Economic and event calendar in Asia December 19, 2025 – Bank of Japan rate hike expected

2025-12-18 22:17:00

Summary

- BoJ expected to hike rates to 0.75%

- Real rates remain negative despite move

- Yen reaction hinges on guidance, not decision

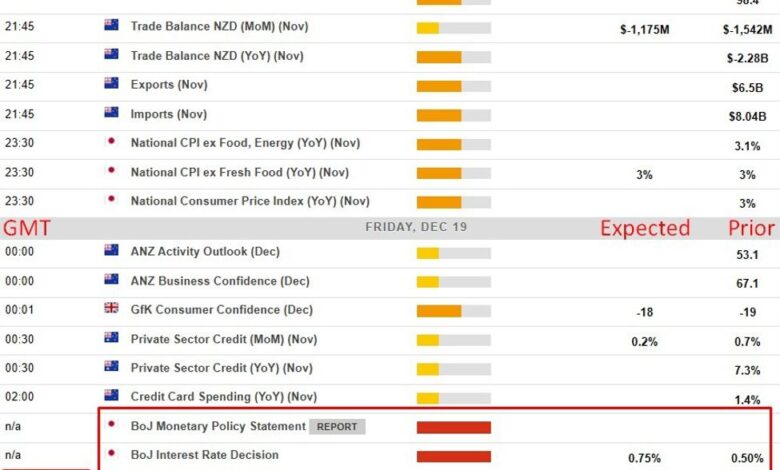

A crowded global macro calendar lies ahead, but for markets the clear focal point is the Bank of Japan’s policy decision, followed closely by Governor Kazuo Ueda’s press conference. Together, the two events are expected to shape near-term expectations for Japanese monetary policy and the yen.

Unlike most major central banks, the BoJ does not announce its decision at a fixed time. Instead, the statement is released once deliberations conclude, a system that contrasts with the clock-driven approach of its global peers. In practice, the decision typically lands between 0230 and 0330 GMT (2130–2230 US Eastern time), a window closely watched by global traders.

The BoJ is widely expected to deliver a 25bp rate hike to 0.75%, which would mark its highest policy rate in roughly three decades. An historic occasion! Despite the near-certainty of a move, expectations for a strongly hawkish signal from Governor Ueda remain low. Policymakers are acutely sensitive to the recent rise in Japanese government bond yields and the broader impact of higher borrowing costs on domestic financial conditions.

Even after the expected hike, the BoJ continues to judge real interest rates as firmly negative, reinforcing the view that policy will remain accommodative in real terms and that any further tightening will proceed cautiously. While market pricing suggests another rate increase as early as June or July next year, a growing number of analysts argue this timeline may be too aggressive.

An alternative view places the next hike closer to October 2026, giving policymakers time to assess how higher rates feed through to bank lending, corporate financing, household consumption and capital expenditure. Spring wage negotiations and yen dynamics will be key inputs into that assessment.

Debate around Japan’s neutral rate has also resurfaced, but officials continue to stress it is a conceptual range rather than a fixed target. The BoJ is expected to maintain its 1–2.5% neutral estimate, implying no urgency to accelerate tightening.

From a market perspective, the fully priced nature of this week’s move reduces the risk of sharp volatility. Unlike August 2024, when a surprise policy shift triggered broad yen carry unwinds, currency moves this time are likely to hinge on forward guidance rather than the hike itself.

USD/JPY update, the pair topped out again this week circa 156.00: