Gold knocks on a 50-year closed door as BTC price faces a defining support test

تكنلوجيا اليوم

2025-12-24 12:03:00

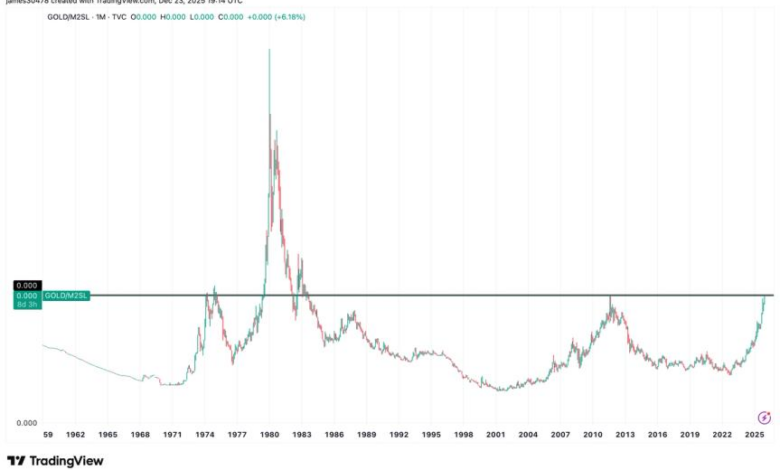

Gold is at a critical juncture when measured against U.S. money supply (M2SL), testing a level it last reached in 2011 and not surpassed since the 1970s, when the price more than tripled to a then-record $700 an ounce over the course of several years.

In contrast, bitcoin , referred to by some supporters as digital gold, has dropped toward a support level, revisiting lows it last touched during the “tariff tantrum” in April.

Back in 2011, gold cost $1,800 an ounce. It’s now around $4,500. When plotted against the money supply, which represents the total stock of dollars circulating in the U.S. economy, including cash, bank deposits and liquid savings, the price has reached a level that’s historically acted as a major resistance zone.

To get there, the precious metal has surged 70% this year. This sharply contrasts with bitcoin, which is down roughly 10%. Still, bitcoin continues to make fresh highs relative to the U.S. money supply each cycle, and the current support level also marks the prior cycle high in March 2024.