Sterling Weakens as U.K. Inflation Surprise Strengthens Case for December BOE Cut

2025-12-18 03:15:00

U.K. consumer price inflation fell sharply to 3.2% y/y in November, well below the 3.5% market consensus and marking the lowest reading since March 2025.

The larger-than-expected decline was driven by falling food prices and weaker alcohol and tobacco costs, with lower clothing prices adding to the disinflationary trend as Black Friday discounting intensified across retail sectors.

The soft print essentially removed any remaining uncertainty about a Bank of England (BOE) rate cut at Thursday’s policy meeting, with markets now pricing near 100% odds of a 25-basis-point reduction to 3.75%.

Key Takeaways

- Headline CPI dropped to 3.2% in November from 3.6% in October, undershooting the 3.5% consensus forecast and the BOE’s own 3.4% projection

- Core inflation (excluding food, energy, alcohol, and tobacco) eased to 3.2% from 3.4%, hitting the lowest level since December 2024

- Services inflation fell to 4.4% from 4.5%, below the BOE’s expectation of unchanged readings and a key metric for policymakers assessing domestic price pressures

- Food inflation slowed to 4.2% from 4.9%, reversing October’s acceleration with notable declines in bread, cereals, and dairy products

- Clothing prices fell 0.6% annually after rising 0.3% in October, with greater Black Friday discounting on women’s clothing driving the shift

- Markets now price 67 basis points of BOE easing through end-2026, up from 58 basis points before the release, suggesting expectations for multiple cuts next year

Link to official ONS Consumer Price Inflation November 2025 Report

Market Reactions

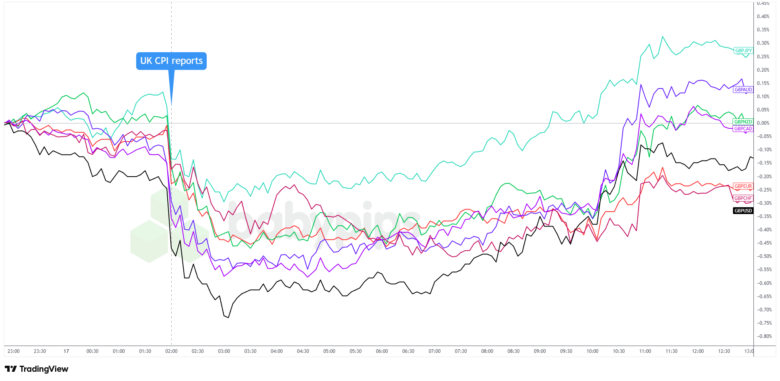

British pound vs. Major Currencies: 5-min

The British pound, which had already been edging lower during the early Asian session, sold off sharply after the softer inflation data. GBP/USD dropped as much as 0.8% to $1.3315 within the first hour post-release, marking its largest one-day decline in about a month.

The move was broad, with GBP weakening against all major currencies as the inflation miss reinforced expectations for a dovish BOE. Losses were most pronounced against the dollar and commodity-related currencies AUD, NZD, and CAD, as traders quickly repriced rate cut expectations, pushing swaps markets toward near certainty of a Thursday cut.

Sterling steadied after the initial rush lower as the knee-jerk reaction faded, but remained under pressure through the morning London session. UK gilts rallied on the data, with 10-year yields falling 7 basis points to 4.45%, highlighting how rate differentials moved further against the pound.

Despite the sharp drop, the response was relatively measured given the size of the inflation miss. Much of the downside had already been priced earlier in the week after weak labor data showed unemployment rising to 5.1%, limiting the scope for fresh panic selling.

By the close, Sterling was broadly weaker across major pairs except against the relatively weaker Australian dollar and Japanese yen. The persistent softness suggested markets viewed the inflation surprise as confirmation of a more aggressive BOE easing path in 2026, with disinflation showing up across food, core goods, and services.