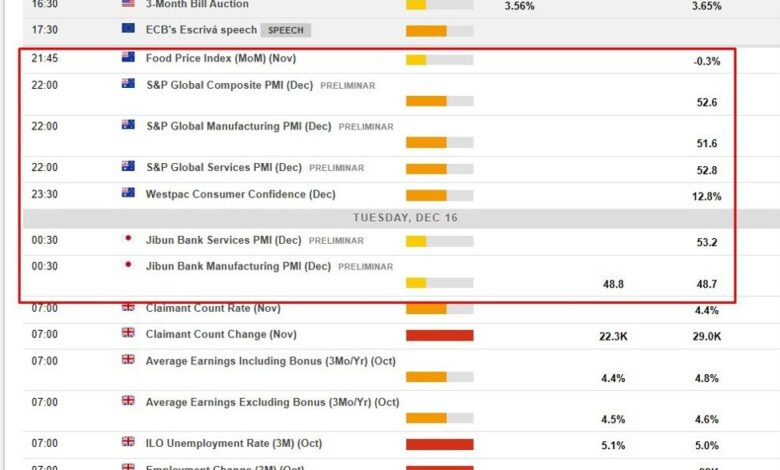

Economic and event calendar in Asia for Tuesday, December 16, 2025

2025-12-15 21:36:00

As always, the screenshot has what’s on the data agenda today.

- This snapshot from the investingLive economic data calendar.

- The times in the left-most column are GMT.

- The numbers in the right-most column are the ‘prior’ (previous month/quarter as the case may be) result. The number in the column next to that, where there is a number, is the consensus median expected.

None of it is too significant in terms of expected immediate market movement.

The preliminary PMIs due from Australia will be interesting. All three are in expansion and are suggestive of an economy that is ‘expanding’. This is welcomed by the Reserve Bank of Australia. What is not welcomed by the Bank right now is the stickiness of high inflation in Australia. This has seen the Bank abandon its dovishness and flip the switch to more hawkish. Indeed, expectations are rising for RBA rate hikes, for example:

Speaking of PMIs and rate hikes, Japan! We have preliminary PMIs also due from Japan today. These are not expected to be as strong as those from Australia, but other data from Japan has been encouraging, for example:

and have prompted expectations of a Bank of Japan rate hike this week. The Bank meet on December 18 and 19, a 25bp interest rate rise is widely expected:

Apart from that the consumer confidence numbers from Westpac will be of note. For November this result was a blockbuster +12.8% jump that I found difficult to attach much credibility to. Perhaps today’s will follow up strongly, let’s see!