Financial & Forex Market Recap – Dec. 15, 2025

Markets traded defensively on Monday as disappointing Chinese economic data and renewed central bank policy uncertainty weighed on risk appetite, while the Japanese yen strengthened ahead of this week’s Bank of Japan decision.

Gold emerged as the session’s standout performer, gaining ground amid broader market caution, while bitcoin extended its recent slide deeper into bear market territory and oil prices tumbled on oversupply concerns.

Check out the forex news and economic updates you may have missed in the latest trading session!

Forex News Headlines & Data:

- New Zealand Services Index for November 2025: 46.9 (49.3 forecast; 48.7 previous)

- RBNZ Governor Anna Breman expects the Official Cash Rate will remain unchanged for some time

- Japan Tankan Large Manufacturers Index for December 31, 2025: 15.0 (15.0 forecast; 14.0 previous)

-

China Economic updates for November 2025:

- China Unemployment Rate for November 2025: 5.1% (5.2% forecast; 5.1% previous)

- China Retail Sales for November 2025: 1.3% y/y (3.3% y/y forecast; 2.9% y/y previous)

- China Industrial Production for November 2025: 4.8% y/y (5.4% y/y forecast; 4.9% y/y previous)

- China House Price Index for November 2025: -2.4% y/y (-1.9% y/y forecast; -2.2% y/y previous)

- Germany Wholesale Prices for November 2025: 0.3% m/m (0.2% m/m forecast; 0.3% m/m previous); 1.5% y/y (1.3% y/y forecast; 1.1% y/y previous)

- Swiss Producer & Import Prices for November 2025: -0.5% m/m (-0.4% m/m forecast; -0.3% m/m previous); -1.6% y/y (-1.5% y/y forecast; -1.7% y/y previous)

- Canada Consumer Price Index Growth Rate for November 2025: 0.1% m/m (0.1% m/m forecast; 0.2% m/m previous); 2.2% y/y (2.3% y/y forecast; 2.2% y/y previous)

- Canada Manufacturing Sales Final for October 2025: -1.0% m/m (-1.1% m/m forecast; 3.3% m/m previous)

- NY Empire State Manufacturing Index for December 2025: -3.9 (11.0 forecast; 18.7 previous)

- Fed Governor Miran argued the policy stance is unnecessarily restrictive, pointing to inflation close to target

- NY Fed President Williams said monetary policy is well positioned for 2026 following last week’s rate reduction

- Fed’s Collins said the December rate cut was a “close call” as she remains concerned about elevated inflation

- On Monday, Ukraine offers to give up its bid to join NATO for security guarantees

- NAHB U.S. Housing Market Index for December 2025: 39.0 (37.0 forecast; 38.0 previous)

- Oil fell to lowest level in almost two months on potential Ukraine deal and weak China data

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Monday’s session reflected growing concerns about global growth prospects and central bank policy paths, with markets struggling to find direction ahead of this week’s critical employment and inflation data releases.

Gold was the day’s clear winner, advancing approximately 0.4% as safe-haven demand returned amid broader market uncertainty. The precious metal benefited from renewed concerns about Chinese economic momentum and expectations for continued Federal Reserve easing, despite division among policymakers about the appropriate pace of rate cuts.

Bitcoin faced heavy selling pressure, plunging 2.5% to breach $86,000 for the first time in two weeks. The largest cryptocurrency has now fallen approximately 30% from its record high above $126,000 reached in early October. The decline highlighted weak liquidity and fading risk appetite, with bitcoin failing to rebound alongside other risk assets despite the Fed’s recent rate cut. Strategy Inc. continued its accumulation strategy, acquiring almost $1 billion in bitcoin for a second consecutive week.

WTI crude oil tumbled to its lowest level in almost two months, declining 2.3% to close near $57 per barrel. The selloff reflected mounting concerns about oversupply, with renewed optimism surrounding potential Ukraine peace talks raising the prospect of additional Russian barrels returning to market. Weak Chinese economic data likely added to demand-side concerns.

U.S. equities wavered throughout the session, with the S&P 500 hovering near 6,820 in choppy trading. A renewed technology selloff weighed on the index, with Broadcom heading toward its worst three-day plunge since 2020 and Oracle extending its multi-session decline to approximately 17%. The cryptocurrency rout and concerns about labor market data kept a lid on risk appetite.

The 10-year Treasury yield remained largely unchanged at 4.18% as investors positioned ahead of Tuesday’s delayed jobs report. Bond markets reflected the Fed’s shift toward greater focus on labor market risks, with two-year yields edging mildly lower amid expectations for two rate cuts in 2026.

FX Market Behavior: U.S. Dollar vs. Majors

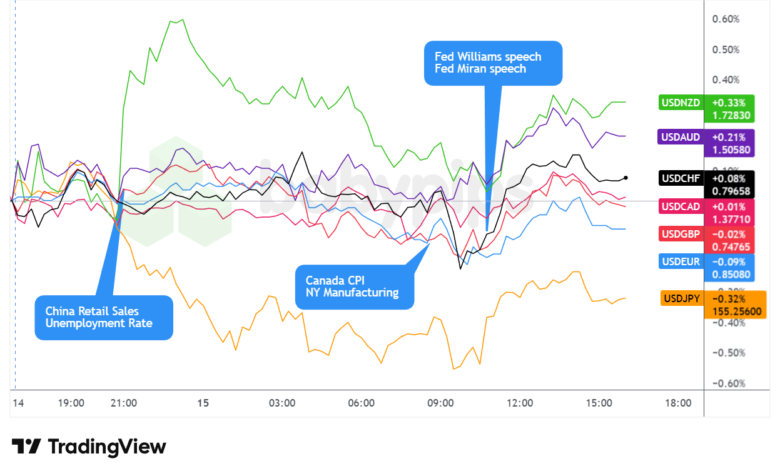

The U.S. dollar experienced mostly sideways trading on Monday, trading choppy during Asian hours before weakening slightly through the London session, then staging a partial recovery during U.S. trading to finish mixed against major currencies with a slightly bullish lean.

The greenback’s Asian session saw choppy, sideways trading with an arguably bearish lean as markets digested the weekend’s developments and positioned ahead of significant Chinese economic data. The releases proved broadly disappointing, with retail sales growing just 1.3% year-over-year versus 3.3% expected, marking the weakest pace since the end of zero-COVID policies. Industrial production and fixed asset investment also missed forecasts, reinforcing concerns about domestic demand weakness despite record trade surpluses.

The dollar saw increased bearish pressure during the London session, and with direct catalysts to point to, it’s possible that traders reduced exposure ahead of this week’s critical U.S. employment and inflation reports, which were delayed by the federal government shutdown. The Japanese yen was a notable mover early on, possibly appreciating on improved Bank of Japan Tankan data and constructive central bank commentary that cemented expectations for a 25 basis point rate hike at this week’s December 18-19 meeting. Markets now price approximately 94% probability of BOJ tightening, with swap markets pricing 67 basis points of additional hikes by end-2026.

During the U.S. session, the dollar found support and rebounded against most major currencies. The recovery reflected positioning adjustments ahead of Tuesday’s jobs report, which will include estimates for both October and November payrolls following the shutdown delays. The U.S. Dollar Index climbed alongside bond yields while equities, gold, oil, and bitcoin traded lower, suggesting some defensive repositioning.

Federal Reserve commentary highlighted ongoing policy divisions. Governor Stephen Miran reiterated his view that the current stance is unnecessarily restrictive, arguing that “underlying” inflation is close to the 2% target after adjusting for shelter and other components. He advocated for a quicker easing pace to reach neutral, warning that keeping rates too high risks job losses. In contrast, New York Fed President John Williams emphasized that policy is “well positioned” for 2026 following the recent 25 basis point cut, while Boston Fed President Susan Collins called the December decision a “close call” due to elevated inflation concerns.

Reserve Bank of New Zealand Governor Anna Breman pushed back against investor expectations for 2026 rate hikes, stating she expects the Official Cash Rate will remain unchanged at 2.25% for some time. The kiwi dollar fell sharply on her comments during the Asia session, which traders interpreted as a warning against overly aggressive market pricing.

At Monday’s close, the dollar showed mixed performance across major currency pairs, reflecting uncertainty about this week’s data releases and their implications for the Federal Reserve’s policy path.

Upcoming Potential Catalysts on the Economic Calendar

- New Zealand Food Price Index for November 2025 at 9:45 pm GMT

- Australia S&P Global Manufacturing & Services PMI Flash for December 2025 at 10:00 pm GMT

- Australia Westpac Consumer Confidence Change for December 2025 at 11:30 pm GMT

- Japan S&P Global Manufacturing & Services PMI Flash for December 2025 at 12:30 am GMT

- U.K. Employment Situation Update for October 2025 at 7:00 am GMT

- U.K. Claimant Count Change for November 2025 at 7:00 am GMT

- Germany Manufacturing & Services PMI Flash for December 2025 at 8:30 am GMT

- Euro area Manufacturing & Services PMI Flash for December 2025 at 9:00 am GMT

- U.K. Manufacturing & Services PMI Flash for December 2025 at 9:30 am GMT

- Germany ZEW Economic Sentiment Index for December 2025 at 10:00 am GMT

- New Zealand Global Dairy Trade Price Index for December 16, 2025

- U.S. Building Permits & Housing Starts for September & October 2025

- ADP U.S. Employment Change Weekly for November 29, 2025 at 1:15 pm GMT

- U.S. Employment Situation Update for October 2025 at 1:30 pm GMT

- U.S. Retail Sales for October 2025 at 1:30 pm GMT

Tuesday’s calendar features an unusually heavy data slate as authorities catch up from the government shutdown. The U.S. employment report will be particularly scrutinized, providing estimates for both October and November payrolls following the extended federal closure.

Global Flash PMI updates will offer fresh perspectives on manufacturing and services momentum across major economies. UK employment data and U.S. retail sales figures will round out a data-intensive session that could significantly influence near-term Federal Reserve expectations and broader market sentiment heading into year-end.

Stay frosty out there, forex friends, and don’t forget to check out our Forex Correlation Calculator when planning to take on risk!