Will 2026 mark the big reset for Big Tech?

2025-12-29 07:04:00

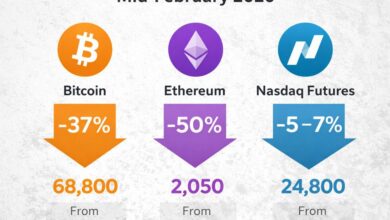

As we look to wrap up 2025, the AI bubble just about managed to get away unscathed to end the year. That being said, there were rising concerns to deal with especially that on valuation. And in talking about that, it is fair to say that all of this will be a mainstay in the conversation for 2026. So the question is, have markets gotten too optimistic about the impact of AI? And are we going to see a reality check come next year?

Well, it definitely is something worth thinking about and considering.

The simple understanding of AI is that it boosts productivity by making processes more efficient and faster right. Let’s take an intelligible example of making orange juice from the fruit itself. Yes, I love fruit examples. It always brings me back to this article here in explaining the whole LIBOR scandal back in the day.

But yes, orange juice.

Let’s say you are someone who squeezes orange juice to sell, and one day you make it known that you are going to buy a high-tech and super-quick orange peeler and squeezer to get the juice ready to sell. People get excited about that and throw you $500 even though you only make like $5 in profits at the time.

The people aren’t fussed about the money today because they “believe” that with the new technology, you’re going to revolutionise the world of selling orange juice.

So, that’s pretty much where we were or somewhat still are at in the whole AI bubble. The sense check hasn’t quite happened yet but it’s only a matter of time until questions are asked about the following:

- Is the new technology really that good?

- How has it really improved the efficiency and time cost of getting the orange juice ready for sale?

- Has it really helped to increase profit margin by a great amount?

If you translate that to companies and firms that are knee deep in AI investment, these are all valid questions at some point. And that could be what investors are demanding next year.

Before this, markets would cheer on AI investment and increased capital expenditure to be revolutionary. Now, doing so isn’t anything new but instead it’s rather commonplace instead.

It’s like having the new PlayStation 5 on release. You’re the cool kid and everyone wants to hang out with you when you have it. But then when everyone else also starts to own it, what you have isn’t anything different and people hang out at their own homes instead.

And so the question then turns to how do you get the people i.e. investors to stay? What makes yours more “magical” and “special”? That is where the productivity conversation comes in.

For Big Tech, that means the conversation isn’t anymore about spending on AI. It’s about who can actually use that correctly to reflect a better bottom line.

For the likes of Google and Meta, it’s all about translating that to ad revenue with the former also going to be scrutinised on their cloud business. And so far, they are two of the better ones that have an easier time to show how increased productivity and how that translates to earnings in general.

Then you have the likes of Amazon and Microsoft, who both have laid out massive amounts of capital in trying to convince investors that they are keeping up in the AI game.

Now, Amazon has committed the most in terms of capital expenditure on AI as compared to everyone else and one thing they are hiding behind for now is that their revenue stream and productivity gains are spread across multiple points. They have their warehouse technologies, robots, website, and cloud systems all layered with AI advancements. And so, the profits have to keep rolling in to convince investors against their big amount of money spent.

That said, Amazon is also big enough to insulate themselves from risks of having to rely on chipmakers and external data centers. They do work to develop their own chips and are going big in expanding on the latter as well. I spoke about data centers and the importance of the fight for power last week here.

As for Microsoft, it’s quite straightforward with Copilot being their biggest push product offering. The proof will be in the numbers, that being how many people actually feel the need to sign up for AI software delivered by the firm. And personally speaking, I’m not a big fan with my own taste preference being to continue using Windows 10.

And we can’t talk about Big Tech without talking about the poster boy of the whole AI bubble now, can we? Nvidia has been the biggest name of them all during this run and is it time that the lofty expectations finally catch up to them?

The Blackwell chip release shows that demand is still well outweighing supply. But if backlogs start to reduce and companies like Amazon and Microsoft also start developing their own AI ecosystem, that could be a troubling sign for Nvidia amid the pressure to constantly outperform and deliver well above what they are doing.

Don’t get me wrong. Nvidia is still a major cash cow and the biggest earner from the continued focus in the AI bubble. But are investor expectations too high that anything less than perfect will get punished? That will be interesting to see, especially with key risks from the China market that could provide some untimely headlines.

But if all goes well for Jensen Huang and his company, they could be the first ever $5 trillion market cap stock. Or if you want to dream big, maybe even $10 trillion.