Financial & Forex Market Recap – Dec. 9, 2025

Markets treaded water on Tuesday as traders held their powder dry ahead of Wednesday’s Federal Reserve decision, though cautious optimism about continued easing helped stocks edge higher while the dollar wobbled and Bitcoin reversed early losses.

Check out the forex news and economic updates you may have missed in the latest trading session!

Forex News Headlines & Data:

- Reserve Bank of Australia holds cash rate at 3.60% as expected; Governor Bullock says board discussed circumstances requiring tightening, singles out February meeting for careful inflation watch

- Australian November NAB business conditions +7 vs +9 prior

- U.K. BRC November retail sales +1.2% y/y vs +1.5% prior

- Bank of Japan Governor Ueda says recent long-term rate rises have been “somewhat rapid,” signals BOJ could increase bond buying if needed

- Germany October trade balance €16.9B vs €15.6B expected

- Trump tells Politico he may consider changes to tariffs to lower prices; calls willingness to lower rates a “litmus test” for Fed chair choice

- ADP weekly employment data suggests private companies added modest 4,750 jobs per week through November 22

- U.S. JOLTS Job Openings for October 2025: 7.67M (7.12M forecast; 7.74M previous) – highest since May but data delayed by government shutdown

- Kevin Hassett says there’s “plenty of room” to cut rates substantially, aligning with Trump’s calls for lower borrowing costs

- Conference Board U.S. Leading Economic Index falls 0.3% in September, points to 2026 slowdown

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Tuesday’s session was defined by cautious positioning ahead of the Fed’s final 2025 rate decision, with most assets trading in tight ranges as traders digested mixed signals from central banks and delayed U.S. labor market data.

The S&P 500 closed fractionally lower at 6,839.3, down 0.23%, after an initial pop on better-than-expected JOLTS data faded quickly. The index opened under pressure during Asian hours and remained heavy through the London session, correlating with JPMorgan’s cautionary comments on consumer health and cost pressures. The modest bounce around 10:00 am ET following the JOLTS release proved short-lived, with stocks drifting lower into the close as Fed uncertainty dominated.

Gold found its footing after early weakness, climbing 0.49% to $4,211.20 as haven demand returned during the U.S. session. The precious metal traded choppily lower through Asian and London hours, testing support near $4,180, before reversing higher around the New York open. While there were no direct gold-specific catalysts for the afternoon rally, it’s possible this was renewed concerns of a “hawkish Fed cut” scenario.

WTI crude oil declined 0.43% to $58.20, extending losses from the previous session. Oil traded mixed through Asian hours but found some strength during London morning before rolling over during U.S. trade. The weakness came despite no major oil-specific news, suggesting the move likely reflected broader risk-off positioning ahead of the Fed meeting.

Bitcoin reversed early losses to close 1.91% higher at $93,067, demonstrating resilience despite the cautious market tone. The cryptocurrency traded under pressure through Asian and early London sessions, declining as much as 2% at one point, before staging a sharp reversal around the U.S. open. The recovery appeared to gain momentum alongside gold’s afternoon strength, possibly reflecting positioning adjustments by crypto traders ahead of the Fed decision or possibly continued interest in alternative assets amid traditional market uncertainty like bonds.

The 10-year Treasury yield edged 0.38% higher to 4.20%, hovering near multi-month highs following the day’s bond auction. Yields climbed modestly during Asian hours, dipped slightly through the London session, then firmed again during U.S. trade. The Treasury Department’s auction of 10-year notes at 1:00 pm ET drew a 4.175% yield, matching pre-auction trading levels, as the dayslong bond market slump continued to reflect trader caution about the pace of monetary easing beyond Wednesday’s likely rate cut.

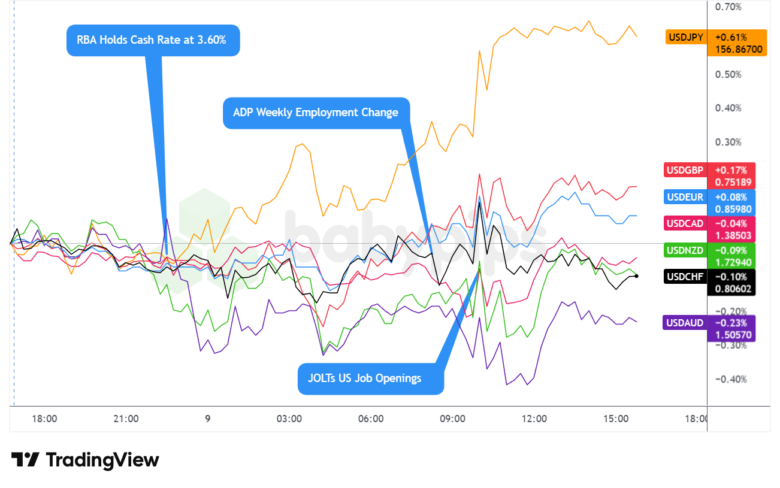

FX Market Behavior: U.S. Dollar vs. Majors

Overlay of USD vs. Majors Forex Chart by TradingView

The U.S. dollar traded choppy and directionally uncertain on Tuesday, initially weakening during Asian hours before finding support in London and then whipsawing through a mixed U.S. session, ultimately closing slightly softer against most major currencies as traders positioned defensively ahead of Wednesday’s Fed decision.

During the Asian session, the greenback posted net losses against major currencies, though the moves were modest and rangebound. There were no direct U.S.-specific catalysts for the weakness, but the RBA’s hawkish hold appeared to provide some support for risk sentiment that possibly weighed on the dollar. The RBA decision initially sparked a brief dip in AUD/USD, but the Aussie quickly rebounded as Governor Bullock’s comments about potential tightening and the February meeting focus reinforced expectations for nearly two rate hikes priced into 2026. This hawkish repricing seemed to outweigh Australia’s softer NAB business conditions, lending modest support to the antipodean and possibly contributing to the dollar’s early weakness.

The London session marked a clear pivot, with the dollar finding a bottom and rebounding. The turnaround came as BOJ Governor Ueda’s comments about “somewhat rapid” rate rises and potential bond buying intervention appeared to undermine yen strength, likely contributing to the bounce in USD/JPY by 0.61% on the day. Meanwhile, Trump’s Politico interview raised fresh questions about tariff policy consistency, potentially supporting defensive dollar positioning. The greenback’s recovery seemed to correlate with renewed caution in equity markets and a modest uptick in Treasury yields, suggesting haven flows were reasserting themselves.

The U.S. session delivered choppy, mixed dollar performance with an arguably bearish lean through the afternoon. The JOLTS job openings data at 10:00 am ET came in well above expectations at 7.67 million versus 7.12 million forecast, which initially sparked a brief dollar bounce as the hawkish data suggested the labor market remained tighter than feared. However, analysts quickly noted the data’s limitations—it was stale, delayed by the government shutdown, and the pace of layoffs had also risen. This nuance seemed to temper the dollar’s gains, and the greenback drifted lower through the afternoon as traders likely returned focus to Wednesday’s Fed meeting.

Upcoming Potential Catalysts on the Economic Calendar

- Japan Reuters Tankan Index for December 2025 at 11:00 pm GMT

- Japan Producer Prices Index for November 2025 at 11:50 pm GMT

- China Inflation Updates for November 2025 at 1:30 am GMT

- Euro area ECB President Lagarde Speech at 10:55 am GMT

- U.S. MBA 30-Year Mortgage Rate & Applications for December 5, 2025 at 12:00 pm GMT

- U.S. Wholesale Inventories Adv for September 2025

- U.S. Employment Cost Index for September 2025 at 1:30 pm GMT

- U.S. Wholesale Inventories Adv for October 2025

-

Bank of Canada Interest Rate Decision for December 10, 2025 at 2:45 pm GMT

- BoC Press Conference at 3:30 pm GMT

- EIA Crude Oil Stocks Change for December 5, 2025 at 3:30 pm GMT

-

FOMC Federal Funds Rate statement for December 10, 2025 at 7:00 pm GMT

- FOMC Economic Projections at 7:00 pm GMT

- Fed Press Conference at 7:30 pm GMT

Wednesday’s calendar is dominated by two major central bank decisions that will shape near-term market direction. The Federal Reserve is widely expected to deliver a 25-basis-point cut—the market prices this with nearly 90% probability—but the real focus will be on Powell’s guidance for 2026. Money markets have already retreated from optimistic forecasts, now pricing around two cuts next year versus more aggressive expectations just weeks ago. The key risk is a “hawkish cut” where the Fed lowers rates but signals a pause in the easing cycle, which could trigger volatility across assets. As one strategist noted, “the rate cut is actually the least important part of this meeting”—the updated dot plot and Powell’s commentary on the labor market, inflation trajectory, and policy path will carry far more weight.

The Bank of Canada decision at 2:45 pm GMT adds another layer of intrigue, with all 13 economists surveyed expecting rates to hold steady at 3.75%. However, recent pricing of a late-2026 rate hike has tightened Canadian financial conditions, potentially prompting Governor Macklem to push back with more dovish guidance at his 4:00 pm GMT press conference.

China’s inflation data overnight will be watched for signs of deflation persistence, though unless we see major surprises, the reports are unlikely to move markets significantly given the focus on North American central banks.

The combination of Fed projections, Powell’s press conference language around the January meeting, and any BOC commentary on rate hike expectations could drive significant moves in bonds, the dollar, and equity volatility—particularly if either central bank surprises relative to the cautious tone markets are now pricing.

Stay frosty out there, forex friends, and don’t forget to check out our Forex Correlation Calculator when planning to take on risk!