Bitcoin Options Are Not Capping BTC Price

Key takeaways:

Covered calls gained traction as cash-and-carry returns collapsed, but data shows they are not structurally suppressing Bitcoin’s price.

Stable put-to-call ratios and rising put demand suggest hedging and yield strategies coexist with bullish positioning.

As Bitcoin (BTC) price entered a downtrend in November, traders began forming theories about why institutional inflows and corporate accumulation failed to sustain price levels above $110,000.

One explanation frequently cited is the rising demand for Bitcoin options, particularly those linked to the BlackRock iShares spot Bitcoin (IBIT) exchange-traded fund.

The aggregate Bitcoin options open interest climbed to $49 billion in December 2025 from $39 billion in December 2024, putting the covered call strategy under closer scrutiny.

Critics argue that by “renting out” their upside for a fee, large investors have unintentionally created a ceiling that prevents Bitcoin from entering its next parabolic phase. To understand this argument, it helps to view a covered call as a trade-off between price appreciation and steady income.

In a covered call strategy, an investor who already owns Bitcoin sells a call (buy) option to another party. This gives the buyer the right to purchase that Bitcoin at a fixed price, such as $100,000 by a specified date. In return, the seller receives an upfront cash payment, similar to earning interest on a bond.

This options strategy differs from fixed income products because the seller continues to hold a volatile asset, even though their potential upside is capped. If Bitcoin rallies to $120,000, the seller must sell at $100,000, effectively missing the additional gains.

Traders argue that this dynamic suppresses price action because professional dealers who purchase these options often sell Bitcoin in the spot market to hedge their exposure, creating a persistent “sell wall” around popular strike prices.

Options-based yield replaced the collapsed cash and carry trade

This shift toward options-based yield is a direct response to the collapse of the cash and carry trade, which involves selling BTC futures while holding an equivalent position in the spot market.

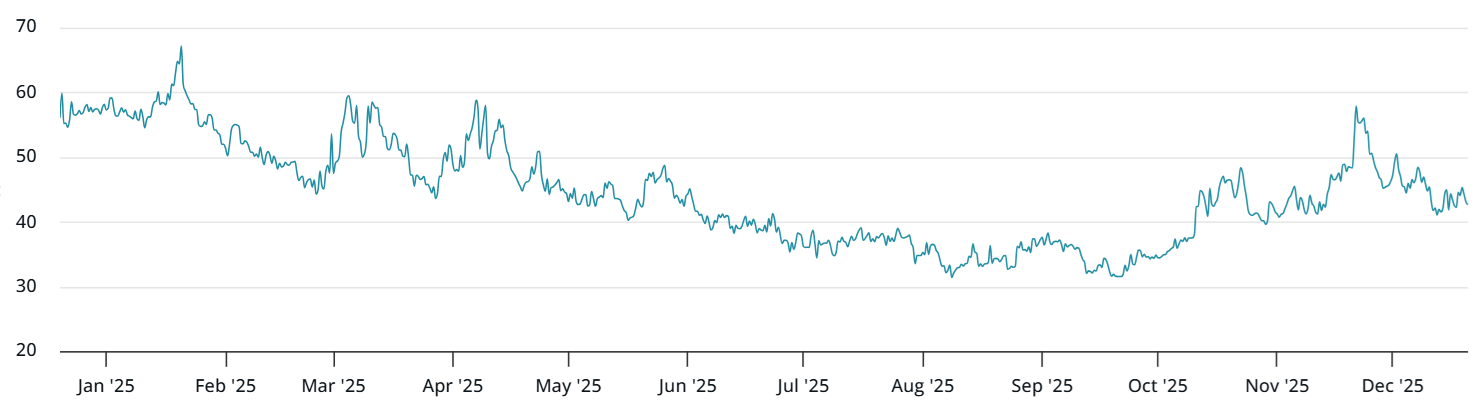

For much of late 2024, traders captured a steady 10% to 15% premium. By February 2025, however, that premium had fallen below 10%, and by November it struggled to remain above 5%.

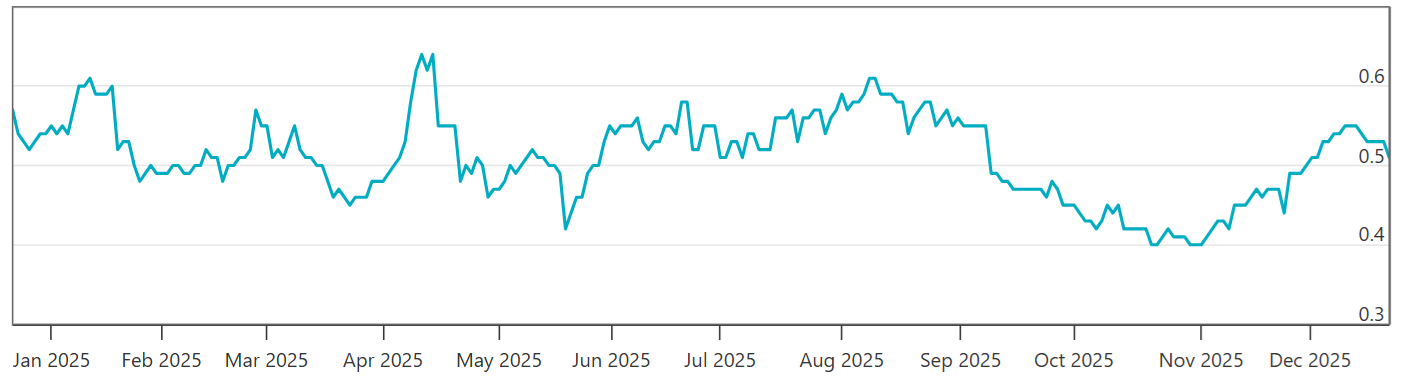

In search of higher returns, funds rotated into covered calls, which offered more attractive annualized yields of 12% to 18%. This transition is evident in IBIT options, where open interest jumped to $40 billion from $12 billion in late 2024. Even so, the put-to-call ratio has stayed stable below 60%.

If widespread “suppressive” call selling were truly the dominant force, this ratio would likely have collapsed as the market became saturated with call sellers. Instead, the balance implies that for every yield-focused seller, there is still a buyer positioning for a breakout.

The put-to-call ratio suggests that while some participants are selling upside call options, a much larger group is purchasing put (sell) instruments as protection against a potential price decline.

The recent defensive stance is reflected in the skew metric. While IBIT put options traded at a 2% discount in late 2024, they now trade at a 5% premium. At the same time, implied volatility, the market’s measure of expected turbulence, declined to 45% or lower from May onward, down from 57% in late 2024.

Lower volatility reduces the premiums earned by sellers, meaning the incentive to deploy this so-called “suppressive” strategy has actually weakened, even as total open interest has increased.

Arguing that covered calls are holding prices down makes little sense when the sellers of those call options stand to benefit most if prices rise toward their target levels. Rather than acting as a constraint, the options market has become the primary venue where Bitcoin’s volatility is being monetized for yield.

This article is for general information purposes and is not intended to be and should not be taken as, legal, tax, investment, financial, or other advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.