British Pound drops across the board as UK inflation surprises to the downside

2025-12-17 07:34:00

KEY POINTS:

- UK CPI Y/Y 3.2% vs 3.5% expected

- UK Core CPI Y/Y 3.2% vs 3.4% expected

- Food and non-alcoholic beverages, and alcohol and tobacco made the largest downward contributions

- The pound dropped across the board as traders increased BoE rate cut bets

- The BoE is expected to cut by 25 bps tomorrow but could sound more dovish

UK INFLATION:

The UK CPI figures this morning surprised to the downside across the board. The Office for National Statistics (ONS) noted that food and non-alcoholic beverages, and alcohol and tobacco made the largest downward contributions to the monthly change in both CPIH and CPI annual rates.

UK CPI

Even though food prices are generally volatile, several BoE members expressed significant concern lately that persistent food price increases could keep inflation sticky above 2% as households change their inflation expectations. Therefore, this should be good news for the central bank ahead of its monetary policy decision tomorrow where it’s expected to cut the Bank Rate to 3.75%.

MARKET REACTION:

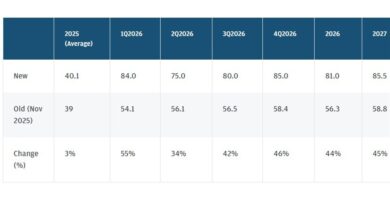

In the markets, we saw a clear dovish reaction with the GBP falling across the baord and the UK FTSE 100 index surging. Given the soft UK employment and inflation data this week, the BoE might not only deliver the rate cut, but also a more dovish tone. The market has been expecting at least one more rate cut in 2026, but traders will likely start to bet on at least two more cuts next year.

This should weigh on the pound, especially against the euro given some hawkish bets on the ECB. On the other hand, the FTSE 100 should be well supported into new all-time highs as lower interest rates and expected susequent recovery in the economy are bullish drivers for the stock market.

GBPUSD – 1 minute