BOJ’s Ueda sees wages and inflation reinforcing rate-hike case

2025-12-25 06:01:00

Bank of Japan Governor Ueda spoke at the Meeting of Councillors of Keidanren

(Japan Business Federation) in Tokyo in Thursday, December 25, 2025. The title of the speech, reflective of its content, was “Toward the Achievement of the Price Stability Target

Accompanied by Wage Increases“.

Summary:

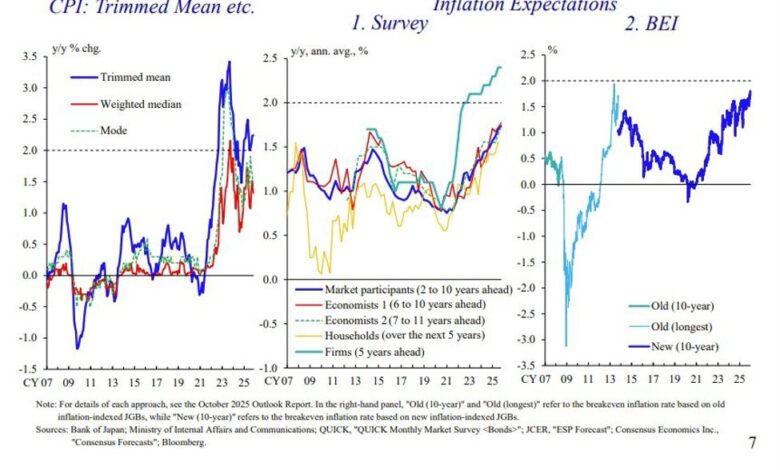

- Ueda said underlying inflation is steadily approaching 2%, supported by tight labour markets and changing wage-price behaviour.

- With real rates still very low, the BOJ is prepared to keep raising rates as economic conditions improve.

–

Bank of Japan Governor Kazuo Ueda said Japan’s underlying inflation is continuing to accelerate gradually and is steadily approaching the central bank’s 2% target, reinforcing the case for further interest-rate increases as economic conditions improve.

Speaking to Japan’s business lobby Keidanren, Ueda said tight labour market conditions are likely to persist barring a major economic shock, putting sustained upward pressure on wages. He pointed to irreversible structural factors, including Japan’s declining working-age population, as key drivers of ongoing labour shortages.

Ueda said companies are increasingly passing on higher labour and raw-material costs not only for food, but across a wider range of goods and services. This, he argued, is evidence that Japan is finally seeing a virtuous cycle take hold in which wages and prices rise together — a dynamic the Bank of Japan has long sought to establish.

“Amid tightening labour market conditions, firms’ wage- and price-setting behaviour has changed significantly in recent years,” Ueda said, adding that achievement of the 2% inflation target, accompanied by wage growth, is now steadily approaching.

With real interest rates still deeply negative, Ueda reiterated that the BOJ remains prepared to continue raising rates if its baseline outlook for the economy and prices is realised. He stressed that policy adjustments would be calibrated in line with economic and inflation developments rather than follow a preset path.

Adjusting the degree of monetary accommodation, Ueda said, will allow the central bank to smoothly secure its inflation goal while supporting sustainable, long-term economic growth — signalling confidence that Japan’s shift away from ultra-easy policy is becoming increasingly durable.