Ripple’s $500M Raise Draws Wall Street With Protected Deal — Report

Ripple’s $500 million raise in November marked a striking turn for a company once defined by its bruising, multiyear battle with the US Securities and Exchange Commission. As its legal challenges ease and Ripple pushes beyond cross-border payments toward a more ambitious crypto-native settlement stack, the company is repositioning itself in ways that are increasingly attracting major Wall Street investors.

The round, which Cointelegraph reported valued Ripple at $40 billion, one of the highest valuations for a private company, drew an unusually heavy institutional roster. Investors included Citadel Securities, Fortress Investment Group and funds linked to Galaxy Digital, Pantera Capital and Brevan Howard.

New details reported by Bloomberg also shed light on how Ripple secured that interest — namely, by offering investors a deal structured with significant downside protections.

The terms allow participating funds to sell their shares back to Ripple after three or four years at a guaranteed annualized return of about 10%, according to people familiar with the matter. That option disappears if Ripple goes public within that window.

The company also retained the right to repurchase the shares itself over the same period — in that case, providing investors with an even higher annualized return of roughly 25%.

Related: Ripple rejects IPO plans despite SEC case victory: Here’s why

Ripple broadens its reach, but investors still zero in on XRP

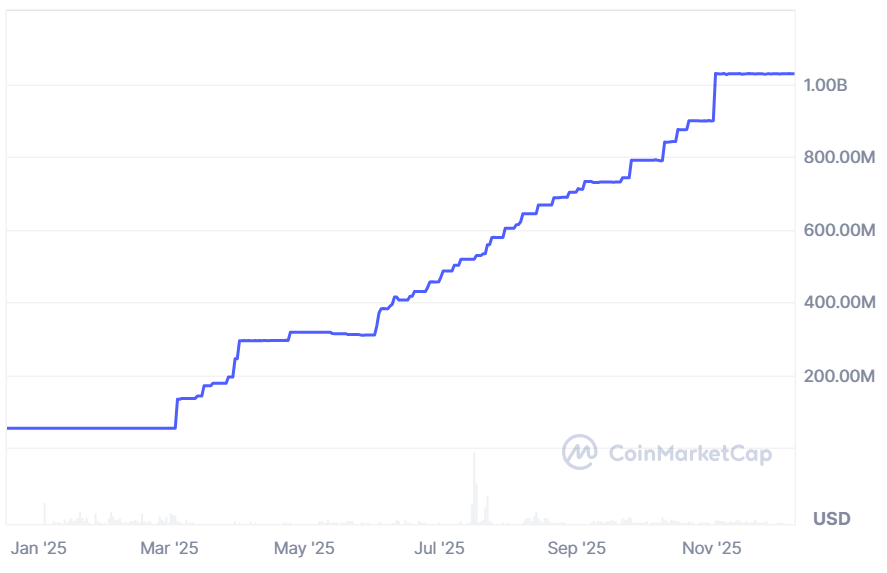

Although Ripple has broadened its focus, including a significant push into the stablecoin market with its dollar-pegged Ripple USD (RLUSD), some institutional investors still view backing the company as a bet on XRP (XRP), according to Bloomberg.

Two of the funds involved concluded that roughly 90% of Ripple’s net asset value was tied to XRP, despite the company’s repeated emphasis that it does not control the token and that XRP functions as an independent asset.

Nevertheless, Ripple is positioning itself as a company that can combine custody, treasury, prime brokerage services and stablecoins to help institutions access digital assets.

As part of that strategy, the company acquired non-bank prime broker Hidden Road in April, now rebranded as Ripple Prime, and also bought treasury-management company GTreasury. The two deals, totaling approximately $2.25 billion, highlight Ripple’s growing effort to establish a comprehensive institutional infrastructure stack.

Related: VC Roundup: Big money, few deals as crypto venture funding dries up