Financial & Forex Market Recap – Dec. 1, 2025

Markets kicked off December with a cautious tone as Bank of Japan rate hike speculation rippled across global bonds and a cryptocurrency selloff weighed on risk sentiment, while gold emerged as the session’s standout performer.

Check out the forex news and economic updates you may have missed in the latest trading session!

Forex News Headlines & Data:

Weekend Developments:

- President Donald Trump said he has decided on his pick for the next Federal Reserve chair, who he expects to deliver interest-rate cuts

- OPEC+ leaders reaffirmed their plan to pause oil production increases during the first quarter of 2026 amid growing fears of a global supply glut

Asia-Pacific Session:

- Bank of Japan Governor Kazuo Ueda sent a clear hint that his board may increase interest rates soon, stating the BOJ will consider the “pros and cons” of raising rates at its December meeting

- Japan S&P Global Manufacturing PMI Final for November 2025: 48.7 (48.8 forecast; 48.2 previous)

-

China NBS Manufacturing PMI for November 2025: 49.2 (49.4 forecast; 49.0 previous)

- China NBS Non Manufacturing PMI for November 2025: 49.5 (50.6 forecast; 50.1 previous)

- China RatingDog Manufacturing PMI for November 2025: 49.9 (50.4 forecast; 50.6 previous)

- New Zealand Building Permits for October 2025: -0.9% m/m (-5.0% m/m forecast; 7.2% m/m previous)

- Australia S&P Global Manufacturing PMI Final for November 2025: 51.6 (51.6 forecast; 49.7 previous)

- Australia ANZ-Indeed Job Ads for November 2025: -0.8% m/m (-0.3% m/m forecast; -2.2% m/m previous)

- Australia Commodity Prices for November 2025: -1.7% y/y (-2.0% y/y forecast; -1.3% y/y previous)

- Australia TD-MI Inflation Gauge for November 2025: 0.3% m/m (0.2% m/m forecast; 0.3% m/m previous)

European Session:

- Swiss Retail Sales for October 2025: 0.7% m/m (0.1% m/m forecast; 0.6% m/m previous); 2.7% y/y (1.9% y/y forecast; 1.5% y/y previous)

- Germany HCOB Manufacturing PMI Final for November 2025: 48.2 (48.4 forecast; 49.6 previous)

- Euro area HCOB Manufacturing PMI Final for November 2025: 49.6 (49.7 forecast; 50.0 previous)

-

U.K. Monetary Developments for October 2025:

- U.K. Net Lending to Individuals for October 2025: 5.4B (6.5B forecast; 7.0B previous)

- BoE Consumer Credit for October 2025: 1.12B (1.5B forecast; 1.49B previous)

- U.K. M4 Money Supply for October 2025: -0.2% m/m (0.2% m/m forecast; 0.6% m/m previous)

- U.K. Mortgage Approvals for October 2025: 65.02k (65.5k forecast; 65.94k previous)

- U.K. S&P Global Manufacturing PMI Final for November 2025: 50.2 (50.2 forecast; 49.7 previous)

North American Session:

- Canada S&P Global Manufacturing PMI for November 2025: 48.4 (50.4 forecast; 49.6 previous)

- U.S. S&P Global Manufacturing PMI Final for November 2025: 52.2 (51.9 forecast; 52.5 previous)

-

ISM U.S. Manufacturing PMI for November 2025: 48.2 (48.8 forecast; 48.7 previous)

- ISM U.S. Manufacturing g Employment for November 2025: 44.0 (47.0 forecast; 46.0 previous)

- ISM U.S. Manufacturing New Orders for November 2025: 47.4 (49.7 forecast; 49.4 previous)

- ISM U.S. Manufacturing Prices for November 2025: 58.5 (58.2 forecast; 58.0 previous)

Broad Market Price Action:

Monday’s trading painted a picture of defensive positioning as markets digested divergent central bank signals and tariff uncertainty, with gold benefiting from haven flows while cryptocurrencies suffered steep losses.

Gold commanded attention as the session’s strongest performer, climbing 0.38% to settle around $4,233.50 per ounce. The precious metal found support from multiple catalysts: Bank of Japan rate hike speculation that drove Japanese government bond yields to multi-year highs, Fed chair uncertainty following President Trump’s weekend announcement, and broader concerns about trade policy direction under ongoing tariff threats.

Bitcoin experienced severe selling pressure, plunging over 5% to around $86,398 after dropping as much as 8% to $83,824 during the session. Nearly $1 billion in leveraged crypto positions were liquidated as the digital asset extended its decline to almost 30% since early October. The selloff reflected mounting concerns about weakening inflows into Bitcoin ETFs, with the iShares Bitcoin Trust experiencing its fifth consecutive week of withdrawals. Michael Saylor’s Strategy Inc. attempted to calm markets by announcing a $1.4 billion reserve for future payments, though the company’s shares still tumbled more than 10%.

WTI crude oil posted modest gains of 0.14% to close near $59.30, recovering from earlier choppy trading that saw prices oscillate between positive and negative territory. OPEC+’s weekend decision to maintain its pause on production hikes through the first quarter of 2026 provided underlying support, though concerns about global demand and potential supply increases tempered enthusiasm.

The S&P 500 opened December on a defensive note, declining 0.36% to 6,815.30 as risk appetite evaporated. The Russell 2000 gauge of small-cap stocks fell over 1%, underscoring the cautious mood. Technology megacaps showed mixed performance, with Alphabet declining while Nvidia bounced back from Friday’s losses. Energy producers managed to join oil’s advance, providing one of the few bright spots in an otherwise downbeat equity session.

Treasury yields climbed sharply across the curve despite equity weakness, with the 10-year yield rising 8 basis points to 4.09%. The move reflected a global bond selloff initiated by Japan, where the 2-year JGB yield hit 1.02%—the highest level since 2008—while the 10-year climbed to 1.87% after Governor Ueda’s hawkish rhetoric. A surge in corporate bond issuance totaling $15.8 billion, led by Merck’s $8 billion offering, signaled favorable financial conditions that competed with Treasuries for investor cash. The combination of robust corporate borrowing and potential BOJ tightening created headwinds for government debt.

FX Market Behavior: U.S. Dollar vs. Majors:

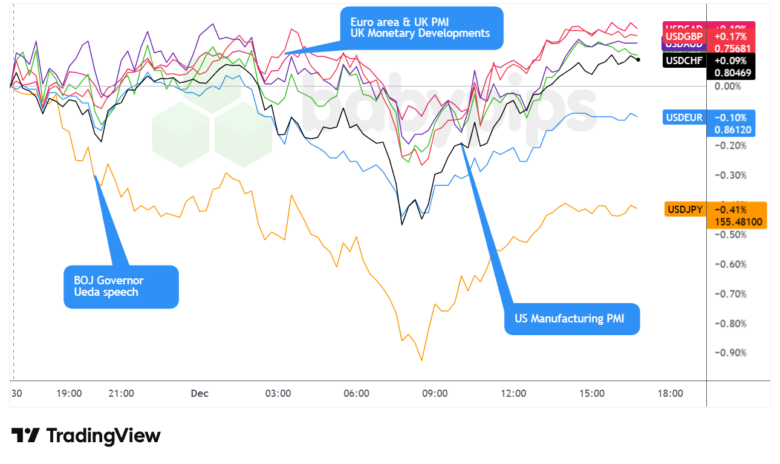

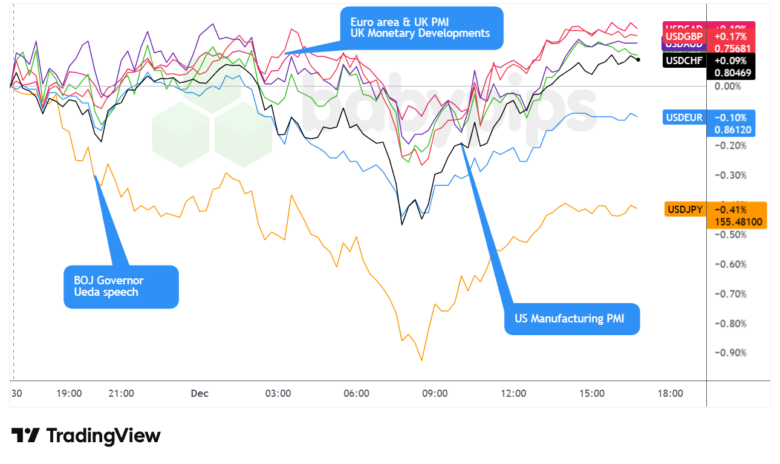

Overlay of USD vs. Majors Forex Chart by TradingView

The U.S. dollar traded through distinct phases on Monday, beginning with choppy sideways movement during the Asian session that carried a slightly bullish undertone, before weakening through the London session and ultimately recovering to close mixed with a modest positive bias overall.

During the Asian session, the greenback maintained a tentative bid ahead of key data releases, though price action remained range-bound as traders positioned for potential volatility. The yen strengthened notably both before and after BOJ Governor Ueda’s speech in Nagoya, where he struck a more hawkish tone than markets anticipated. Ueda’s comments that the BOJ would assess the “pros and cons” of raising interest rates at the December meeting triggered a sharp repricing in Japanese government bonds and lifted the yen across the board. Japan’s 2-year yield surged above 1% for the first time in 17 years, while the 10-year climbed 4.5 basis points to 1.845%. Markets moved to price in roughly 76% odds of a December BOJ rate hike, up from around 58% on Friday.

Chinese economic data painted a weaker picture, with weekend PMI figures confirming the economy lost momentum in November. The official manufacturing PMI remained in contraction for an eighth consecutive month at 49.2, while non-manufacturing slipped to 49.5—its first decline since late 2022. The RatingDog private manufacturing PMI also retreated into contraction at 49.9, though an eight-month high in export demand provided a modest offset to softening domestic orders.

The London open brought broader dollar weakness as European manufacturing data arrived largely in line with subdued expectations. The eurozone HCOB Manufacturing PMI finalized at 49.6, slightly below the preliminary 49.7 reading, while Germany’s gauge came in at 48.2 versus 48.4 expected. UK data showed mixed signals with the S&P Global Manufacturing PMI edging into expansion at 50.2, though monetary developments disappointed as net lending to individuals, consumer credit, and mortgage approvals all came in below forecasts. The pound nevertheless found footing against the weakening dollar.

The U.S. session brought a decisive reversal. The dollar found a bottom around midday and rallied steadily through the afternoon as traders digested the disappointing ISM Manufacturing PMI. The headline index declined to 48.2, marking the ninth consecutive month of contraction and falling short of the 48.8 forecast. Factory employment contracted more sharply than anticipated at 44.0 versus 47.0 expected, while new orders weakened to 47.4 from 49.4 previously. Survey respondents repeatedly cited tariff uncertainty as driving customer hesitation, with many noting that orders were being delayed pending clarity on trade policy. Despite the weak data suggesting potential Fed easing, the dollar recovered as markets appeared to focus on relative growth concerns elsewhere and ongoing safe-haven dynamics.

Oil’s modest rally following the OPEC+ announcement provided some support for commodity-linked currencies during the North American afternoon, though gains remained limited. The U.S. dollar closed the session mixed but with a marginally positive tilt overall, outperforming most currencies except the euro and Japanese yen, the latter of which capitalized on BOJ rate hike speculation to post the day’s strongest performance.

Upcoming Potential Catalysts on the Economic Calendar

- New Zealand Import & Export Prices for September 2025 at 9:45 pm GMT

- Japan Monetary Base for November 30, 2025 at 11:50 pm GMT

- U.K. BRC Shop Price Inflation for November 2025 at 12:01 am GMT

- Australia Building Permits Prel for October 2025 at 12:30 am GMT

- Australia Current Account for September 30, 2025 at 12:30 am GMT

- Fed Chair Powell Speech at 1:00 am GMT

- Japan Consumer Confidence for November 2025 at 5:00 am GMT

- U.K. Nationwide Housing Prices for November 2025 at 7:00 am GMT

- Swiss procure.ch Manufacturing PMI for November 2025

- ECB Buch Speech at 8:40 am GMT

- Euro area Inflation Rate Flash for November 2025 at 10:00 am GMT

- Euro area Unemployment Rate for October 2025 at 10:00 am GMT

- New Zealand Global Dairy Trade Price Index for December 2, 2025

- Fed Bowman Speech at 3:00 pm GMT

- API Crude Oil Stock Change for November 28, 2025 at 9:30 pm GMT

Tuesday’s calendar features a relatively light slate of top-tier economic releases, with most scheduled events falling into the low-to-mid tier category. This environment could produce choppy, directionless trading absent any surprise geopolitical developments.

The primary focus will center on central bank communications, particularly Fed Chair Jerome Powell’s speech scheduled for 1:00 am GMT. Markets will parse his remarks carefully for any signals regarding the December FOMC meeting, especially following President Trump’s weekend announcement about selecting Powell’s successor. Any hints about the Fed’s willingness to cut rates again this month—or guidance on the policy path into 2026—could generate significant volatility across currencies and rates markets.

The eurozone inflation flash estimate for November represents the other potentially market-moving release, with traders watching for signs that price pressures continue moderating toward the ECB’s target or show unexpected stickiness.

Fed Governor Bowman’s afternoon speech provides another opportunity for Fed communication, though Powell’s earlier remarks will likely set the tone.

Barring unexpected commentary from central bankers or surprise headline developments, Tuesday’s trading may lack the catalysts needed to establish strong directional trends, leaving markets to consolidate Monday’s moves while positioning for Wednesday’s more substantial data releases later in the week.

Stay frosty out there, forex friends, and don’t forget to check out our Forex Correlation Calculator when planning to take on risk!