Canada October retail sales -0.2% vs 0.0% expected

2025-12-19 13:30:00

- Prior was -0.7% (revised to -0.9%)

- Ex-autos vs +0.2% expected

- Advance November reading +1.2%

The surprise story of post-Liberation Day Canada has been just how strong retail sales have been. Unemployment has been creeping up and housing is in a terrible slump in much of the country but consumer keep on spending.

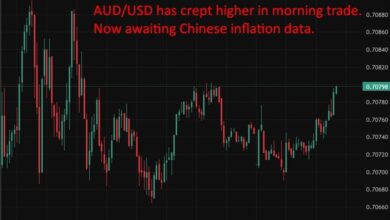

The headline chart doesn’t look great but the underlying numbers have been good.

Canada retail sales

RBC also publishes a report based on its credit card data and it has core sales up 1.1% on a three-month rolling average.

“Early signs for Q4 remain positive with spending momentum holding up

despite elevated borrowing costs, and still cautious consumer sentiment,” RBC said.

My sense is that retirees are those near retirement are driving much of the spending. Despite home prices losing value since 2022, they’ve still generated incredible returns over the past decade and that’s keeping that cohort spending. For younger generations, unemployment has risen but there are still enough jobs to keep the consumer buoyant.

Looking to 2026, I expect consumers to