Ackman pitches radical SPARC deal to Elon Musk to take SpaceX public (Tesla-linked route)

2025-12-22 02:31:00

Summary:

-

Ackman proposes taking SpaceX public via a SPARC merger

-

Tesla shareholders would receive rights to invest in SpaceX

-

Structure avoids IPO fees, dilution and market timing risk

-

Pershing Square commits $4bn at the same valuation

-

Path created for a future xAI listing

Ackman is offering Musk a way to take SpaceX public without Wall Street banks, without IPO fees, and without favouring big institutions. By giving Tesla shareholders special rights to buy SpaceX shares first, he aims to reward loyalty, broaden access, and lock in a fixed valuation insulated from market swings — while positioning Pershing Square as a long-term strategic partner across Musk’s companies.

—

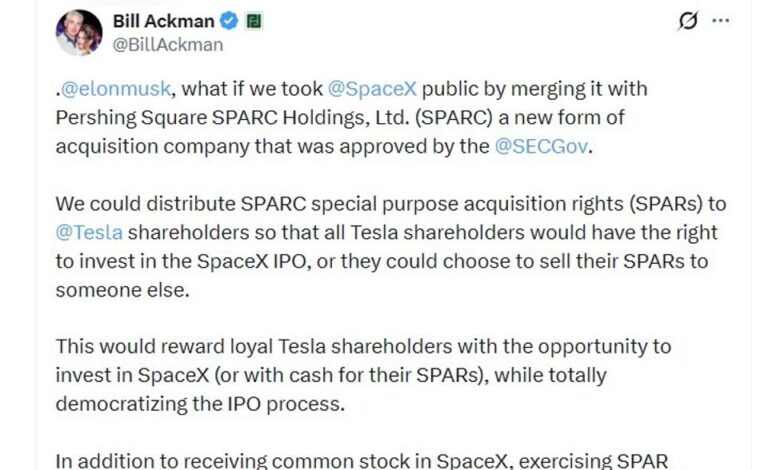

Hedge fund billionaire Bill Ackman has floated an unconventional proposal to Elon Musk that would take SpaceX public while bypassing the traditional IPO process and rewarding existing Tesla shareholders.

In a detailed public message, Ackman suggested merging SpaceX with Pershing Square SPARC Holdings, a newly approved acquisition vehicle that operates differently from a conventional SPAC. Instead of raising capital upfront, SPARC distributes special purpose acquisition rights — known as SPARs — which give holders the option, but not the obligation, to invest in a future deal at a fixed price.

Under Ackman’s proposal, SPARs would be distributed to Tesla shareholders, giving them priority access to the SpaceX IPO. Shareholders could either exercise those rights to buy SpaceX shares or sell the SPARs in the market for cash, effectively monetising the opportunity.

Ackman argues this structure would “democratise” the IPO process by allowing everyday investors — not just institutions — to participate on equal terms. Pershing Square would commit $4 billion of its own capital at the same valuation, acting as a cornerstone investor and performing due diligence on behalf of SPAR holders.

A key feature of the proposal is cost and dilution avoidance. Ackman says the transaction would involve no underwriting fees, no founder shares, no warrants and no sponsor promote — features that have drawn criticism in both traditional IPOs and SPAC deals. SpaceX would list with a pure common-stock structure and minimal transaction costs.

Ackman also suggested a longer-term strategy. Investors who exercise SPARs in the SpaceX deal would receive rights in a second SPARC vehicle, which could later be used to take xAI public at Musk’s discretion.

Valuation flexibility is central to the pitch. By adjusting the exercise price of SPARs, SpaceX could raise anywhere from roughly $40 billion to nearly $150 billion, while retaining control over how much capital comes from new shares versus existing ones.

Ackman said a definitive agreement could be reached within 45 days, with the transaction announced as early as mid-February, pending regulatory approval.