducing dependence on China.

What Are the Odds?

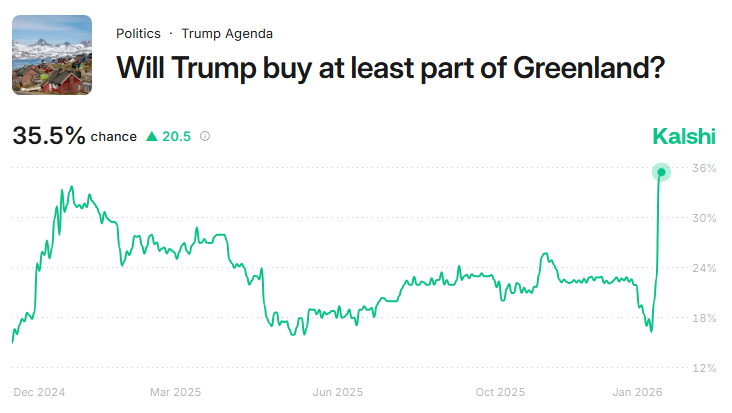

Prediction markets show traders taking this more seriously after Venezuela:

Kalshi: 35.5% chance the U.S. takes control of any part of Greenland by January 2029 (up from 18% before Venezuela)

Polymarket: 14-15% chance Trump acquires Greenland before 2027 (over $2.3 million in bets)

To put these numbers in perspective: 35% is roughly like flipping a coin twice and getting heads at least once—unlikely but not impossible. The 15% figure is more like rolling a six-sided die and getting a 1.

The key insight: these odds jumped significantly after the Venezuela operation, showing traders now believe Trump is more willing to use force than they previously thought.

What About Currency Markets?

Traditional forex markets haven’t panicked yet, but analysts are watching for potential dollar and euro impacts.

Short-Term Dollar Strength: Geopolitical conflict typically creates “risk-off” sentiment where investors move to safe assets. The dollar often strengthens initially as the world’s primary safe-haven currency. We saw this briefly with Venezuela.

Long-Term Dollar Weakness: However, any NATO crisis could undermine dollar dominance. If the U.S. attacks an ally, it may accelerate “de-dollarization”—countries reducing dollar usage in favor of alternatives. This could push investors toward gold (which has no political risk) or strengthen the euro as Europe unites in opposition.

Some risk analysts suggest a Greenland intervention could pose comparable or even greater risks to transatlantic relations than Russia’s invasion of Ukraine, since it would involve one ally threatening another.

Euro’s Response: The euro’s reaction depends on European unity. A unified European response would demonstrate strength and potentially attract capital flows away from the dollar. A divided response would create uncertainty and euro weakness.

The Bottom Line

The probability of a U.S. takeover appears low but isn’t zero. The Venezuela operation demonstrated Trump’s willingness to use military force more aggressively than many expected.

Major obstacles remain: local opposition, potential NATO collapse, international law violations, domestic political resistance, and questionable economic benefits that would take decades to realize.

For traders, the key lessons:

- Geopolitical events can move markets quickly based on possibility, not just probability.

- Watch for two-phase dollar reaction: initial strength from risk-off flows, then potential long-term weakness if alliances fracture.

- Gold may be the ultimate beneficiary of increased geopolitical uncertainty.

- Prediction market odds reflect collective wisdom but contain significant speculation.

What to Watch:

This situation reminds us that even unlikely events can impact markets simply from the possibility they might occur. The Greenland question may seem unusual, but millions in prediction market bets suggest traders are taking it seriously enough to price in meaningful odds.

This article is for educational purposes only. It does not constitute financial advice. Trading and prediction markets involve substantial risk. Always do your own research and consider consulting with a qualified financial advisor.

This content is strictly for informational purposes only and does not constitute as investment advice. Trading any financial market involves risk. Please read our Risk Disclosure to make sure you understand the risks involved.