U.S. ADP Employment Plunges 32K in November as Small Business Hiring Collapses

2025-12-04 03:12:00

The U.S. private sector shed 32,000 jobs in November, according to ADP’s National Employment Report, marking the largest monthly decline since spring 2023 and falling far short of the 15,000 gain economists had expected.

The disappointing figure reinforces mounting concerns about labor market deterioration heading into the Federal Reserve’s December policy meeting.

Key Takeaways

- Private sector employment fell by 32,000 in November versus expectations for a 15,000 gain, with October’s figure revised upward from 42,000 to 47,000

- Small businesses drove the decline, with establishments under 50 employees shedding 120,000 jobs—the steepest drop since May 2020—while large firms added 39,000 positions

- Pay growth continued to moderate, with job-stayers seeing annual wage increases of 4.4% (down from 4.5% in October) and job-changers at 6.3% (down from 6.7%)

- Goods-producing sectors suffered their largest losses since the pandemic, declining 19,000 jobs, led by manufacturing (-18,000) and construction (-9,000)

- Service sectors also contracted, losing 13,000 positions, with professional/business services (-26,000) and information (-20,000) posting notable declines

Link to ADP Employment Change Report (November 2025)

ADP’s Chief Economist Dr. Nela Richardson said hiring has been choppy as employers deal with cautious consumers and an uncertain outlook. You could see that clearly in the split between big and small companies.

Large firms managed to add about 39,000 jobs, but small businesses pulled back hard, cutting roughly 46,000 positions, while mid-sized companies trimmed another 74,000. It feels like tighter margins are hitting the little guys first, while the big players still have some hiring muscle.

Sector data did not make things any brighter. Manufacturing fell again, construction eased despite its usual fourth-quarter lift, and information services saw a steep decline. Only education and health services and leisure and hospitality showed any strength, and even those gains were on the mild side.

Wage growth cooled as well, adding to the sense that the labor market is loosening.

Market Reactions

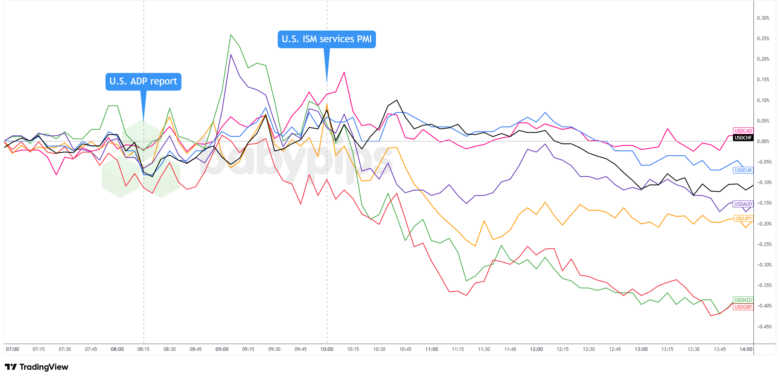

U.S. Dollar vs. Major Currencies: 5-min

The Greenback had already been leaning bearish before the ADP release, suggesting traders were positioning for disappointing data.

When ADP confirmed the 32,000-job decline—far worse than the expected 15,000 gain—the dollar extended its losses but also saw immediate bullish pullback, potentially on profit-taking aroudn the U.S. session open and ahead of the ISM services PMI release.

The selling pressure eventually persisted even after the ISM Services PMI arrived slightly above expectations at 52.6. Markets appeared focused exclusively on labor market weakness, dismissing mixed signals from the services report. The dollar index fell approximately 0.45% on the session, marking its worst single-day performance since September.

By the close, USD posted losses across all major pairs. It lost the most pips to “risk” currencies like the British pound, Australian dollar, and the New Zealand dollar, while seeing more limited losses to the Canadian dollar, euro, and the Swiss franc.

The uniform dollar weakness underscores how completely markets interpreted the ADP data as clearing the path for Federal Reserve easing. Fed funds futures now price in over 90% probability of a December rate cut, up from around 25% just two weeks ago.

With the delayed November nonfarm payrolls report not due until December 16—after the Fed’s December 17-18 meeting—the ADP figures took on outsized importance in shaping interest rate expectations.