Financial & Forex Market Recap – Jan. 7, 2026

Markets retreated from intraday records on Wednesday as traders digested stronger-than-expected services data and presidential social media posts targeting defense contractors and homebuilders, though geopolitical developments in Venezuela continued to influence energy and FX markets.

Check out the forex news and economic updates you may have missed in the latest trading session!

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Wednesday delivered a session of divergent performance as markets digested stronger-than-expected services data alongside presidential announcements targeting defense contractors, with equities retreating from intraday records while the dollar strengthened modestly.

The S&P 500 touched its second intraday record of 2026 during the morning session before reversing to close down 0.36% around 6,921. The index rallied early following the 8:15 am ET ADP employment report, which showed private sector hiring of 41,000 jobs versus 45,000 expected. The morning strength carried through the 10:00 am ET release of the ISM Services PMI, which surprised sharply to the upside at 54.4 versus 52.0 expected, with the employment component rising to 52.0 from 48.9 previously. Despite this economic resilience, equities faded through the afternoon session, with losses accelerating into the close. The decline appeared to correlate with Trump’s social media post banning dividends and stock buybacks for defense contractors, which sent Lockheed Martin down approximately 3.5% and Northrop Grumman lower by more than 4%. Homebuilder stocks also weakened on separate Trump commentary about restricting large institutional investors from purchasing single-family homes.

Gold declined 0.89% to settle near $4,454, extending losses through most of the trading day. The precious metal weakened during Asian hours and continued lower through London and US sessions with no direct gold-specific catalyst to point to. The decline possibly reflected profit-taking following recent gains and reduced safe-haven demand as equity markets initially posted strength on the economic data.

WTI crude oil declined 0.67% to close around $56.30 per barrel, pulling back from Tuesday’s rally despite Trump’s announcement that Venezuela would provide 30-50 million barrels of sanctioned oil to the US. The move lower appeared to reflect market positioning adjustments as traders weighed the implications of increased supply potentially entering the market, though the EIA crude inventory report showing a 3.83 million barrel drawdown provided some underlying support.

Bitcoin fell 2.30% to trade near $91,074, underperforming traditional risk assets. The cryptocurrency declined steadily from the Asian session through the US close with no apparent direct crypto-specific catalysts to point to, possibly reflecting broader rotation out of speculative assets or technical selling following recent volatility.

Treasury yields declined 0.74% to settle around 4.15% on the 10-year note. Yields traded in a relatively tight bearish leaning range through Asian and London sessions before volatility picked up and bears held during the US afternoon. The move lower appeared to correlate with the afternoon equity selloff, suggesting some flight-to-quality positioning, though the stronger ISM Services data likely limited the bond market rally. The 10:00 am ET JOLTs job openings report showed a decline to 7.15 million versus 7.7 million expected, reinforcing a gradual cooling in the labor market that kept rate cut expectations alive for later in 2026.

The US Dollar Index strengthened 0.12% to close around 98.71, posting modest gains as the greenback likely benefited from relative economic strength signaled by the ISM Services data. The dollar’s advance came despite falling Treasury yields, suggesting cross-currency dynamics and relative growth concerns in other regions provided underlying support.

FX Market Behavior: U.S. Dollar vs. Majors

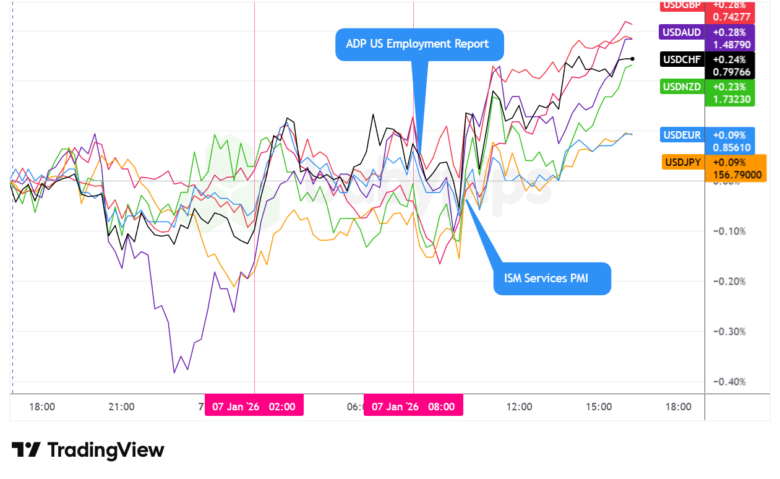

The U.S. dollar posted choppy but ultimately bullish trading on Wednesday, closing with modest gains against the other major currencies as stronger-than-expected services data likely reinforced U.S. economic resilience relative to softer readings from abroad.

During the Asian session, the dollar traded with an arguably net bearish lean against the major currencies. Australian CPI data came in softer than expected but remained sticky, ultimately lifting the Australian dollar and likely contributed to the slight bearish USD lean.

The London session brought European economic data that likely helped the dollar recover. Germany’s retail sales disappointed at -0.6% m/m versus 0.4% expected, while eurozone flash CPI confirmed the preliminary 2.0% y/y reading with core inflation at 2.3% y/y as expected. The dollar traded choppy but maintained a slightly bullish bias through European hours as traders awaited the US data releases.

The U.S. session opened with the dollar dipping following the 8:15 am ET ADP employment report showing 41,000 jobs added in December. While this came in slightly below the 45,000 forecast, it represented a significant improvement from November’s revised -32,000 reading and suggested labor market stabilization.

The dollar shifted net bullish following the 10:00 am ET ISM Services PMI release at 54.4 versus 52.0 expected, with the employment component rising to 52.0 from 48.9 previously. This data reinforced the narrative of U.S. economic resilience and possibly reduced expectations for aggressive Federal Reserve rate cuts in 2026. The JOLTs report at 10:00 am ET showed job openings declining to 7.15 million versus 7.7 million expected, but this softer reading was overshadowed by the strength in the ISM Services data. The dollar maintained its gains through the afternoon session despite the equity market selloff, suggesting the economic data impact outweighed risk sentiment concerns.

At Wednesday’s close, the dollar posted net gains against all major currencies, with its strongest performance coming against the Canadian Dollar, British pound and Swiss franc. The dollar’s resilience despite falling Treasury yields and weakening equities suggested that relative economic growth dynamics remained the dominant driver, with the ISM Services surprise reinforcing expectations that the U.S. economy continues to outperform other developed markets.

Upcoming Potential Catalysts on the Economic Calendar

- Japan Average Cash Earnings for November 2025 at 11:30 pm GMT

- Australia Balance of Trade for November 2025 at 12:30 am GMT

- Japan Consumer Confidence for December 2025 at 5:00 am GMT

- Germany Factory Orders for November 2025 at 7:00 am GMT

- U.K. Halifax House Price Index for December 2025 at 7:00 am GMT

- Swiss CPI Growth Rate for December 2025 at 7:30 am GMT

- Swiss SNB Monetary Policy Meeting Minutes at 8:30 am GMT

- ECB Guindos Speech at 8:30 am GMT

- ECB Consumer Inflation Expectations for November 2025 at 9:00 am GMT

- Euro area Consumer Confidence for December 2025 at 10:00 am GMT

- Euro area PPI Growth Rate for November 2025 at 10:00 am GMT

- Euro area Unemployment Rate for November 2025 at 10:00 am GMT

- U.S. Challenger Job Cuts for December 2025 at 12:30 pm GMT

- Canada Balance of Trade for October 2025 at 1:30 pm GMT

- U.S. Unit Labor Costs & Nonfarm Productivity Prel for September 30, 2025 at 1:30 pm GMT

- U.S. Balance of Trade for October 2025 at 1:30 pm GMT

- U.S. Initial Jobless Claims for January 3, 2026 at 1:30 pm GMT

- U.S. Consumer Inflation Expectations for December 2025 at 4:00 pm GMT

- U.S. Consumer Credit Change for November 2025 at 8:00 pm GMT

- U.S. Fed Balance Sheet for January 7, 2026 at 9:30 pm GMT

Thursday’s calendar features weekly initial jobless claims data at 8:30 am ET that will provide another read on labor market conditions following Wednesday’s mixed employment signals from ADP and JOLTs. The claims report has become increasingly important as traders attempt to gauge whether the labor market is stabilizing or continuing to cool gradually.

European data releases include Swiss inflation at 2:30 am ET and SNB monetary policy meeting minutes at 3:30 am ET, which could provide insight into the Swiss National Bank’s thinking on future policy moves. Eurozone unemployment data at 5:00 am ET will be closely watched for signs of labor market deterioration amid ongoing growth concerns in the region.

The U.S. trade balance report at 8:30 am ET alongside productivity and unit labor costs data could spark volatility if either shows unexpected shifts, particularly given recent focus on inflation dynamics and Fed policy trajectory. Markets remain sensitive to any data suggesting persistent price pressures or weakening growth momentum.

Stay frosty out there, forex friends, and don’t forget to check out our Forex Correlation Calculator when planning to take on risk!