Bitcoin Slips $85k, DATs Threatened By ‘mNAV Rollercoaster’

Cryptocurrency markets experienced another week of downside as investor activity gradually wound down ahead of the holiday period.

Bitcoin (BTC) fell over 5% during the past week, dipping to a weekly low of $84,398 on Thursday, before recovering to trade above $87,769 on Friday, TradingView data shows.

Crypto market volatility continues to threaten the sustainability of digital asset treasury (DAT) companies, as their longevity now depends on avoiding the multiple-to-net-asset-value (mNAV) “roller coaster,” making these firms subject to the value swings of the tokens held on their balance sheet, according to Solmate CEO Marco Santori.

In the wider cryptocurrency space, the US Securities and Exchange Commission (SEC) dropped its four-year investigation into Aave, marking a significant regulatory win for the industry.

Following the development, Stani Kulechov, the founder of Aave, unveiled the 2026 “master plan” for the decentralized lending platform, aiming to capture $1 billion worth of value through real-world asset deposits by launching Aave v4, Horizon, and the Aave App.

DAT longevity hinges on avoiding “mNAV roller coaster”: Solmate CEO

The rise of digital asset treasury companies will go down as a meta-narrative of 2025, but the longevity of the movement will be decided by capital management and sound business strategies.

According to Solmate CEO Marco Santori, all DATs have to contend with the value of the underlying token they hold on their balance sheets. This shouldn’t be a problem for revenue-generating businesses, but pure-play DATs will be in for a bumpy ride.

“The multiple-to-net-asset value is how a lot of these treasury companies survive. If they’re trading at a high mNAV, meaning their market cap is bigger than the value of the coins they have on the balance sheet, then they can sell stock in an accretive way,” Santori said on Cointelegraph’s Chain Reaction X show.

“Every dollar of stock they sell, they take that and go out and buy the underlying coin with, and that increases their net asset value. So long as they can maintain the premium, they can just keep doing that. And that is the pure play treasury model. I actually think that has a future.”

But the issue is that mNAV will dwindle when the interest in the underlying token of a DAT wanes. Santori explained that falling token prices result in lower mNAVs.

“That means a lot of the treasury companies are kind of idle because they can’t grow efficiently and effectively. I didn’t want to be subject to that. I didn’t want that for our investors. I want to give them exposure to SOL and to the growth of the Solana network, but I didn’t want them riding an mNAV roller coaster,” Santori said.

Continue reading

Aave founder outlines 2026 “master plan” after end to SEC probe

Aave founder Stani Kulechov has unveiled his decentralized protocol’s “master plan” for 2026, shortly after revealing the US Securities and Exchange Commission has dropped its four-year investigation into the platform.

In a post to X on Tuesday, Kulechov said despite 2025 marking the most “successful year” for the platform to date, he still feels that Aave is on “day zero compared to what lies ahead.”

Pointing to 2026, the CEO outlined a master plan that places significant focus on scaling the DeFi platform and achieving specific usage metrics, such as $1 billion in real-world asset (RWA) deposits.

“As it stands, our strategy going into next year has three main pillars: Aave v4, Horizon, and Aave App,” he said.

Aave v4 is a major upgrade touted to bring significant enhancements to the platform’s borrowing and lending pools, user interface and liquidation parameters, among other things.

In his post, Kulechov said v4 will be the “backbone of all finance,” as he pointed to the tailored lending markets that the v4’s Hub and Spoke model will provide.

Under this model, the hub refers to a single unified crosschain liquidity pool that functions as the central location for all assets on the protocol, while the spokes refer to highly customizable markets that tap into hub liquidity.

“This will allow Aave to handle trillions of dollars in assets, making it the go-to choice for any institution, fintech, or company looking to access Aave’s deep, reliable liquidity,” he said, adding:

“In 2026, Aave will be home to new markets, new assets, and new integrations that have never existed before in DeFi. We’ll continue engaging with fintechs and work closely with the DAO and our partners on the rollout to progressively scale TVL throughout the year.”

Looking at the next pillar in Horizon, Aave’s decentralized real-world asset market, the CEO outlined intentions to onboard “many top financial institutions” to become a central player in the RWA space.

Continue reading

Hyperliquid governance vote aims to permanently sideline $1 billion Assistance Fund

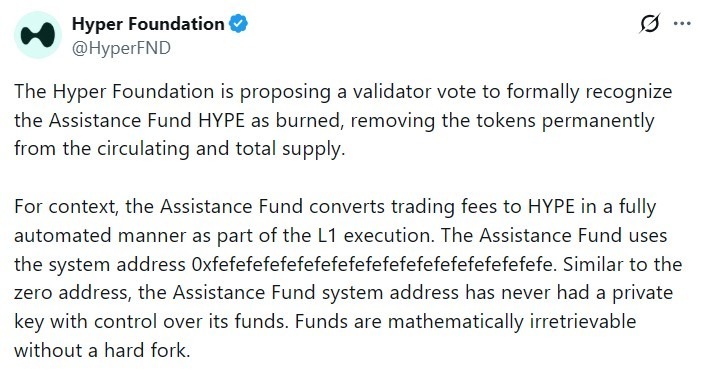

The Hyper Foundation proposed a validator vote to formally recognize HYPE tokens held in the Hyperliquid protocol’s Assistance Fund system address as permanently inaccessible, excluding them from the asset’s circulating and total supply.

According to the foundation, the Assistance Fund is a protocol-level mechanism embedded in the layer-1 network’s execution. It automatically converts trading fees into HYPE tokens and routes them to a designated system address. At the time of writing, the wallet contains about $1 billion in tokens.

The system address was designed without control mechanisms, making the funds irretrievable without a hard fork. “By voting ‘Yes,’ validators agree to treat the Assistance Fund HYPE as burned,” Hyper Foundation wrote.

Native Markets, the issuer of the Hyperliquid-native stablecoin USDH, reminded users that 50% of the stablecoin’s reserve yield is routed to the Assistance Fund and converted into HYPE tokens. “Should this validator vote pass, these contributions will then be formally recognized as burned,” the company wrote.

Continue reading

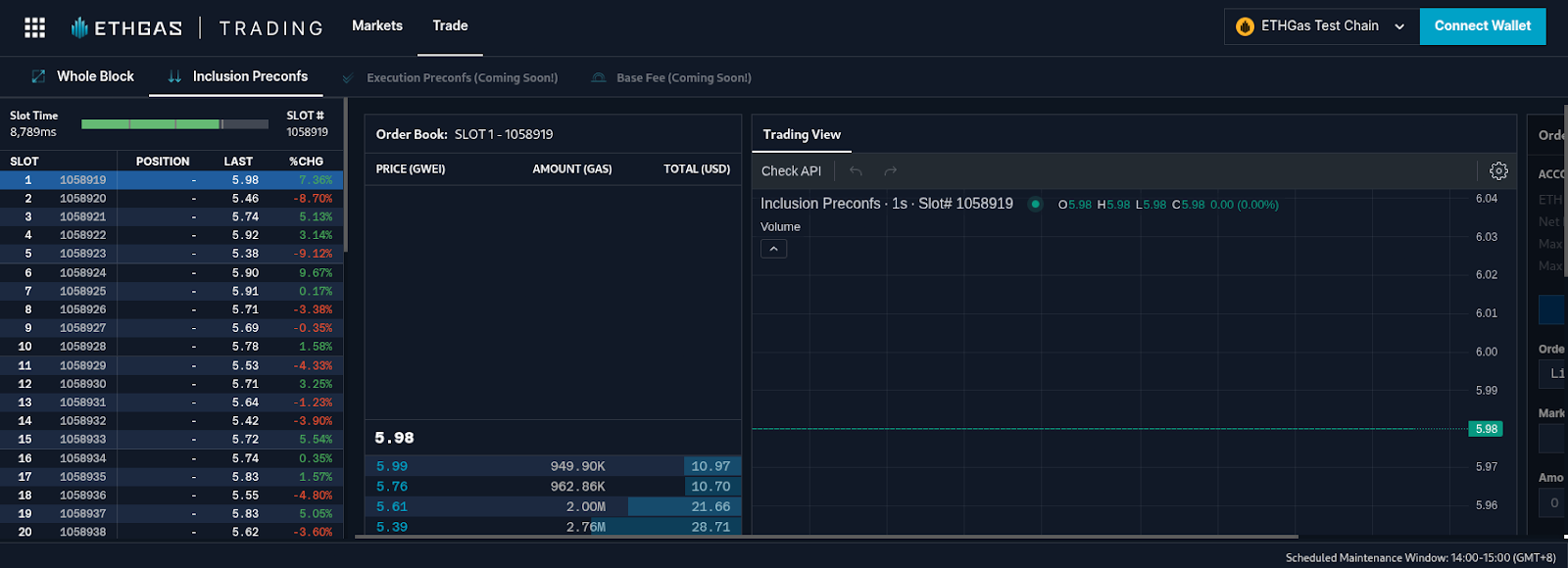

ETHGas raises $12 million as Buterin revives gas futures debate

Ethereum blockspace trading platform ETHGas announced it has raised $12 million in a seed round led by Polychain Capital.

The funding announcement comes after Ethereum co-founder Vitalik Buterin recently discussed the idea of an onchain “gas futures” market, arguing that such a product could give users a clearer signal of expected fees and let them hedge future costs.

ETHGas argues that Ethereum needs “a reimagination of the way blockspace is allocated on the network” and claims that its newly-launched blockspace trading platform is a step in that direction. The company said the market launched with $800 million in commitments from validators, builders and other participants.

Continue reading

Tokenized stocks may be onchain, but the SEC still wants the keys

The US Securities and Exchange Commission’s Trading and Markets Division on Wednesday laid out how broker-dealers can custody tokenized stocks and bonds under existing customer protection rules, signaling that blockchain-based crypto asset securities will be slotted into traditional securities safeguards rather than treated as a new category.

The division said it would not object to broker-dealers deeming themselves in possession of crypto asset securities under existing customer protection rules, as long as they meet a set of operational, security and governance conditions. This applies only to crypto securities, including tokenized stocks or bonds.

While the statement is not a rule, it provides clarity on how US regulators expect tokenized securities to fit within traditional market safeguards.

The guidance suggests that tokenized securities are not treated as a new asset class with unique rules. Instead, they are being placed into existing broker-dealer frameworks, even if they settle within blockchain networks.

Continue reading

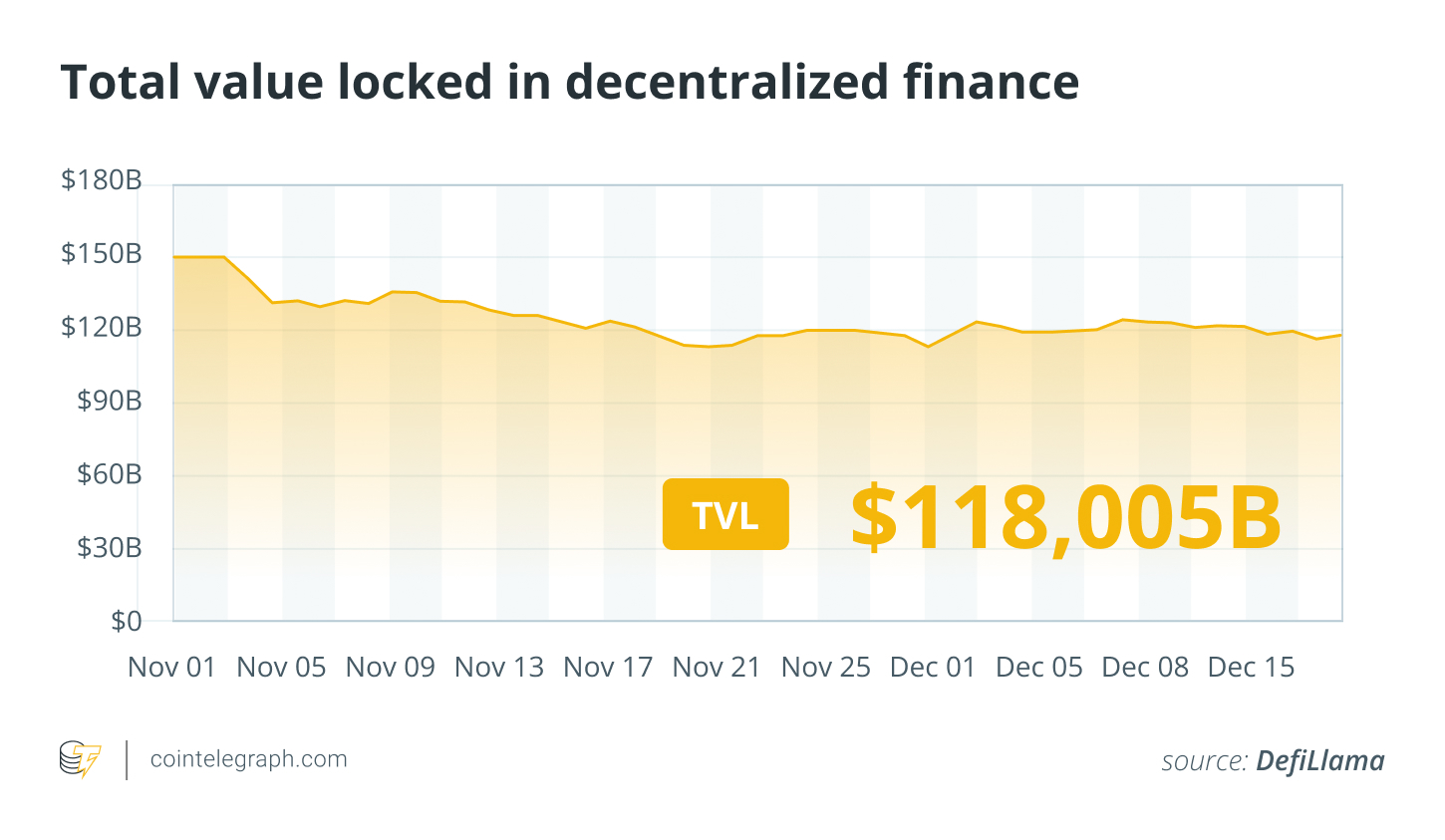

DeFi market overview

According to data from Cointelegraph Markets Pro and TradingView, most of the 100 largest cryptocurrencies by market capitalization ended the week in the red.

Memecoin launchpad Pump.fun’s (PUMP) token fell 32% marking the week’s biggest decline in the top 100, followed by decentralized exchange Aster’s (ASTER) token, down over 27% during the past week.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education regarding this dynamically advancing space.