Financial & Forex Market Recap – Dec. 2, 2025

Markets delivered a cautiously optimistic session on Tuesday, with U.S. equities eking out modest gains while Bitcoin staged a dramatic recovery from Monday’s rout. The dollar traded mixed in choppy action as traders parsed Bank of England policy signals and awaited Wednesday’s key U.S. employment data.

Check out the forex news and economic updates you may have missed in the latest trading session!

Forex News Headlines & Data:

- New Zealand Terms of Trade for September 30, 2025: -2.1% q/q (3.5% q/q forecast; 4.1% q/q previous)

- Australia Building Permits Prel for October 2025: -6.4% m/m (-2.0% m/m forecast; 12.0% m/m previous)

- Australia Current Account for September 30, 2025: -16.6B (-10.2B forecast; -13.7B previous) – largest deficit since 2016

- Japan Consumer Confidence for November 2025: 37.5 (36.1 forecast; 35.8 previous)

- U.K. Nationwide Housing Prices for November 2025: 0.3% m/m (0.2% m/m forecast; 0.3% m/m previous)

-

Euro area Inflation Rate Flash for November 2025: 2.2% y/y (2.1% y/y forecast; 2.1% y/y previous)

- Euro area Core Inflation Rate Flash for November 2025: 2.4% y/y (2.3% y/y forecast; 2.4% y/y previous)

- Bank of England Financial Stability Report noted increased risks in 2025 but judges UK banking system resilient, slightly easing structural capital requirements to support lending

- Putin meets with U.S. envoys Witkoff and Kushner at the Kremlin on Ukraine peace proposals

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Tuesday’s session featured a notable divergence between asset classes, with cryptocurrency markets rebounding sharply while traditional risk assets consolidated and commodities extended their retreat.

The S&P 500 managed to squeeze out a sixth gain in seven sessions, rising modestly to around 6,830, though the advance masked underlying weakness as most constituent stocks actually declined. The index traded in a relatively tight range throughout the day, with early Asia session losses giving way to modest recovery during London hours. After the U.S. open, equities chopped sideways through the afternoon, suggesting traders remained cautious ahead of Wednesday’s ADP employment data and broader concerns about market breadth. Apple led megacap gains while Tesla fell after Michael Burry called the shares “ridiculously overvalued.”

Bitcoin delivered the day’s most dramatic price action, surging back above $90,000 after Monday’s bruising selloff that had wiped out nearly $1 billion in leveraged positions. The cryptocurrency initially struggled during Asian trading, holding around $86,000-$87,000, before catching a strong bid during London hours. The rally accelerated through the U.S. afternoon, with Bitcoin climbing as much as 6.7% to $92,228. The rebound correlated with positive industry-specific headlines, including SEC Chairman Paul Atkins’ comments on plans for an “innovation exemption” for digital asset companies and Vanguard’s decision to allow cryptocurrency ETFs on its platform. However, several metrics suggest the recovery may be fragile—funding rates remain negative and CoinMarketCap’s Fear and Greed Index stayed at “extreme fear” levels.

Gold extended its pullback from Monday’s highs, declining about 0.9% to trade around $4,192 per ounce. The precious metal came under pressure during Asian trading and continued to drift lower through London and U.S. sessions, likely reflecting profit-taking after recent record-breaking runs and possibly responding to the slightly firmer dollar during London hours.

WTI crude oil posted the session’s worst performance, dropping 1.55% to around $58.20. The energy complex faced pressure throughout all three trading sessions, with no direct oil-specific news to point to as a catalyst. The decline may have reflected broader concerns about demand given mixed global economic data, though geopolitical tensions remained elevated with Putin threatening strikes on ships supporting Ukraine amid attacks on Russian tanker fleets.

The 10-year Treasury yield traded largely sideways around 4.09-4.11%, showing little net change on the day despite considerable intraday movement. Yields initially declined during Asian hours before recovering through London trading, then settled into a narrow range during U.S. hours. The stability came despite growing speculation about a more dovish Fed Chair potentially being nominated, suggesting traders were waiting for clearer signals from Wednesday’s employment data.

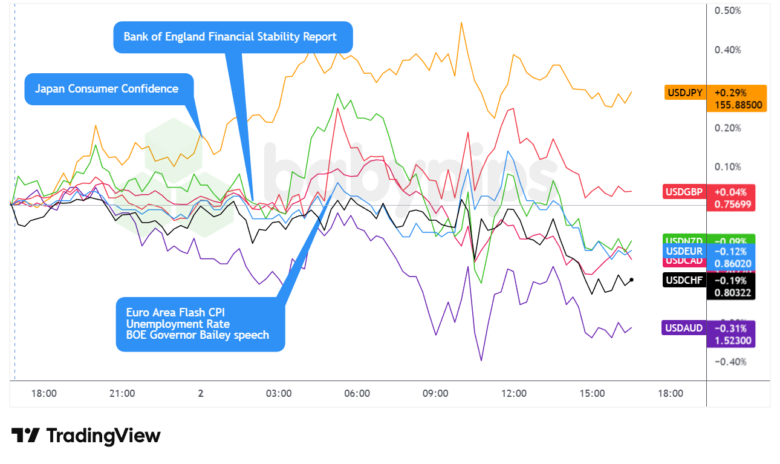

FX Market Behavior: U.S. Dollar vs. Majors:

Overlay of USD vs. Majors Forex Chart by TradingView

The U.S. dollar delivered a choppy, mostly directionless performance on Tuesday, posting mixed results against major currencies as competing narratives left traders reluctant to take strong directional bets ahead of Wednesday’s critical U.S. employment data.

During the Asian session, the greenback traded with a slightly bullish lean but lacked conviction, oscillating in tight ranges against most majors. The session featured relatively light economic data, with disappointing figures from Australia and New Zealand having limited impact on broader dollar direction.

The dollar’s most decisive move came at the London open, when the greenback rallied broadly against major currencies. This strength correlated with the release of the Bank of England’s Financial Stability Report and comments from BoE Governor Bailey, though there were no direct dollar-bullish catalysts from U.S. data. The dollar’s advance seemed to outweigh the slightly hotter-than-expected Eurozone CPI data (2.2% vs 2.1% expected), suggesting traders were positioning based on relative central bank policy expectations rather than reacting mechanically to inflation prints.

However, the dollar’s London session strength proved short-lived. Ahead of the U.S. session open, the greenback began pulling back from its highs, possibly as traders booked profits or adjusted positions ahead of Wednesday’s ADP report and Friday’s nonfarm payrolls data.

After U.S. markets opened, the dollar traded in a mixed, choppy pattern with a net bearish bias through the afternoon. By the session close, the greenback posted a mixed but net bearish leaning performance against the major currencies.

The dollar’s broad weakness during U.S. hours, despite no major U.S.-specific negative catalysts, suggests traders may be positioning for potential dovish surprises in upcoming employment data and/or factoring in reports that economic adviser Kevin Hassett—seen as supportive of rate cuts—could be nominated as the next Fed Chair.

The overall price action also highlighted the market’s current lack of conviction on near-term dollar direction, with positioning likely to remain fluid until Wednesday’s ADP employment data and particularly Friday’s nonfarm payrolls report provide clearer signals about Fed policy trajectory.

Upcoming Potential Catalysts on the Economic Calendar

- Australia S&P Global Services PMI Final for November 2025 at 10:00 pm GMT

- Australia AIG Manufacturing Index for November 2025 at 10:00 pm GMT

- Australia GDP Growth Rate for September 30, 2025 at 12:30 am GMT

- Japan S&P Global Services PMI Final for November 2025 at 12:30 am GMT

- China RatingDog Services PMI for November 2025 at 1:45 am GMT

- Swiss Inflation Rate for November 2025 at 7:30 am GMT

- Euro area HCOB Services PMI Final for November 2025 at 9:00 am GMT

- U.K. S&P Global Services PMI Final for November 2025 at 9:30 am GMT

- Euro area Producer Prices Index Growth Rate for October 2025 at 10:00 am GMT

- Euro area ECB Lane Speech at 10:30 am GMT

- U.S. MBA 30-Year Mortgage Rate & Applications for November 28, 2025 at 12:00 pm GMT

- U.S. ADP National Employment Report for November 2025 at 1:15 pm GMT

- Canada Labor Productivity for September 30, 2025 at 1:30 pm GMT

- Euro area ECB President Lagarde Speech at 1:30 pm GMT

- U.S. Import & Export Prices for September 2025 at 1:30 pm GMT

- U.S. Manufacturing & Industrial Production for September 2025 at 2:15 pm GMT

- Canada S&P Global Services PMI for November 2025 at 2:30 pm GMT

- ISM Services PMI for November 2025 at 3:00 pm GMT

- EIA Crude Oil Stocks Change for November 28, 2025 at 3:30 pm GMT

Wednesday shapes up as a potentially volatile session with multiple top-tier U.S. data releases that could significantly influence Fed policy expectations heading into next week’s FOMC decision. The ADP National Employment Report at 1:15 pm GMT will provide the first significant read on November labor market conditions, setting the tone for Friday’s nonfarm payrolls report. Markets currently price in an 89.2% probability of a 25-basis-point Fed cut on December 10, but any significant deviation from consensus in employment data could shift those odds materially.

The U.S. ISM Services PMI at 3:00 pm GMT represents another critical data point, given services’ dominance in the U.S. economy. Following recent manufacturing weakness, a strong services reading could temper rate cut expectations and support the dollar, while disappointing figures might reinforce concerns about broader economic slowing.

Beyond scheduled data, geopolitical developments warrant close attention after Tuesday’s Putin-Witkoff meeting on Ukraine peace proposals. Any unexpected announcements on that front could trigger risk-on or risk-off flows depending on perceived progress.

Additionally, speeches from ECB officials Lane and Lagarde may provide fresh insight into European monetary policy trajectory amid slightly elevated inflation readings, potentially impacting euro positioning.

Stay frosty out there, forex friends, and don’t forget to check out our Forex Correlation Calculator when planning to take on risk!